Recently, Rockshield Capital Corp (CSE: RKS) published an information circular to Sedar. Within, it outlined its intention to perform two separate spin outs of the company. To be performed concurrently, the new firms are to be entitled Rockshield Acquisition Corp, and Rockshield Opportunities Corp. Together, they will offer sector specific investment opportunities to diversify ones portfolio. Similar to an ETF, but with the involvement of private companies as well.

For seasoned investors, a company spin out is nothing new. A process that is common to large conglomerates, the theory behind the process is that it will “unlock” investor value. That is to say, that the value of the parts are worth more than the whole when broken out. Several large corporations as of late have performed a similar move so as to provide a deeper value and better return for shareholders.

However, it is a process that is best left to the majors. Often times, equities listed on the junior markets don’t have enough value within themselves to justify a spinout, especially for two being performed concurrently. Nevertheless, we’re here to help eliminate some confusion that we have witnessed among new investors in relation to the proposed spin out.

Rockshield Capital: Understanding the Spin Outs

Your Rockshield Capital share count will not change

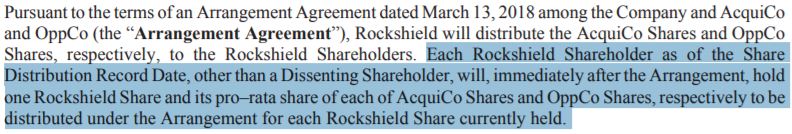

The very first question that comes up among investors it seems, is the impact it will have on their share count. It’s unclear where this notion of the company retracting shares comes from, however this is false. There will be zero impact on the current count of Rockshield Capital Corp shares you as an investor currently hold. This is outlined on the ninth page of the PDF document available via Sedar.

Within the highlighted text above is a bunch of legalese that outlines what exactly will happen to your current share count. In short, you will receive a portion of each of the new firms being created. This will be at a defined conversion rate. However, the amount of shares of RKS in which you own will not change.

What investors do need to be aware of however, is that the value of these shares will inherently change as a result of value being pulled out of them. This is a result of the assets being transferred to the two new firms. Don’t be surprised to see the share price fall after the transaction has closed. Collectively, with your new shares in AcquiCo and OppCo, the total value should be the same. And if the theory prevails, the value should actually be higher as a result of the spin outs.

The Rockshield conversion factor

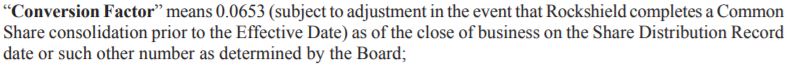

The way in which shareholders can determine how many shares of the new firms they will own is through the use of the conversion factor. In short, the conversion factor is multiplied by the amount of shares held by an investor as of the Share Distribution Record Date.

That rate is currently defined as 0.0653. In the event that an investor should have an amount that is not “whole”, the value will be rounded down to the nearest whole number. No partial shares will be distributed by the company.

In total, each of the spin out companies are to have 3,000,100 outstanding shares as of the transaction date.

Dates to be aware of for the proposed Rockshield transaction

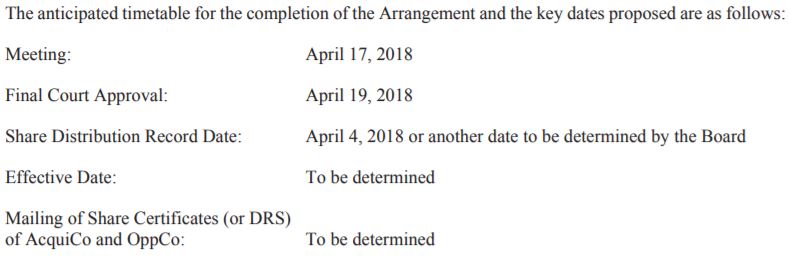

In addition to knowing what effect the transaction will have on your current investment, there are a number of dates that investors need to be aware of. This includes the date of the meeting in which the proposed transaction will be voted upon, as well as the Share Distribution Record Date.

Perhaps the most significant date for investors within this list is the Share Distribution Record Date. Be aware that the price action on RKS may be a bit odd or sideways after this point in time. This is due to the fact that investors that purchase shares in the company after this date, should the transaction go through, will be investing in fewer assets. If shares are purchased after this time, shares in the spin out companies will not be allocated for them. This is the equivalent of an ex-dividend date.

The details on AcquiCo and OppCo

Let’s get down to the nitty gritty. Basically, both of these two new subsidiaries of Rockshield Capital will have very little assets. It has been determined that AcquiCo will be focused in cannabis investments, while OppCo will be focused on health sciences. Both of which Rockshield currently has significant investments in. However, not all related assets will be transferred to the new firms.

Speaking to AcquiCo, it has been determined that the initial assets allocated to the firm will be 130,000 shares of Plus Product Holdings Ltd. In addition to these shares, $500,000 will be issued to the firm in exchange for 3,000,000 common shares. It is believed that this is roughly one quarter of Rockshield Capital’s current investment in Plus Products. No other assets at this time will be allocated to the firm, even though other cannabis related assets do exist.

In regards to OppCo, 13,000 shares of Helius Medical Technologies Inc (TSX: HSM) will be allocated. Similar to AcquiCo, an additional $500,000 will be issued by Rockshield Capital to OppCo in exchange for a total of 3,000,000 common shares of the company. Based on the last closing price of $13.17 for Helius, the assets are valued at roughly $171,210. Similar to AcquiCo again, this is not the entire position in which Rockshield Capital currently holds in this equity.

Based on the valuation of Helius, we can estimate that the value of each subsidiary will initially be in the $675,000 range. As a result of the known outstanding shares of 3,000,100 for the new firms, we can estimate that the net asset value per share will be roughly $0.22499. This is assuming no liabilities will exist for the firms as of the effective date.

The SpinCo’s will not be immediately listed

Although your share count may not be changing, one item that investors need to be absolutely aware of is that the spin out companies will not be listed immediately. Although Rockshield intends to acquire listing status for both of the firms, they cannot at this point in time guarantee that this will occur.

As such, investors need to be aware that there may not be a method in which they can buy or sell the new securities for a period of time. Although it appears that Rockshield intends to list these securities on a Canadian stock exchange, they can not promise that this will occur.

Closing Remarks

Truth be told, at this point in time we don’t see much merit in the spin out of two subsidiaries. Perhaps it would make more sense if all related assets were being spun out, rather than one equity to each company. With it being only a partial sale of the equities in question, it makes even less sense from an investment standpoint.

At this point in time, it appears that this will cost more in transaction fees than it will be worth for the company. With the way that it is structured, Rockshield Capital would be better off to just sell the current investments rather than spin them out if they no longer want them. Otherwise, it’s a lot of effort for no clear benefit.

Be critical. Dive Deep.

Information for this analysis was found via Sedar, Plus Product Holdings Ltd, and Rockshield Capital Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.