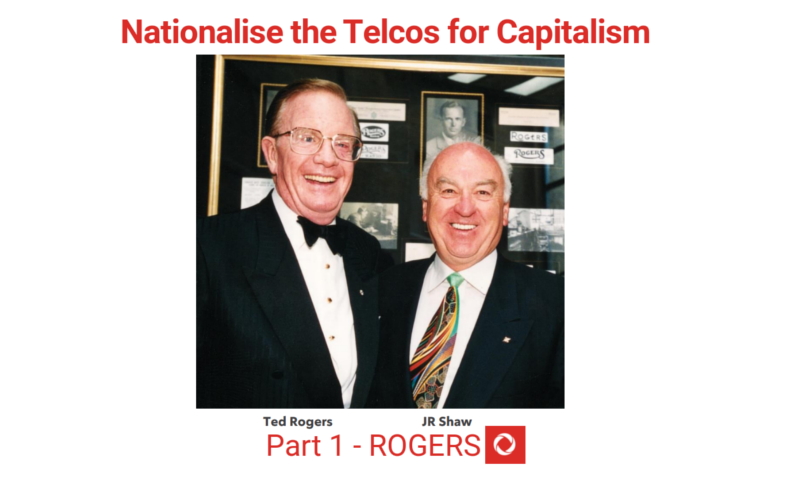

The Rogers Communications (TSX: RCI) saga has continued to unfold this weekend as expected, and it appears we might be headed for the main event soon. Friday night, as well as yesterday, director and daughter of company founder Ted Rogers, Martha Rogers, took to Twitter to publicly eviscerate her brother, Ed Rogers.

Her tweets relate to private discussions that have come spewing into the limelight related to the control of Rogers Communications, following the passing of its founder and family patriarch Ted Rogers in 2008. Things have come to a head in recent weeks, with Edward Rogers, the only son, looking to take control of the Canadian media conglomerate and telco through any means possible.

Just this past week, through his control of Rogers Control Trust, Edward ousted several independent members of the board of directors of the company, following the board removing him from the chairman role. Here’s a quick summary from yours truly, as found in the latest SmallCapSteve Substack letter that was published on Friday.

“Ah, Fridays. The day where all the garbage comes spewing out of the markets like a sewer pipe that’s been clogged for an entire week. Today was no exception.

EXCEPT. For the simple fact that the unclogging this week didn’t primarily occur in the small cap market within Canada. Instead, its happened with a household name that you’ve likely given some of your weekly pay to at some point in your life.

Rogers Communications (TSX: RCI) has found itself in the midst of a shareholder battle that is unlike anything in Canada. One journalist referred to the saga as Canada’s version of Succession. Yesterday, the firm pushed Edward Rogers, son of the late Ted Rogers, out of the role of Chairman following a failed ousting of the firms CEO in September for perceived ineffectiveness – a move which wasn’t even supported by his mother or two sisters, whom also sit on the board.

The problem however, is that Ed effectively controls the company via the Rogers Control Trust, which holds 97.53% of all Class A shares of the company.

What followed was a classic shareholder battle. Ed is currently in the process of ousting five independent directors whom he will replace with his own, while the company can just stand there with its hands in its pockets muttering “oh shucks.”

What’s more, due to the structure of the company, Ed expects to have the required resolutions completed by the end of the day today – meaning we should have plenty of fodder to chew on as we head into the weekend.”

And boy, we weren’t wrong. Hours after our initial publishing, the saga continued with @MarthaLRogers making a series of tweets, commenting that “24,000 employees > 1.” Within, she threatened to release information on “what’s actually happening,” while referring to Edward’s proposed directors as “his old boys club Trump cabal.”

In a series of late-night tweets, Martha Rogers promised to share "the truth" about her brother's "Trump scandal" from May and how she was threatened to "suppress it": pic.twitter.com/3o0OpatXDc

— CANADALAND.COM/JOIN (@CANADALAND) October 23, 2021

Chief among the threats is “the truth about his Trump scandal 5 mos ago,” referring to photos of Ed Rogers and Trump that surfaced from a visit at Mar-a-Lago. To avoid further drama, she suggested she would stop once Edward steps down from his role with the company as well as the family trust.

Corporately, on Friday evening it was announced that the company had received a resolution from Rogers Control Trust stating that five independent members of the board had been removed from their positions, as previously outlined. The company however viewed this as invalid after discussions with external legal council, with no further details provided.

Then yesterday afternoon, a statement by John A MacDonald was issued, wherein it was stated that a board meeting held by Ed Rogers with this supposed new board of directors over the weekend does not comply with the laws of the jurisdiction where Rogers is incorporated, and is therefore invalid. MacDonald then went a step further, stating that anything arising from the meeting is invalid, before referring to Rogers as the former chairman of the firm.

Where things head next is anyone’s guess.

Rogers Communications Class B shares last traded at $60.02 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.