Russia and India are reportedly in talks to integrate their digital payment systems to encourage swift transactions between the two countries. This hopes to boost the already booming trade between the two giant markets as western states continue to ice Russia out of the global economy.

The initiative might see Russia’s Mir and India’s RuPay payment cards be mutually accepted in both countries. The two governments are also reportedly discussing the possibility to integrate India’s Unified Payments Interface and Russia’s SPFS–the countries’ own versions of the SWIFT system for interbank transactions.

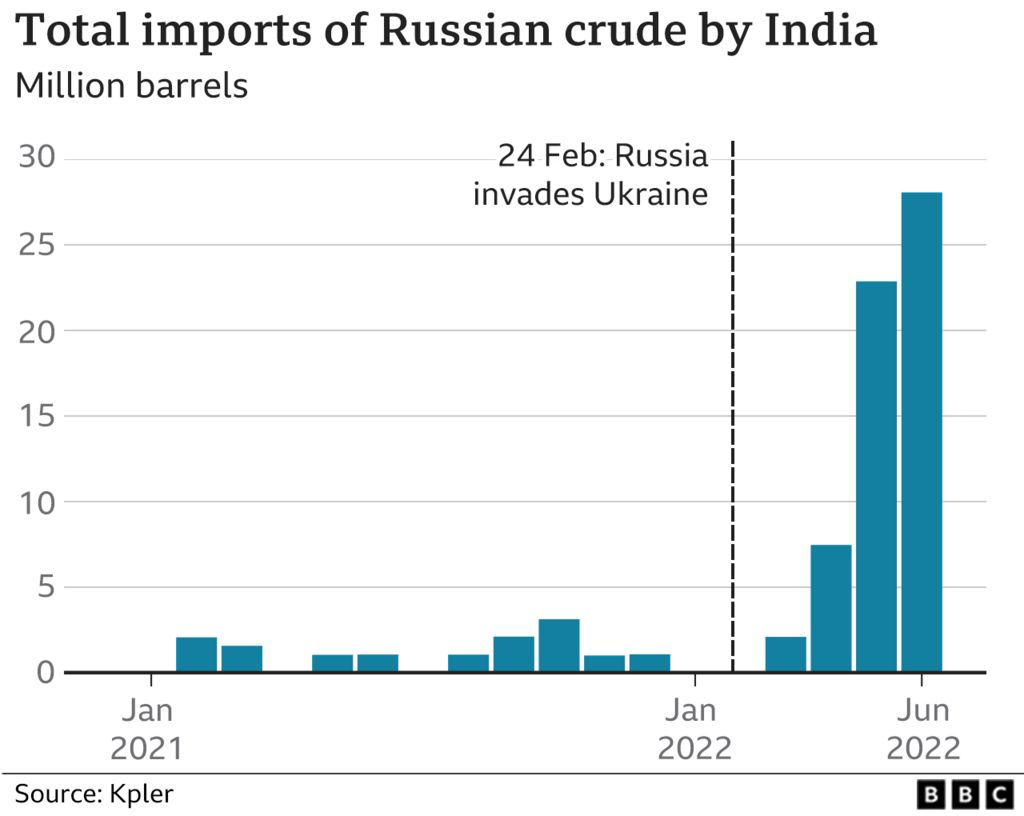

“We’ve seen just in the last few months a certain change in the direction of trade,” Indian Ambassador to Moscow Pavan Kapoor described. “We are certainly buying lots more oil from Russia, and fertilizers also… There is a greater demand from Russia for many more products: consumer goods, food-processing items, auto parts… including, of course, traditional items like textiles, tea, pharmaceuticals… I think all these areas, including many more, will also get a push, hopefully very soon in the future.”

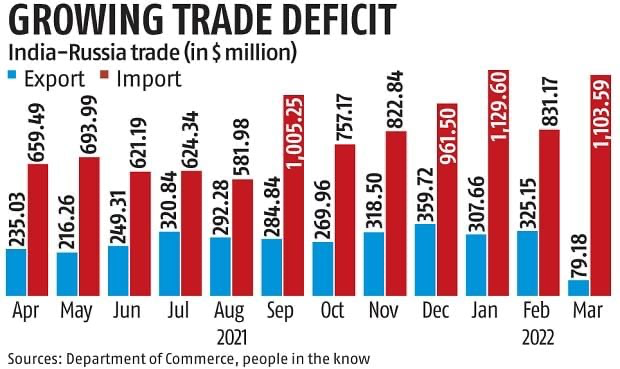

India has remained one of Russia’s trade partners that saw an increase in trade volume even after sanctions were imposed on Moscow following the invasion of Ukraine. For the period between April 2021 and February 2022, India’s value of trade with Russia grew 45.79% compared to its year-ago counterpart.

One month into the Russia-Ukraine war at a time when states and businesses have started cutting import ties with Moscow, India tried to fill the hole by shoring up its imports–heavily discounted oil in particular.

India has also been using other currencies to circumvent the US dollar and subsequent repercussions following the sanctions on Russia.

Aside from boosting the trade, Russia and India integrating their digital financial systems is seen as a retaliation after the US first froze Moscow out of the SWIFT banking system.

Information for this briefing was found via Russia Today, NDTV Profit, and Canindia. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.