But he kept it in the dark because “reporters will freak the f*ck out.”

Next stop on the failed FTX chief Sam Bankman-Fried’s public image rebranding train: an interview with a self-admitted non-journalist, crypto space follower Tiffany Fong. He sang his recurring hits, including regretting the chapter 11 filing regret, failing to anticipate the margin position, and defending the crypto exchange from Ponzi scheme characterization.

But Bankman-Fried–touted to be a top Democrat donor–dropped a bombshell in the interview, saying he donated “about the same amount to both parties this year.”

“All my Republican donations were dark,” Bankman-Fried said. “The reason was not for regulatory reasons, it’s because reporters freak the f*ck out if you donate to Republicans. They’re all super liberal, and I didn’t want to have that fight.”

Audio from my first interview with Sam Bankman-Fried. SBF talks bankruptcy, the alleged “backdoor,” donations to the Democratic Party, Ukraine money laundering rumors, the hack, Alameda’s margin position on FTX, using FTT as collateral & more. 👀 https://t.co/qVfUv6dhww

— Tiffany Fong (@TiffanyFong_) November 29, 2022

In a seemingly tell-all DM conversation with Vox’s Kelsey Piper, Bankman-Fried did admit that the “ethics stuff” was mostly for show, saying “it’s what most reputations are made of.”

“I feel bad for those who get fucked by… this dumb game we woke westeners play where we say all the right shiboleths and so everyone like us,” Bankman-Fried answered.

READ: FTX’s Sam Bankman-Fried, Who’s Facing Regulatory Investigations, Said “F*ck Regulators”

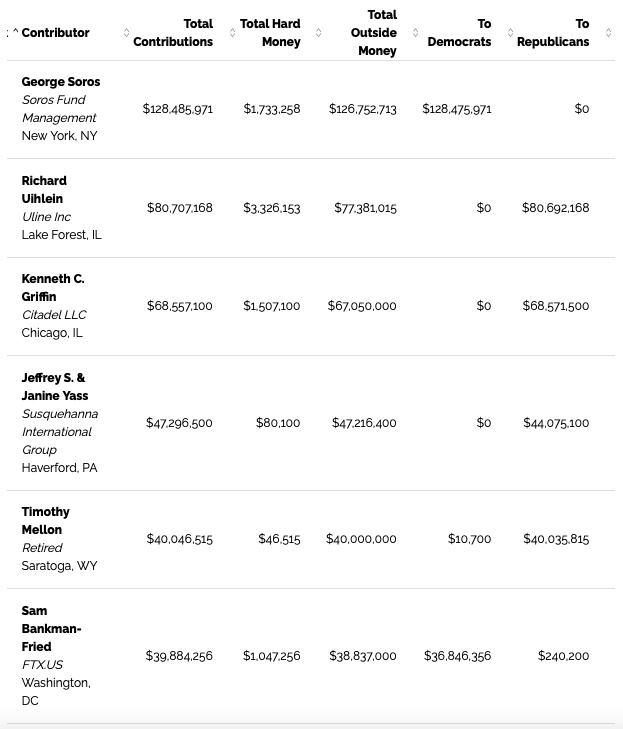

Bankman-Fried personally gave $40 million to lawmakers and political action committees ahead of the 2022 midterm elections, largely to Democrats and liberal-leaning groups. Ryan Salame, another top FTX executive, gave more than $23 million to Republicans and right-leaning organizations.

The FTX founder would be the fifth-largest individual Republican donor if he donated the same amount to both parties as he said.

Source: Opensecrets.org

Sen. Kirsten Gillibrand, Illinois Rep. Jesus “Chuy” Garcia, and Oklahoma Rep. Kevin Hern have since returned or vowed to return the funds when FTX crumbled and shocked the crypto industry.

Bankman-Fried earlier admitted that the FTX implosion happened because he “f*cked up,” lamenting he “should have done better.” He owned up to his two mistakes: a poor internal labeling of bank-related accounts that gave him a false sense of margin (twice) and not communicating the concern enough.

READ: In A Nutshell: How FTX Fell From Grace, According To Sam Bankman-Fried Himself

The so-called FTX contagion, however, has taken many crypto names with it. Most recently, crypto lender BlockFi filed for bankruptcy, revealing it has around $355 million in crypto assets frozen in the bankrupt crypto exchange.

Genesis Global’s lending arm announced that it is temporarily freezing redemptions and new loan originations after declaring it has around $175 million locked in FTX.

Ikigai Asset Management also revealed its exposure to FTX earlier this month, resulting in the firms halting their respective withdrawals. In its Q3 2022 report, Galaxy Digital reportedly had around $76.8 million in cash and digital assets invested in the embattled crypto exchange, around $47.5 million of which is in the process of being withdrawn.

Information for this briefing was found via Fortune Crypto, Mint, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.