With prices running at historic highs in both Canada and the US, the Bank of Nova Scotia (TSX: BNS) is penciling multiple aggressive rate hikes this year in an effort to cool an economy riddled with stagflation.

According to Bloomberg, which cited a report published by Scotiabank chief economist Jean-Francois Perrault on Wednesday, the Bank of Canada is forecast to raise its overnight borrowing rate from the current 0.25% to at least 2% before the end of 2022. Likewise, the Federal Reserve is expected to follow suit, and also hike its benchmark rate to 2% before the end of the year.

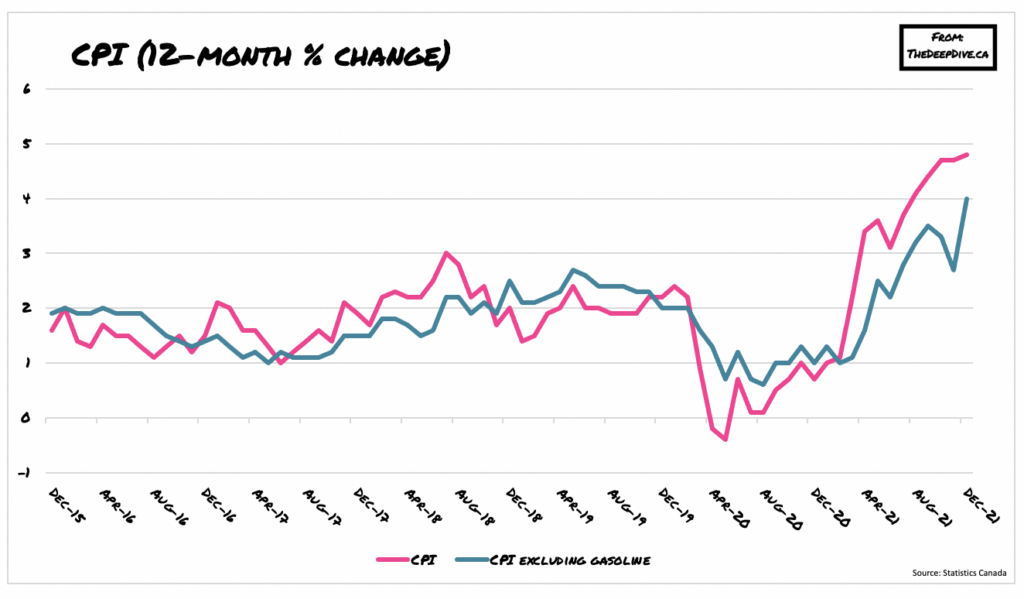

The latest forecasts come just as Statistics Canada released data showing inflation at a thirty-year high, while an earlier Bank of Canada quarterly survey showed that rising inflation has become the biggest concern among both businesses and consumers. “The simple reality is that the very serious public health impacts of omicron and the associated economic consequences do not outweigh the pressing need to withdraw monetary stimulus,” explained Perrault.

The Scotiabank economist said that Canada’s central bank will be the first to make a move on interest rates, with a 25-basis-point increase during its policy meeting next week. Then, another 25-basis-point increase is expected to follow in March, with a jump of another 50 basis points come April. Three more rate hikes are expected after that, to eventually bring borrowing costs to 2% before the end of the year.

“Even with this pace of tightening, the real policy rate would remain negative at the end of this year,” Perrault added.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.