In its ongoing crackdown on the crypto space, the Securities and Exchange Commission has focused its attention on BKCoin Management, a Miami-based financial manager. The regulatory agency filed on Monday an emergency action against the firm and one of its principals, Kevin Kang, “in connection with a crypto asset fraud scheme.”

The SEC said that the injunctive relief is meant “to prevent further fraud and misappropriation of investor money.”

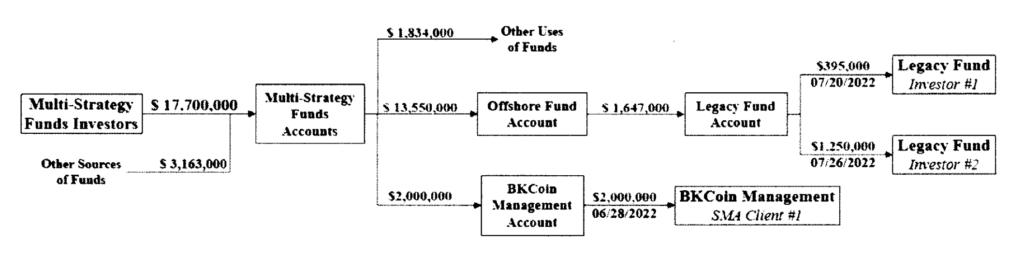

According to the complaint, BKCoin received roughly $100 million from at least 55 investors from October 2018 to September 2022 to invest in crypto assets, but BKCoin and Kang instead utilized some of the money “to make Ponzi-like payments and for personal use.”

Today we announced that we successfully obtained an asset freeze, appointment of a receiver, and other emergency relief against Miami-based investment adviser BKCoin Management LLC and Kevin Kang, in connection with a crypto asset fraud scheme.

— U.S. Securities and Exchange Commission (@SECGov) March 6, 2023

🚨#BREAKING: The SEC has frozen assets & obtained emergency relief against Miami-based BKCoin Management for an alleged fraud scheme

— The Roundtable Show (@RoundtableSpace) March 6, 2023

The SEC alleges that the company raised $100 million from investors for cryptocurrency but instead used it for luxury items & Ponzi-like payments pic.twitter.com/iGNw0bUTj8

While BKCoin told investors their funds “would be used primarily to trade in crypto assets… would generate returns for investors… and one of [their] Multi-strategy Funds received a US opinion from a ‘top four auditor’,” the SEC said these “statements were false or materially misleading.”

“ln fact, during the Relevant Period, Defendants disregarded the BKCoin Funds’ structures, commingled investor assets, and used over $3.6 million to make Ponzi-like payments to fund investors,” the complaint said.

For instance, crypto firm Bison Digital, co-founded by Kang and who had no investors except him and the other managing member of BKCoin, “received $12 milion from BKCoin and the BKCoin Funds for no apparent or legitimate reason.”

The complaint also said Kang sought to conceal the improper use of investor funds by presenting changed paperwork with inflated bank account balances to the third-party administrator for certain of the funds.

By October 2022, BKCoin had suspended Kang and informed investors that it would be stopping redemption requests and capital withdrawals from the BKCoin Funds. The firm then sought appointment of a receiver over the Multi-strategy Funds, which was granted and subsequently expanded to include the Legacy Fund and the Offshore Fund.

Tens of millions of dollars of the over $100 million raised by BKCoin from investors are unaccounted for, said the complaint.

In a separate document, it was revealed that Silvergate Capital (NYSE: SI) is one of the financial institutions that held a Multi-strategy Fund for BKCoin. It is unclear yet how much of the investor funds are held at the crypto-friendly bank.

Today's emergency @SECGov action reveals $SI hosted the "BKCoin" Ponzi Scheme via numerous bank accounts. Has anyone ever banked more frauds than @silvergatebank ?https://t.co/ezxqRSiBUz pic.twitter.com/bTnWBzOd6k

— AV (@AureliusValue) March 6, 2023

Silvergate has problems of its own. The bank recently published a notice at the top of its website indicating that it has shut down its Silvergate Exchange Network, although it currently states that other deposit-related services remain operational.

This comes as the bank has seen most of its crypto exchange clients, including Coinbase, pulling out from its clientele as Silvergate reported that its ability to continue as a going concern is threatened by liquidity issues.

New York-based Kang, 33, is said to be a chartered financial analyst but is not registered with the SEC and holds no securities licenses.

“As we allege, investors entrusted their money to the defendants to trade in crypto assets. Instead, the defendants misappropriated their money, created false documents, and even engaged in Ponzi-like conduct,” said Eric Bustillo, Director of the SEC’s Miami Regional Office. “This action highlights our continued commitment to protecting investors and uprooting fraud in all securities sectors, including the crypto asset arena.”

The SEC filed six counts of violations of the Exchange Act, two counts of violations of the Advisers Act, and one count of unjust enrichment. The action seeks permanent injunctions against both defendants, as well as disgorgement, prejudgment interest, and a civil penalty from both defendants, as well as an officer and director bar and a conduct-based injunction against Kang.

The recent legal action adds to the mounting crackdown of the regulatory agency on the cryptocurrency space. Most recently, the SEC charged Terraform Labs and its CEO Do Hyeong Kwon with plotting a multi-billion dollar crypto asset securities scheme using an algorithmic stablecoin and other crypto asset securities.

The agency is also reportedly sending out Wells Notices to a number of US-based stablecoin firms, ordering them to stop selling supposedly unregistered securities to investors. When an entity receives a Wells Notice, they receive notification from regulators to inform them of investigations where infractions have been discovered.

Information for this story was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.