Royal Dutch Shell stands to make a hefty profit, after controversially purchasing heavily-discounted crude from Russia despite pulling its business out of the country merely days earlier.

Shell early last week announced plans to withdraw from its joint venture with Russia, drawing criticism to President Vladimir Putin’s military invasion in Ukraine. “Our decision to exit is one we take with conviction,” asserted Shell chief executive Ben van Beurden. “We cannot — and we will not — stand by.”

Shell joined a growing list of major companies and governments boycotting and sanctioning Russia, after Moscow granted sovereignty to the Donbass region and subsequently launched a military attack on Ukraine. Canadian Prime Minster Justin Trudeau announced Canada will ban imports of Russian oil (despite not making any such purchases from the country since 2019), while Germany indefinitely axed the certification process for Gazprom-owned Nord Stream 2.

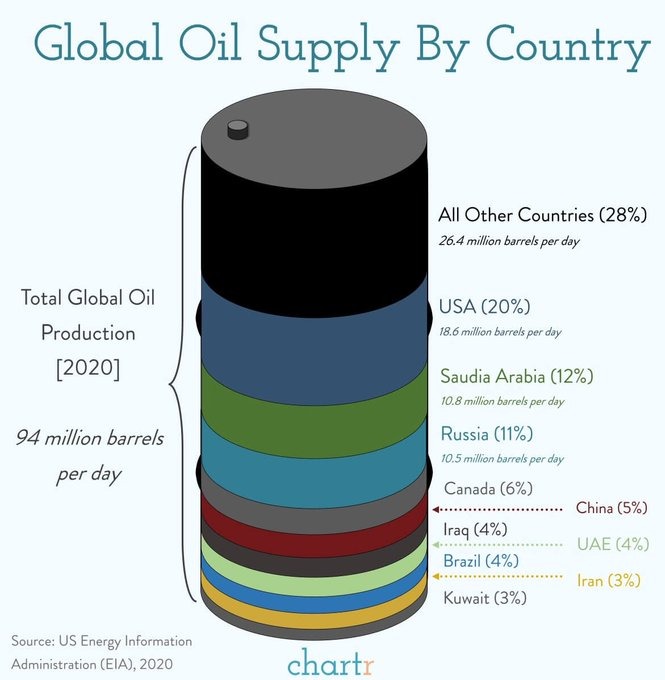

Russia, which is responsible for approximately 11% of the total global supply of oil, is now forced to find ulterior buyers for its crude, as fears of backlash prompt most countries and entities from conducting business with Moscow. As a result, commodity trader Trafigura was forced to hastily find a buyer for a cargo load of 725,000 barrels, since it is legally obligated to lift a certain number of Urals cargoes per month for Russian-based producer Rosneft.

And who better to sell the oil to than Shell! Indeed, by Friday, it appears that the temptation of profits from the heavily discounted Russian crude was too much for Shell to bare, prompting the energy company’s trading arm to purchase the Urals from Trafigura at an attractive $28.50 per barrel. Naturally, one would assume the cheap oil would be purchased by either an Indian or Chinese refinery or trader, not the world’s largest energy trader that merely days earlier denounced Russia’s military intervention in Ukraine.

“We will further reduce our use of Russian oil as alternative crudes become available to buy, but this is highly complex as Russian oil plays a significant role in global supply and in the current, tight market there is a relative lack of alternatives,” Shell explained. However, the company’s crude purchase didn’t sit well with Ukraine’s foreign minister Dmytro Kuleba, who heavily criticized the move, asking Shell if Russian oil smelt like “Ukrainian blood for you?”

I am told that Shell discretely bought some Russian oil yesterday. One question to @Shell: doesn’t Russian oil smell Ukrainian blood for you? I call on all conscious people around the globe to demand multinational companies to cut all business ties with Russia.

— Dmytro Kuleba (@DmytroKuleba) March 5, 2022

Shell, assuring that it’s still simultaneously appalled by the events in Ukraine, said it only bought the cargo in order to prevent a potential shortage of fuels and goods for the global market. “We currently purchase it and other Russian products for some refineries and chemical plants to ensure that we continue the production of essential fuels and products that people and businesses rely on every day,” the company said in a statement.

Shell deleted the Tweet. pic.twitter.com/IfxdbMaIZa

— Muddy (@MuddysMoney) March 5, 2022

But, despite its “sincere” understanding for the crisis in Ukraine, the oil company stands to make a pretty profit from Trafigura’s desperate sale of Russian crude. The 725,000 barrels of Urals are expected to heed Shell about $20 million once the oil is refined and sold to customers. Have no fear, though, Shell assured any profits would be donated to a dedicated fund aimed at alleviating the adversity faced by Ukrainians.

“We will work with aid partners and humanitarian agencies over the coming days and weeks to determine where the monies from this fund are best placed to alleviate the terrible consequences that this war is having on the people of Ukraine,” Shell concluded in its statement.

Information for this briefing was found via Shell and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.