Shopify Inc. (TSX: SHOP) reported today its financial results for Q1 2022, generating US$1.20 billion in revenue for the quarter. This is an increase from Q1 2021’s US$988.6 million.

Revenue for the quarter consisted of US$334.8 million in subscription solutions revenue, up from US$320.7 million last year, as well as US$858.9 in merchant solutions revenue, up from US$668.0 million last quarter.

“The agility of the Shopify platform was evident in our first quarter,” said CFO Amy Shapero. “Our omnichannel capabilities helped merchants navigate the welcome return of foot traffic to their brick-and-mortar stores, and enabled them to leverage the growing volume of commerce on social, in search and in apps.”

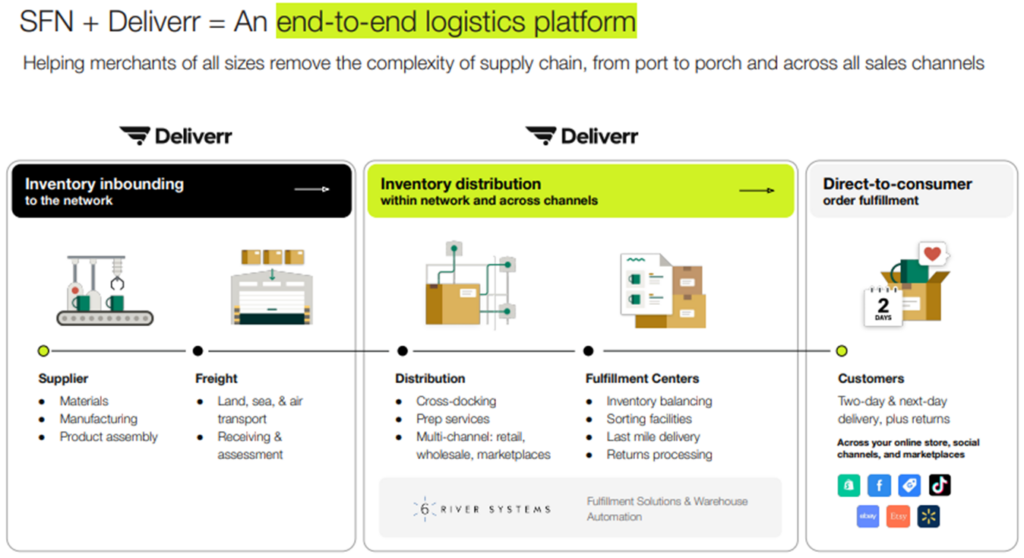

The e-commerce firm also announced the agreement to acquire the fulfillment company Deliverr “to remove the complexity of fragmented supply chain management.” The transaction is reportedly valued at US$2.1 billion, 80% of which will be satisfied with cash and the remaining 20% will be paid in Class A subordinate voting shares.

The firm’s gross profit margin for the quarter is 53.0% compared to 56.5% in Q1 2021.

However, the company ended with a net loss for the quarter at US$1.47 billion, notching a significant drop from last year’s net income of US$1.37 billion. The quarterly loss included a US$1.55 billion net unrealized and realized loss on equity and investment. This translates to a US$11.70 loss per share.

$SHOP: Shopify 1Q'22 Earnings Results vs. Consensus

— Consensus Gurus (@ConsensusGurus) May 5, 2022

Buying Deliverr for $2.1B$SQ $PYPL $WIX $SQSP pic.twitter.com/ylonVHIPhn

Excluding a number of financial items, Shopify’s adjusted net income for Q1 2022 amounted to US$25.1 million. This is a decrease from last quarter’s US$254.1 million. The posted adjusted net income for the quarter translates to US$0.20 per diluted share.

Looking at the balance sheet, the company ended Q2 2021 with approximately US$2.45 billion in cash and cash equivalents and US$4.80 billion in marketable securities. This puts the balance of the current assets at US$8.07 billion while current liabilities ended at US$681.9 million.

The e-commerce platform expects the rest of the year will see a higher year-on-year revenue rate increase, especially in Q4. It also plans to reinvest all of its gross profit dollars back into the business “to pursue multiple paths to growth.”

The quarterly financials came in a month after the firm announced it is restructuring its company share structure, which will see Founder and CEO Tobi Lütke gain a perpetual “founder share”.

Shopify Inc. last traded at $618.30 on the TSX.

Information for this briefing was found via Sedar and Shopify. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.