On June 2, Sigma Lithium Resources (TSXV: SGMA) released a constructive preliminary economic assessment (PEA) on its Grota do Cirilo Lithium Project in Brazil. The Brazilian project will produce battery-grade 6% lithium concentrate.

The PEA estimates that Phase 2 of the facility has an after-tax net present value (NPV) of US$449 million and an internal rate of return (IRR) of 208% based on an 8% discount rate. This brings the after-tax NPV of Phase 1 and Phase 2 combined to US$844 million.

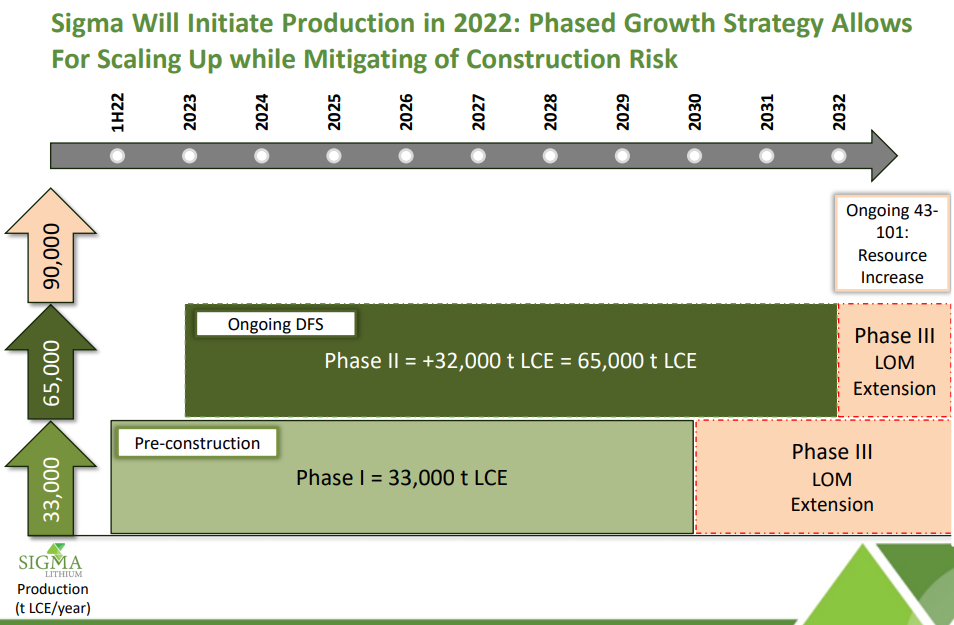

Phase 1 of the project, the input for which would be sourced from Sigma’s Xuxa deposit and has the capacity to produce 220,000 tonnes per year (tpy) of lithium concentrate, could commence commercial operations in 3Q 2022. The 220,000 tpy output of Phase 1 is equivalent to 32,000 tonnes of lithium carbonate.

Phase 2, which would add a further 220,000 tonnes of processing capacity and be sourced from the Barreiro deposit, could be operational sometime in 2023. Construction is planned to commence in 3Q 2022.

Lithium (Li), which is in high demand as a battery component in the electric vehicle (EV) industry, is refined from lithium carbonate. One hundred kilograms (kg) of lithium carbonate can produce about 19 kg of lithium metal. In time, industry observers expect the annual demand for lithium carbonate to reach about 1.6 million tonnes per year. The total amount produced in 2019 was only about 20% of that total.

Sigma’s Planned Production Facilities

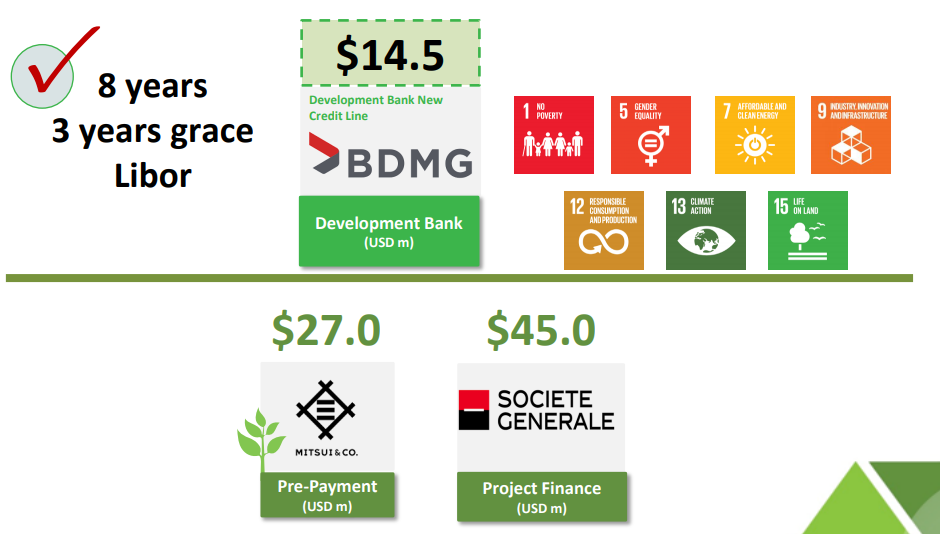

All remaining state permits for Phase 1 construction are expected to be received by 3Q 2021. Phase 1 construction costs are projected to be about US$100 million. Mitsui & Co. has pledged US$27 million to Sigma to cover part of this cost. This prepayment is part of a strategic alliance between the companies, which also includes an offtake agreement where Mitsui can take up to 80,000 tpy of the total Phase 1 annual output of 220,000 tonnes of lithium concentrate.

The balance of the construction costs will be covered by a US$45 million project finance facility with Societe Generale; a US$13.3 million private placement which closed in August 2020; and US$14.5 million of construction financing from the Development State Bank of Minas Gerais (BDMG) of Brazil.

Recent Private Placement Strengthens Strong Balance Sheet

As of March 31, 2021, Sigma had $46.8 million of cash, bolstered by $42 million of proceeds from a private placement which closed in February 2021. The company’s quarterly operating loss and operating cash flow shortfall began to expand noticeably in 4Q 2020 and 1Q 2021 as Sigma prepared for its construction program. (About $5.5 million of its 1Q 2021 operating loss stems from an unusual stock-based compensation accrual.)

| (in thousands of Canadian $, except for shares outstanding) | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 |

| Operating Income | ($6,375) | ($814) | ($330) | ($142) | ($263) |

| Operating Cash Flow | ($2,199) | ($1,300) | ($385) | ($250) | ($483) |

| Cash – Period End | $46,848 | $13,543 | $16,072 | $150 | $61 |

| Debt – Period End | $3,184 | $5,140 | $5,207 | $5,152 | $4,587 |

| Shares Outstanding (Millions) | 87.3 | 77.8 | 77.2 | 68.9 | 68.9 |

It is possible that EV makers could eventually decide that traditional nickel-manganese-cobalt batteries are preferable to those with a heavy lithium content and no cobalt (even though cobalt production is decidedly unfriendly to the environment). In that case, a lithium miner and processor like Sigma would be disadvantaged.

In just over a year, Sigma could begin producing substantial quantities of lithium concentrate, a key component in EV batteries. The company has secured sufficient investment, plus project finance funding and a construction credit facility, to fund the fairly modest US$100 million Phase 1 construction cost of its Brazilian mine. A further step change in production capacity could take place in 2023. As Sigma’s Phase 1 project moves closer to commercial production, investor interest could increase, boosting its share price.

Sigma Lithium Resources Corporation last traded at $6.20 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.