BMO Capital Markets this week raised their price target on Sigma Lithium Resources (TSXV: SGML). The price target lift follows the firm earlier this week filing an updated phase one feasibility study for its Grota do Cirilo Project.

The updated feasibility study is said to demonstrate that the first phase of operations is “financially robust even as a standalone project,” as per the company. Current modeling suggests average production of 230,000 tonnes per year of 6% lithium concentrate for an eight year period. On a standalone basis, the project now has a US$1.6 billion after-tax net present value, resulting in an after-tax internal rate of return of 424%. Additional optionality related to battery grade lithium could increase those figures to 265,000 tonnes of 5.2% lithium concentrate and an NPV of $1.9 billion.

The study also include a second phase of development for the mine, which could increase production by 220,000 tonnes per annum to that of 450,000 tons per year. A phase two pre-feasibility study is targeted to be released early in the second quarter.

BMO lifted their price target to $25.00 from $24.00 off the back of this development, while maintaining their speculative buy rating. They open the note by stating that the update was “generally in line with our expectations.”

In terms of the phase one study, BMO had estimated 9 years of production versus the 8 years estimated by Sigma. This discrepancy is blamed on “optimized pit shells resulting in lower tonnage but a higher overall grade (1.55% vs. 1.46% Li2O).” Cash costs meanwhile came in higher at $461 per tonne, versus estimates of $427 per tonne. Overall, the analyst firm said that “standalone results of the updated Feasibility Study were relatively in line with our expectations, which were based on the 2019 FS with added conservatism.”

As for the phase two portion of the project, BMO commented that, “The maiden mineral reserve estimate at Barreiro also gives us increased confidence in Sigma’s planned Phase 2 expansion, which we now view as effectively a ‘done deal’.” The phase two deposit has a maiden reserve estimate of 21.8 metric tonnes of ore with a lithium grade of 1.37%. BMO currently expects a definitive feasibility study scheduled for later this year to result in a construction decision by year end for the project. In terms of funding, BMO expects “management to fund Phase 2 capex with existing cash on hand and project debt from Soc Gen (existing US$60m term sheet),” while they suspect a financing may come in the second half of the year.

Overall, BMO commented that they “like the company for the quality of its asset, short timeline to production (<12 months), and substantial growth profile.” Collectively, BMO expects these factors to make Sigma a “clear takeout target.”

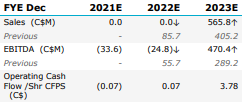

The firm currently expects the company to generate $565.8 million in sales in FY2023, versus prior estimates of $405.2 million, while EBITDA is expected to come in at $470.4 million versus $289.2 million in prior estimates. For 2022, the company has reduced sales estimates to nil versus the previous estimate of $85.7 million, while EBITDA is expected to be negative $24.8 million, versus prior estimates of positive $55.7 million.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.