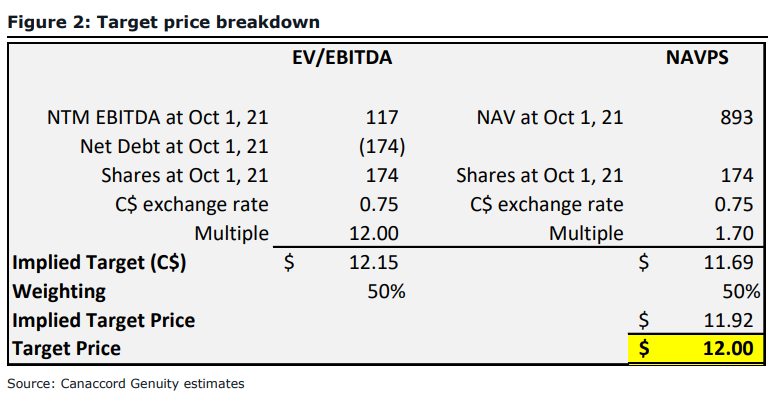

This morning, Canaccord Genuity’s analyst Dalton Baretto initiated coverage on Silvercorp Metals (TSX: SVM) (NYSE: SVM) with a C$12 price target and a Hold rating saying, “we view SVM as a compelling investment for investors looking for leverage to the silver price, although we acknowledge that the stock appears near fully valued at our current commodity price deck.”

Baretto then comments, “our estimates indicate that the company does not currently offer meaningful production or cash flow growth (relative to its precious metals producer peers) but does offer a clean balance sheet and a track record of disciplined capital allocation. SVM’s China-centric exposure may give investors pause, but we believe there are several positive aspects to this exposure as well.”

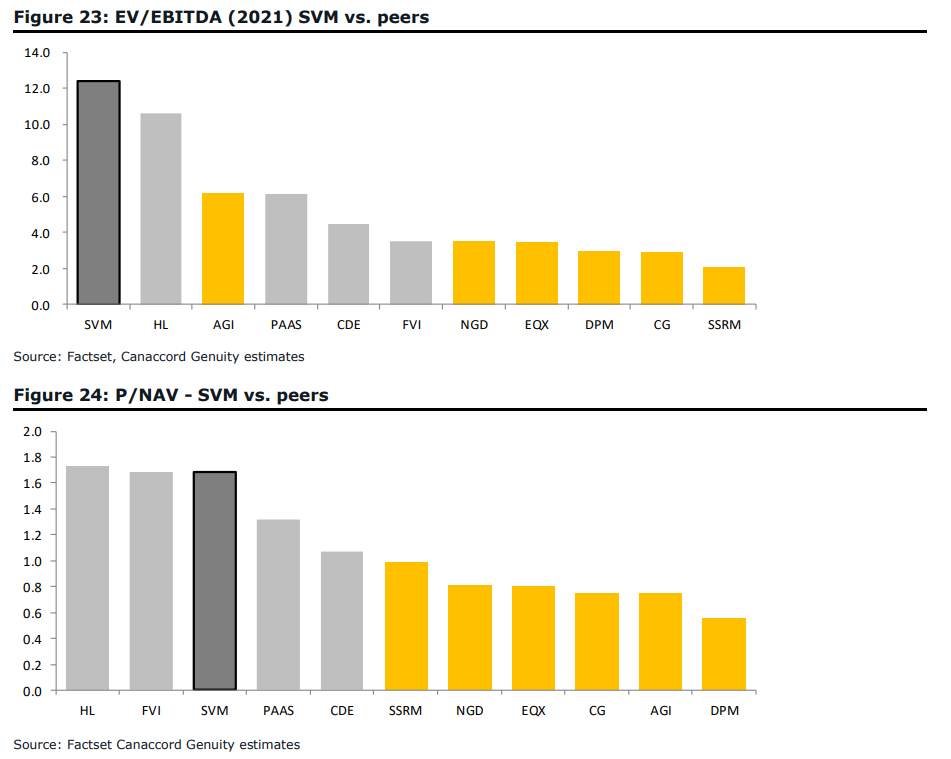

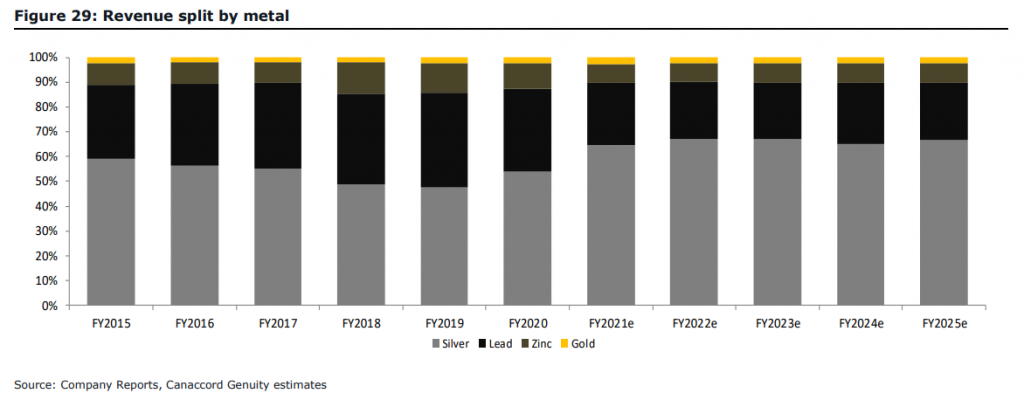

Baretto loves Silvercorp because two-thirds of its revenue comes from silver, making it the “highest revenue exposure to silver among the mid-cap precious metals producers we cover.” He then goes on to say that for this reason and the recent rise in interest from investors to get silver leverage, it could make Silvercorp have a “scarcity premium”. Baretto believes that this is already happening as Silvercopr trades at 12.4x Canaccords 2021 EBITDA estimates and 1.7x NAV vs. their peer average of 5.3x and 1.1x, respectively.

The next thing Baretto likes about Silvercorp is that “lack of growth has not created a lack of discipline.” He cites how Silvercorp recently walked away from Guyana Goldfields rather than matching a higher offer, which Baretto says shows Silvercorp is, “very disciplined on price as well as asset potential.” As 100% of their silver exposure comes from one jurisdiction and 90% of the silver production comes from one single mine, it is crucial that they actively seek another silver producing asset.

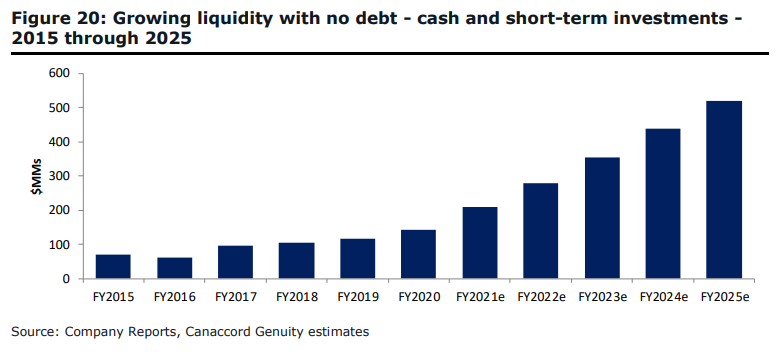

The last thing Canaccord like about Silvercorp is that they have a strong balance sheet with little or no debt, which is expected to be maintained. “The company has historically maintained a very conservative balance sheet with little or no debt, and we do not expect this to change in the normal course of business,” says Baretto. He mentions that based on their estimates, Silvercorp can take on roughly $375 million in debt after factoring in cash and short-term investments in fiscal 2021

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.