Last week, Silvercorp Metals Inc. (TSX: SVM) (NYSE: SVM) reported its operational results and announced a definitive date for its fiscal first-quarter results. The company will report its first-quarter results on August 5th after market close.

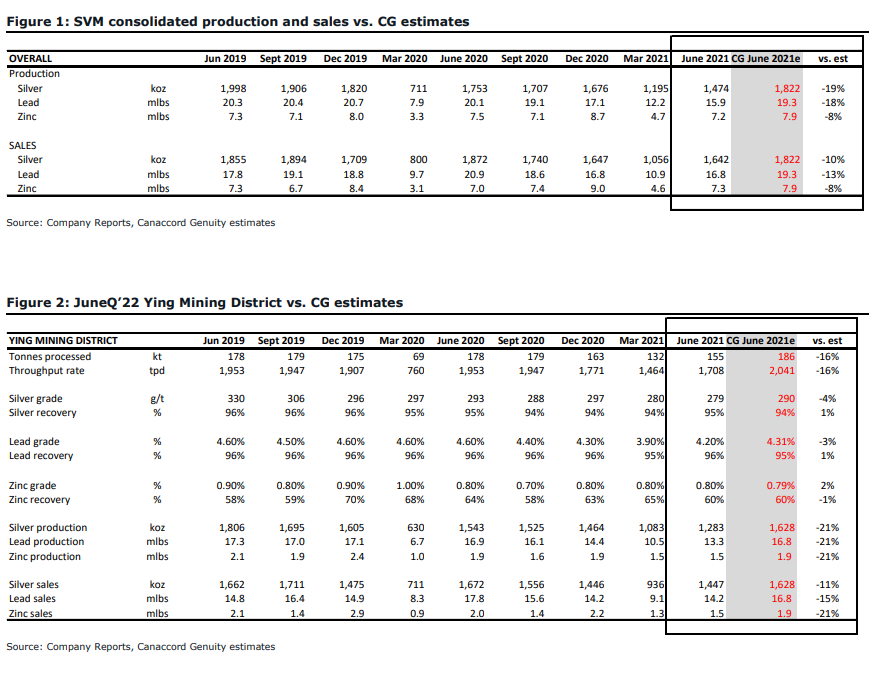

The company produced 1.5 million ounces of silver for the quarter, 1,000 ounces of gold, 15.9 million pounds of lead, and 7.2 million pounds of zinc. The company sold 1.6 million ounces of silver, 1,000 ounces of gold, 16.8 million pounds of lead, and 7.3 million pounds of zinc. The company also saw a decrease in silver, gold, and lead sold but a slight increase in zinc sold compared to the prior quarter.

Silvercorp currently has five analysts covering the stock, with a weighted 12-month price target of $9.40, or a 44% upside. The street high sits at $11, while the lowest price target comes in at $7.75. Out of the five analysts, two have strong buys, one has a buy rating, and the other two have hold ratings.

Canaccord Genuity released a note on July 13 following the production results. They reiterated their buy rating and $9.50 price target. They say that the first-quarter production results missed Canaccord’s estimate but could provide investors with a buying opportunity.

They say that the contract negotiations, which were first disclosed on April 28, had a larger impact on the business than they had initially expected. The company’s two-year contract with eight mining contractors lapsed on March 31, and they agreed to a two-month extension while the parties negotiated a long-term contract. During this period, the company said that “a number of contractor employees took breaks or left due to uncertainty.”

Canaccord believes that the Ying Mine complex will allow the company to hit their full-year guidance, while calling Silvercorp, “a well run, profitable company with significant leverage to silver. We view any significant decline in the share price tomorrow as a buying opportunity.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.