Silvergate Capital Corporation (NYSE: SI), the once high-flying crypto bank that at one point had a market capitalization of almost $6.0 billion, is now active in the news due to its relationship with a number of crypto scandals including the blowup at FTX. The stock has since been under pressure from short-sellers like Marc Cohodes, Marcus Aurelius, and the Bear Cave. Not to mention under the eye of FinTwit darlings like Bitfinex’ed and Bennett Tomlin.

Insiders Cashed Out

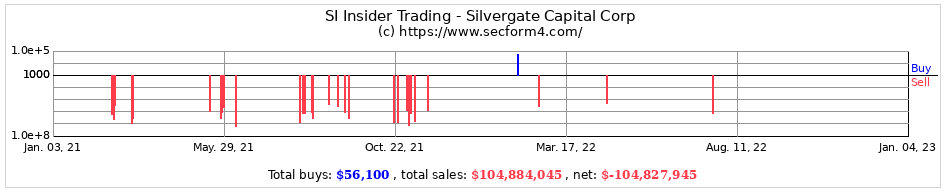

With Silvergate’s stock now trading in the $17 range, investors are left examining how much insiders cashed out of the stock during the last two years. According to Form 4’s filed with the SEC, there were 167 instances where an insider sold, with only 1 instance where an insider bought shares.

Insiders sold shares between the prices of $88.53 and $221.36, or between 5x and 13x higher than the current stock price. In total, the sales over the last two years amounted to roughly $100.3 million in gross proceeds. Among those insiders is the company’s CEO, Mr. Lane, who personally sold 21 times throughout the last two years for $16.1 million.

A Quick History

Silvergate was founded in California in 1988 as a savings and loans association. By 1996, the bank had 3 branches in Southern California.

In 2013, CEO Alan Lane personally invested in Bitcoin. Shortly after Silvergate started offering services to cryptocurrency clients and saw their bank grow rapidly to $1.9B in assets by 2017. In 2019, the company launched an initial public offering that saw it get listed on the NYSE.

Today their website says they are a “Federal Reserve member bank” and a leader in innovative financial infrastructure solutions and services for the digital currency industry.

The Silvergate Exchange Network

Among its financial services offered is the Silvergate Exchange Network, which sounds like a bank, but with better hours as it allows their clients to transfer U.S dollars and Euros “24 hours a day, 7 days a week, 365 days a year.” The service is only available to digital currency and institutional investor clients. While their other crypto-related offering is SEN Leverage, which allows institutional investors access to leverage collateralized by Bitcoin, which was used by MicroStrategy throughout the last 2 years.

The bank also appears to have many typical commercial bank offerings, such as commercial banking, commercial and residential real estate lending, mortgage warehouse lending, and commercial business lending.

Silvergate, which is now down over 88% over the last year and has a market capitalization of roughly $550 million, started its massive drop in November. This came after FTX announced that it would declare bankruptcy due to the commingling of funds that led to over $8 billion of customer funds being misused.

About a month after the bankruptcy, on December 6 Elizabeth Warren, the Massachusetts Democratic Senator and member of the Senate banking committee, and two Republican colleagues sent Silvergate’s CEO Alan Lane a request for information about the bank’s relationship with FTX and its related companies.

“Silvergate conducted significant due diligence on FTX and its related entities, including Alameda Research, both during the onboarding process and through ongoing monitoring, in accordance with our risk management policies and procedures.” Read more here: https://t.co/9nAViJOzoi

— Silvergate Bank (@silvergatebank) December 5, 2022

Shortly after the news broke, Alan Lane, the CEO, issued a public letter blaming short sellers for spreading misinformation to “capitalize on market uncertainty.” Further in the letter, he commented that the company operates in accordance with the Bank Secrecy Act and the USA PATRIOT Act, which means that the bank needs to know the beneficial owner, the source of funds, and the purpose of the funds.

Talking specifically about their relationship with FTX, the CEO says they conducted “significant due diligence on FTX and its related entities, including Alameda Research,” during both the onboarding process and on an ongoing basis.

Later, @AlderLaneEggs on Twitter posted their official response to Senator Elizabeth Warren’s request, where they rehash the filing on December 5th but in greater detail.

So this is @silvergatebank Lame Response,(taking the 5th).They didn't want to put it out to the Public SO WILL !! This is what Cowards and Cheats do(HIDE THE BALL). Enjoy reading this cover up letter.. @AureliusValue @zerohedge @Seawolfcap $SI pic.twitter.com/Nxj8CTIhg5

— Marc Cohodes (@AlderLaneEggs) December 20, 2022

Silvergate shares last traded at $17.64 on the NYSE.

Information for this briefing was found via SEC, LinkedIn, Twitter, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.