Snap Falls 25% Following Q3 2022 Results: US$1.13 Billion In Revenue, US$359.5 Million Net Loss

After an onslaught of challenges, Snap Inc. (NYSE: SNAP) was able to squeeze out relatively decent third quarter 2022 financials as reported post closing on Thursday. The firm generated US$1.13 billion in revenue, up from Q2 2022’s US$1.11 billion and Q3 2021’s US$1.07 billion.

“This quarter we took action to further focus our business on our three strategic priorities: growing our community and deepening their engagement with our products, reaccelerating and diversifying our revenue growth, and investing in augmented reality,” said CEO Evan Spiegel.

On that front, Snap did grow its daily active users to 363 million this quarter, up from 347 million last quarter and 306 million from the year-ago period. Average revenue per user, however, came down to US$3.11 this quarter from US$3.20 last quarter and US$3.49 last year.

The firm also touted that its subscription-based platform Snapchat+ reached over 1.5 million paying subscribers this quarter after reaching 1.0 million users back in August.

Nevertheless, the firm still widened its operating loss to US$435.2 million this quarter coming from the losses of US$400.9 million last quarter and US$180.8 million last year.

Then, it led to a further net loss of US$359.5 million compared to US$422.1 million loss in the previous quarter and US$72.0 million loss in the previous year. This translates to US$0.22 loss per share.

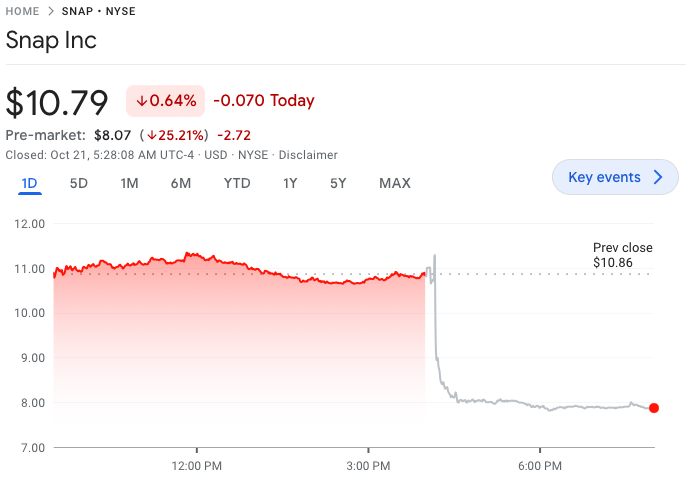

Following the news, Snap shares fell 25% in post-market trading. Year-to-date, the share price has fallen 77% as of last trading.

Calibrating for financial items–including US$312.7 million in stock-based compensation–adjusted EBITDA for the quarter came in at US$72.6 million. This compares to Q2 2022’s US$7.2 million and Q3 2021’s US$174.2 million. Diluted income per share ended at US$0.08, down from last year’s US$0.17 but up from US$0.02 loss last year.

The firm also generated US$55.9 million in operating cash and US$18.1 million in free cash flow, down from last year’s US$71.6 million and US$51.7 million, respectively. This is an improvement, however, from last quarter when the firm suffered cash burns.

The tech company ended the quarter with US$1.92 billion in cash balance from a beginning balance of US$2.30 billion. The cash burn was mainly driven by the recently authorized stock repurchase program of up to US$500 million of its Class A common shares.

“The goal of the program is to utilize the company’s strong balance sheet to opportunistically offset a portion of the dilution related to the issuance of restricted stock units to employees as part of the overall compensation program designed to foster an ownership culture,” the company said in a statement.

The quarter also marks the company’s first quarter-on-quarter decline in workforce, ending with 5,706 from 6,446 employees in the previous quarter. The firm was reportedly considering letting go 20% of its employees back in August.

Snap last traded at US$10.79 on the NYSE.

Information for this briefing was found via the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.