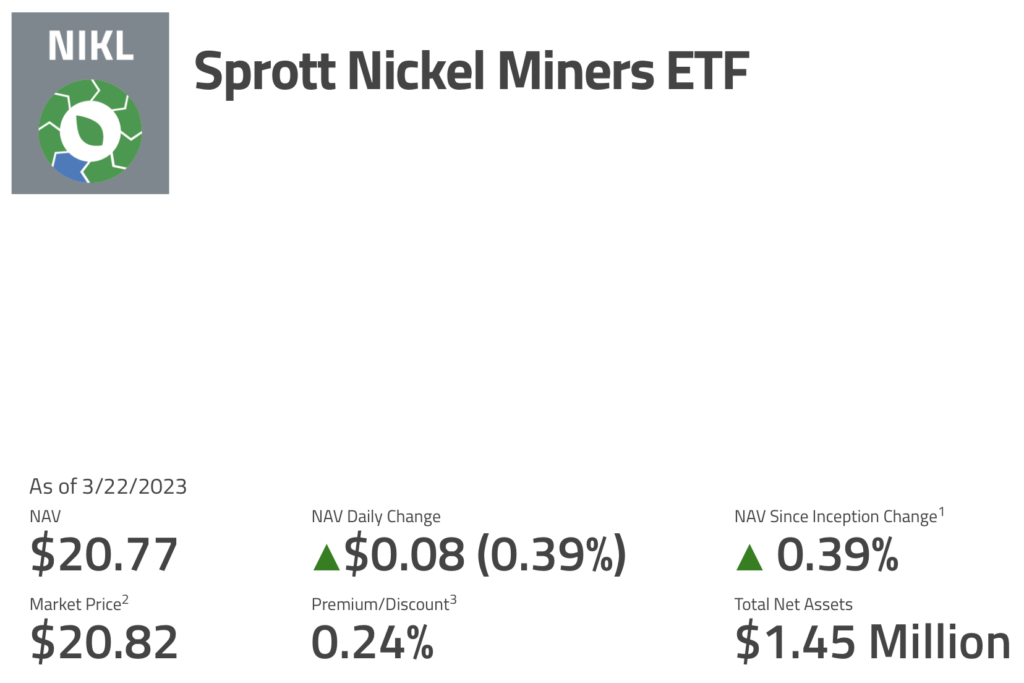

Sprott Asset Management LP has launched the Sprott Nickel Miners ETF (NASDAQ: NIKL), the first US-listed exchange-traded fund focusing on nickel mining businesses that provide a vital commodity required for the clean energy transition.

Not a lot of first-evers anymore in the ETF world, but today we have the first-ever Nickel Miners ETF via Sprott, who also has the uranium miners ETF. Both were launched after awful stretch of performance (which is rare but respectable) pic.twitter.com/7UXT05aDKJ

— Eric Balchunas (@EricBalchunas) March 22, 2023

“Nickel is a vital component in the rechargeable batteries used for hybrid and electric vehicles [EVs] and clean energy storage,” said John Ciampaglia, CEO of Sprott Asset Management. “Automakers have begun adding more nickel to EV batteries to increase their drivable range.”

Ciampaglia added that demand for this critical mineral for use in EVs and battery storage “may increase nearly 20 times by 2040, relative to 2020.”

“We believe nickel producers are well positioned to benefit from the significant investment required to fund the energy transition,” he said.

The Sprott Nickel Miners ETF attempts to produce investment outcomes that, before fees and expenses, correspond to the Nasdaq Sprott Nickel Miners Index total return performance. The said index is intended to measure the performance of a group of worldwide nickel equities, including nickel producers, developers, and explorers.

Sprott’s line of energy transition-focused ETFs was expanded with the launch of four essential minerals ETFs in early February. The Nickel Miners ETF joins Energy Transition Materials ETF, Lithium Miners ETF, Uranium Miners ETF, Junior Uranium Miners ETF, Junior Copper Miners ETF, and the company’s Physical Uranium Trust.

The development comes amid a tight spot for the nickel industry. The London Metal Exchange recently received “information that a number of physical nickel shipments, out of one specific facility of an LME-licensed warehouse operator, have been subject to such irregularities.”

A person familiar with the matter told the Financial Times that the nickel consignments actually contained stone rather than the metal.

Earlier, Swiss trader Trafigura Group declared a $577 million impairment since the cargoes allegedly containing the nickel the firm purchased contained lower-value components such as carbon steel.

Nickel futures were trading below $23,000 a tonne, a level not seen since November 2022, as investors worried about continuously low demand and increased global supply.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.