On October 1, the private start-up electric vehicle (EV) manufacturer Rivian filed an S-1 Registration Statement with the SEC, paving the way for an initial public offering later this month or in early November. It will trade on the NASDAQ under the symbol RIVN.

While not specified in the filing, both Bloomberg and Reuters report that Rivian seeks a valuation of around US$80 billion, equivalent to twice the market capitalization of the richly valued start-up EV manufacturer Lucid Group, Inc. (NASDAQ: LCID), and 18 times the valuation of another start-up EV maker, Fisker Inc. (NYSE: FSR).

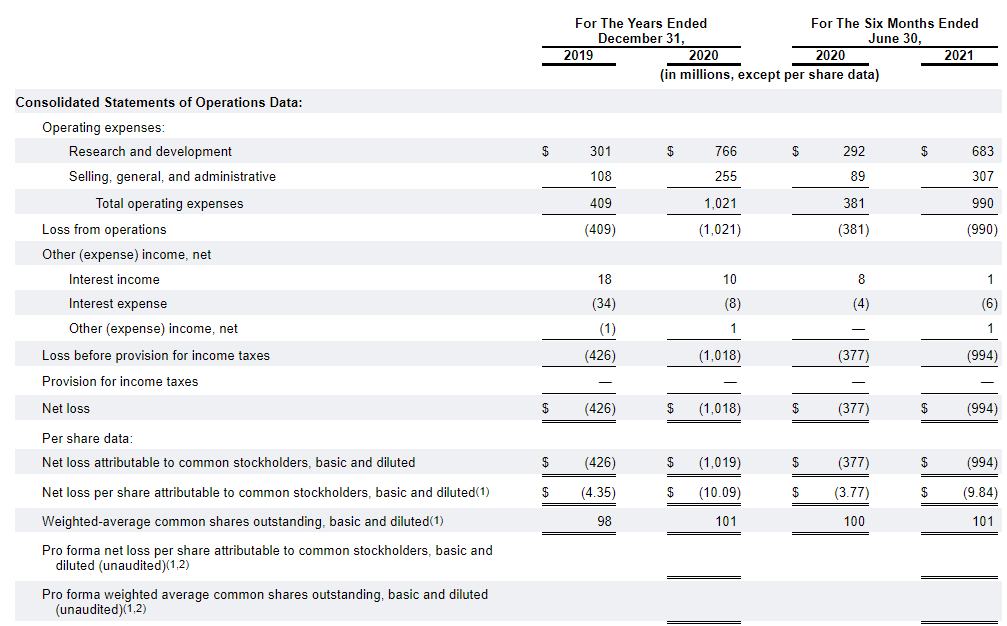

Several details of Rivian’s filing and the implied valuation are at least somewhat surprising. First, the company had zero revenue and incurred an operating loss of US$990 million in the first half of 2021, approximately equal to its full year 2020 operating loss of US$1.018 billion. Rivian’s EV models — an all-electric pickup truck, the R1T, and an all-electric SUV, the R1S — have received excellent reviews and are expected to be popular with consumers, but according an US$80 billion valuation to a company which has booked this magnitude of losses and before one dollar of revenue is received seems aggressive.

The starting prices for both the R1T and the R1S models are around US$70,000 and each has a range of 300+ miles. The vehicles will be manufactured at the company’s plant in Normal, Illinois. Deliveries are expected to begin this fall. Car and Driver magazine rates the R1T as its fourth favorite electric vehicle, behind only the Tesla Model S, the Porsche Taycan, and the Porsche Taycan Cross Turismo.

Second, investors generally expect that about US$5 – US$8 billion of Rivian shares will be issued in the IPO. This represents 25-40% of the public float of five popular EV start-up manufacturers, including Lucid. Given the high-profile nature of the Rivian offering, and perhaps a limit of the amount that investors as a group will allocate to the EV space, it is possible that some accounts will sell their positions in currently publicly traded EVs to “make room” for Rivian.

| Share Price (US$) | Shares Out. (Mill.) | Float (Mill.) | Value of Float (US$ Bill.) | |

| Lucid Motors | $24.61 | 1,620 | 529 | $13.0 |

| Fisker Inc. | $14.84 | 164 | 160 | $2.4 |

| Canoo Inc. | $7.18 | 237 | 100 | $0.7 |

| Lordstown Motors | $6.53 | 181 | 111 | $0.7 |

| Nikola Corp. | $10.62 | 398 | 194 | $2.1 |

| Total | $18.9 |

Third, Amazon, which is one of Rivian’s core investors, announced in 2019 that it would purchase 100,000 electric delivery vehicles from Rivian as part of its pledge to achieve net-zero carbon emissions firmwide by 2040. Other core investors include Ford Motor Company and money managers T. Rowe Price Associates and BlackRock. Amazon has virtually exclusive rights to purchase Rivian electric delivery vehicles for at least four years and the right of first refusal after that.

Fourth, as of June 30, Rivian had 6,274 (all non-union) employees, an astonishing number for a pre-revenue company. Rivian has raised US$10.5 billion privately since it revealed prototypes of its models at the 2018 Los Angeles Auto Show. These funds, coupled with the certainty of the Amazon agreement, allowed Rivian to assemble this giant workforce.

Rivian’s IPO seems likely to be a key event for the EV industry. If well received, it could augur well for a variety of industry players. On the other hand — and more likely in our opinion — the process could cause investors to sell some of their EV start-up investments to fund participation in the Rivian offering.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.