Michael Saylor’s Strategy (NASDAQ: MSTR) is beginning to feel the pinch of falling bitcoin prices. The company in a Form 8-K filed this morning indicated that it will be taking a large loss in the first quarter as a result of the adoption of certain accounting standards as of January 1.

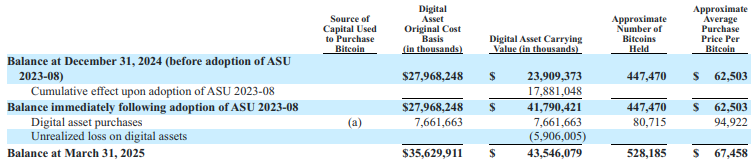

The loss relates to its bitcoin holdings, with the new accounting standards requiring the company to incur any increase or decrease in the fair value of its bitcoin holdings. With the price of bitcoin falling in recent weeks, this means the company is facing a $5.91 billion loss related to its bitcoin holdings in the first quarter.

The loss is expected to be partially offset by an income tax benefit of $1.69 billion.

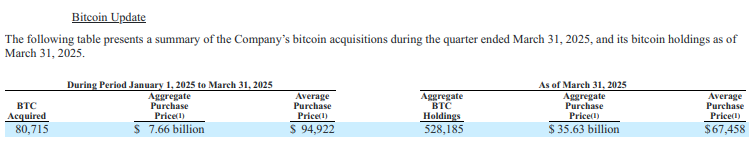

Strategy in the first quarter purchased a total of 80,715 bitcoin at an average price of $94,922, leading to an aggregate purchase price of $7.66 billion. Collectively, the company has spent $35.63 billion acquiring 528,185 bitcoin at an average price of $67,458. The carrying value of that bitcoin sits at $43.55 billion.

Strategy last traded at $271.36 on the Nasdaq.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.