On Monday, Sundial Growers Inc. (Nasdaq: SNDL) reported its first quarter financial results. The company announced that revenues for the quarter totaled $17.6 million, down slightly from the $18 million it reported last quarter. On the segments, the company recorded $8.77 million in revenue from cultivation while its retail segment reported $7.5 million, and its liquor segment brought in $1.3 million in revenue.

The company saw its gross margins contract sequentially to $3.42 million, as its production segment reported negative gross margins. The company reported an Adjusted EBITDA loss of $0.7 million, and a net loss of $38 million.

Additionally, the company saw a loss of $17.71 million on marketable securities. They say that during the quarter they made investments totaling roughly $650 million, which includes $453 million into their joint venture SunStream Bancorp. Their investment portfolio generated $3.9 million in fee revenues.

The company ended the quarter with $361 million in unrestricted cash and $1 billion in cash, marketable securities, and long-term investments.

Sundial currently has 5 analysts covering the stock with an average 12-month price target of US$0.60, or an upside of 37%. Out of the 5 analysts, 1 has a buy rating and the other 4 have hold ratings. The street high price target sits at US$0.80, or an upside of 84%.

In Canaccord Genuity’s note on the results, they reiterated their hold rating and decreased their 12-month price target from US$0.60 to US$0.50, saying that even though the company missed on a number of Canaccord’s estimates and they continue to forecast near-term challenges for the business, the company is in a position to capture some additional gains in its provincial sales channels.

On the results, Canaccord was expecting revenues to come in at $21.8 million, well above the reported number. They say that this miss was primarily due to a slowdown across all cannabis sectors, which is blamed on seasonality pressures. For the segments, cannabis cultivation revenues were down 31% sequentially, which was attributed to weakness in both wholesale and provincial sales.

Canaccord says that they continue to believe that Sundial will see near-term challenges for the cannabis segment as the company tries to realign its business offerings. Though they remain hopeful that the company will successfully pivot from discount offerings, into more of a premium product and premium inhalable segment.

For Sundial’s adjusted EBITDA, they said they were estimating for it to come in at C$10 million, versus the ($0.6) million result. This miss was a combination of factors which included a “softer top line, muted margin profile, and declining income from the company’s investment operations.”

Lastly, Canaccord believes that Sundial will, “become more active in deploying its capital across various opportunities in the sector,” as the company ended the quarter with roughly C$511 million in cash and short-term investments. Of which, a very small amount is earmarked for CAPEX or OPEX.

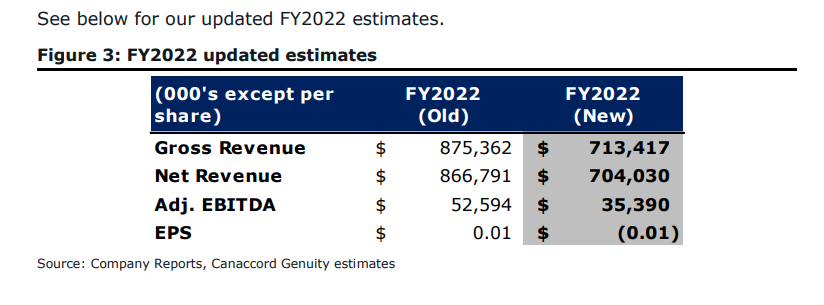

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.