Supreme Cannabis (TSX: FIRE) reported their fourth quarter 2020 financial results this evening, posting declining net revenues of $9.5 million, and a net loss of $33.3 million for the quarter, which included impairments of $15.5 million. Revenues declined on both a year over year and a quarter over quarter basis. Revenues for the year came in at $39.7 million on a net basis, along with a net loss of $139.4 million.

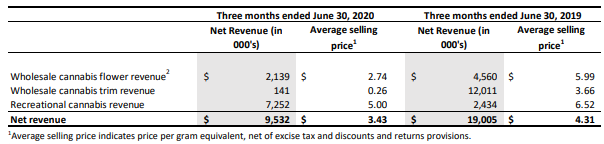

Supreme is quick to highlight in the news release announcing the results that recreational sales net revenue increased 27% on a quarter over quarter and 373% on a year over year basis. This however is largely a function of the transition from a wholesale model to that of a consumer focused sales model. Sales in the year ago period were at $19.0 million on a net basis, representing a decline of 49.8% on a year over year basis. The decline on a quarter over quarter basis comparatively was only 2.0%.

Gross margin before fair value adjustments this quarter also took a significant hit, with the company recognizing negative margins of $8.2 million, thanks in part to a $12.1 million impairment on production costs. The result of which, is that the company ended up posting a negative gross margin for the year as well of $21,000, with total production cost impairments for the fiscal year of $19.3 million.

Quite simply, things don’t get much better from here. Operating expenses came in significantly higher than even gross revenues, at $15.9 million, lead primarily by share based compensation at $4.7 million. This was followed by wages and benefits of $3.6 million, and general and administrative expenses of $2.8 million. The company was then hit with a further $5.2 million in finance expense.

Moving to the balance sheet, the firms cash position managed to climb from $23.1 million to $28.4 million, which is largely a function of the firm raising $13.0 million on a net basis through a credit facility during the three month period, as well as $1.7 million through its at the market program. Receivables meanwhile fell from $14.9 million to $9.0 million, and inventory fell from $46.6 million to $40.2 million. Total current assets overall tumbled from $105.1 million to $90.6 million.

On the other side ofthings, accounts payable climbed from $12.7 million to $13.6 million, while other current liabilities rose to $3.2 million from $1.5 million. Total current liabilities overall climbed from $16.2 million to $19.9 million.

Other notable items included within the financial statements include production figures, with the company managing to produce 10,313 kilograms of cannabis during the three month period, compared to 10,362 kilograms in the first quarter. Comparable figures on kilograms sold during the quarter were not provided by the company. What was provided however was the average selling price per gram, which fell from $4.31 to $3.43 per gram on a year over year basis.

Supreme Cannabis last traded at $0.14 on the TSX.

Information for this analysis was found via Sedar and Supreme Cannabis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.