Yesterday, Teladoc Health (NYSE: TDOC) reported its third quarter earnings results, reporting $228.8 million in revenue. In a note Friday morning, Canaccord Genuity’s analyst Richard Close raised his 12-month price target on Teladoc to US$261 from US$255.

Canaccord also reiterated their buy rating on the company, saying, “We reiterate our BUY on Teladoc after the company reported another quarter that outperformed expectations and guidance that should prove conservative based on management’s track record.”

A number of recent price target changes have been made on Teladoc Health, including:

- Piper Sandler raises target price to $305 from $232

- D.A. Davidson raises target price to $260 from $250

- JP Morgan raises target price to $270 from $266

- Deutsche Bank raises target price to $244 from $239

- SVB Leerink raises price target to $256 from $246

- Wells Fargo raises target price to $200 from $175

- UBS raises target price to $239 from $223

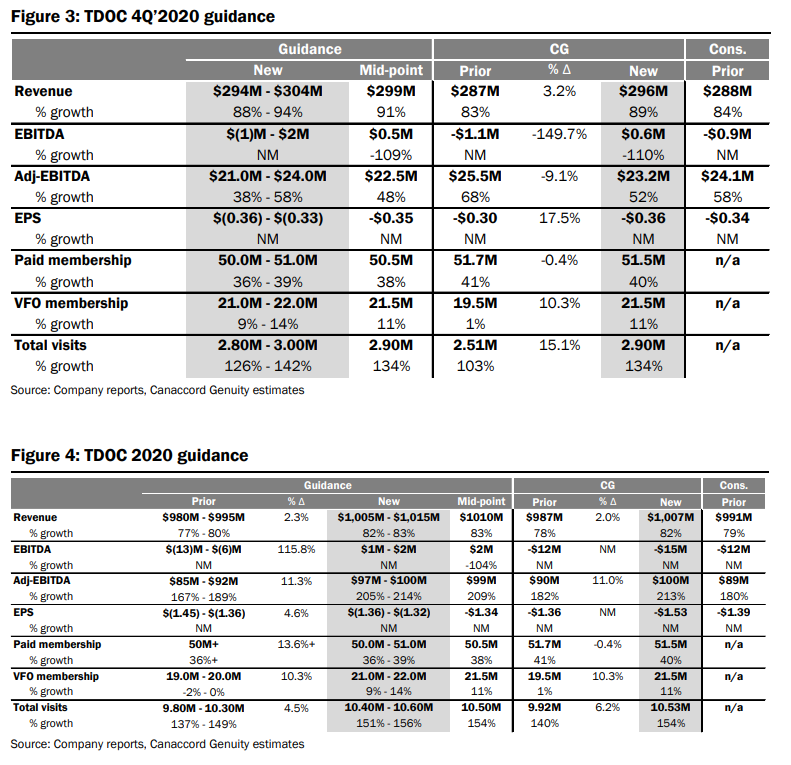

Richard Close gives a bullish takeaway and a bearish takeaway. For the bullish takeaway, he says that the utilization rate of 16.5% increased 0.5% sequentially. This is notable, “considering many “shelter in place” mandates were lifted and in person healthcare resumed.” While the bearish takeaway for Close is that their previous fourth-quarter adjusted EBITDA estimate is too high, but Teladoc did beat their third-quarter adjusted EBITDA estimate due to some advertising and marketing programs being deferred to the fourth quarter. Close says, “Although our 4Q est. moves lower, TDOC raised 2020 full-year guidance given the 3Q beat.”

Onto the numbers, Teladoc beat on every angle. Visits grew 206% to 2.8 million visits, which are above Canaccord’s estimate of 2.6 million. Revenue of $289 million was $10 million higher than Canaccord’s estimate. Adjusted EBITDA came in at $39.5 million versus an estimate of $27.3 million. Close comments, “Newly registered members grew 80% in 3Q and visit growth from those members outpaced existing user growth,” and, “Bookings and pipeline commentary remains strong.”

Close says that the Teladoc and Livongo merger is already bearing fruit. Teladoc management has detailed “several cross sell wins and highlighted a robust pipeline of opportunities. Previously announced, Guidewell (Florida Blue), which is an existing TDOC client, contracted for Livongo’s offering to serve its 50K members with diabetes.” Close expects management to provide updated guidance for the fourth quarter once the deal is closed.

Below you can find Canaccord’s fourth quarter and full-year estimates compared to management’s guidance.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.