The January 3, 2023 collapse in Tesla, Inc. (NASDAQ: TSLA) stock price puts enormous pressure on highly valued start-up electric vehicle (EV) makers Lucid Group, Inc. (NASDAQ: LCID) and Rivian Automotive, Inc. (NASDAQ: RIVN) to announce at least reasonably positive news regarding 4Q 2022 production levels and possibly 2023 production and cash flow guidance. On January 2 when the market was closed, Tesla announced 4Q 2022 deliveries of 405,278 EVs, up 40% year-over-year but somewhat shy of analysts’ consensus delivery forecasts of around 427,000 cars.

In turn, Tesla shares plunged US$15.08, or 12.2%, on the next trading day. Perhaps equally distressing, the drop was based on 229 million shares of trading volume, 220% of normal. Clearly, that represents heavy volume, but not a level that reflects a wash-out, where every seller who was contemplating selling actual sold. This could suggest additional near-term downside risk for Tesla.

The aggressive selling in Tesla shares — with possible further selling pressure to come — suggests that in order to escape the ire of investors, less established participants in the EV industry like Lucid and Rivian may be required to post solid production and financial data in coming days.

After the close on January 3, Rivian reported that it produced 10,020 vehicles in 4Q 2022 and delivered 8,054 of them. This brings its full-year 2022 production quantity to 24,337, less than its 25,000-unit goal, and full-year 2022 deliveries to 20,332. (As an aside, this giant gap between cars manufactured and delivered is difficult to explain.)

Lucid is expected to announce its 4Q 2022 production figures in the next few days. It had to produce 2,313 to 3,313 vehicles in the quarter to meet its 6,000 to 7,000 full-year 2022 guidance.

The table below reflects key recent production and financial data for Lucid and Rivian, as well as guidance provided by the companies.

Key Statistics of EV Start-Ups Lucid Group and Rivian Automotive

| (in millions of U.S. dollars, except EV production and reservation data) | Lucid Group | Rivian |

| EV Unit Production – Full-Year 2022 Guidance/Actual | 6,000 to 7,000 | 24,337 |

| EV Unit Production – 4Q 2022 Guidance/Actual | 2,313 to 3,313 | 10,020 |

| EV Unit Production – 3Q 2022 Actual | 2,282 | 7,363 |

| Non-Binding Reservations as of Early November 2022 | 34,000 | 114,000 |

| Adjusted EBITDA – Full-Year 2022 Guidance | None Given | ($5,450) |

| Adjusted EBITDA – 3Q 2022 Actual | ($553) | ($1,307) |

| Enterprise Value | $10,000 | $3,800 |

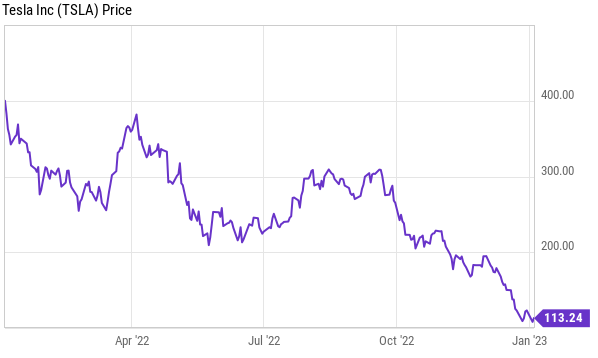

Separately, a problem for Tesla shares — and therefore for the stocks of Lucid and Rivian as well — is Tesla’s chart pattern. Tesla stock has knifed through all discernable support levels over US$100 and looks not to find additional support until somewhere in the US$70 range. Both Lucid and Rivian are trading at essentially all-time lows, so no technical support for those names can be easily identified.

Tesla, Inc last traded at US$113.25 on the NASDAQ.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.