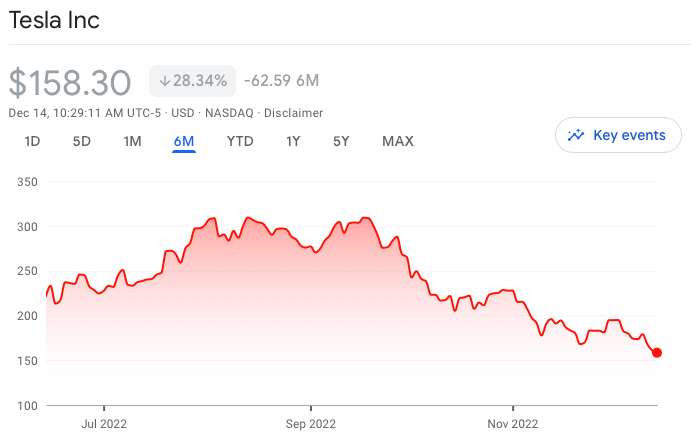

Tesla stock has dropped 28% since October 27, when CEO Elon Musk purchased and took over Twitter.

Tesla (Nasdaq: TSLA) shares finished at $160.95 on Tuesday, down more than 4% on the day. It was a rare exception among growth-oriented tech equities, which mainly climbed after inflation rate hit below than expected.

Since October 27, the day Tesla CEO Elon Musk outright bought Twitter and made himself “chief Twit,” the carmaker’s share price slid by 28%. Other big manufacturers, such as Ford, GM, and Volkswagen, have increased throughout the same period; the same can be said for Chinese electric vehicle maker BYD. Rivian, a manufacturer of electric trucks in the United States, has dropped by 27% throughout that time.

The company’s largest retail shareholder, billionaire and founder of IT services giant SHI International Leo Koguan, has called for the company’s board to “perform shock therapy to resuscitate stock price,” notably by a share buyback.

In a recent tweet, Musk said it was “generally wise” to avoid using margin loans on any company when there are macroeconomic risks involved.

“When there are macroeconomic risks, it is generally wise to avoid using margin loans on any company, as stocks may move in ways that are decoupled from their long-term potential,” Musk tweeted.

The tweet comes after Musk’s bank lenders are reportedly considering replacing some of the high-interest debt he piled on Twitter with fresh margin loans backed by Tesla stock that he would be personally responsible for repaying.

In financing the $44-billion Twitter takeover, Musk placed slightly more than $27 billion of his own cash in the acquisition. In addition, the chief executive had to sell 19.5 million Tesla shares over the three market days, generating cumulative gross proceeds of $3.9 billion. The latter heavily connected the social media platform to the carmaker.

Since taking over the company, Musk has been constantly posting fiery tweets, particularly aimed at people with center-to-left political ideals, whom Musk frequently portrays as opponents infected with a “woke mind virus.”

“My pronouns are Prosecute/Fauci,” Musk tweeted on Sunday, pleasing critics of the usage of nonbinary pronouns as well as Mr. Fauci, America’s top immunologist who disagrees with President Donald Trump on how to reopen the country in 2020. The Tesla chief has previously attacked pandemic lockdowns, having defied one that affected Tesla’s California facility, as well as remote work.

Musk has repeatedly touted the engagement on Twitter is at an “all-time high” since he took over, scoring points from the conservative side of the spectrum–most especially after he reinstated former US President Donald Trump’s account.

However, Musk’s shock tactics do not appear to be intended to entice advertisers who froze spending on Twitter during the upheaval of his takeover. The negative impact on the social media company seems to spillover to Tesla.

"@elonmusk is doing significant brand damage," says @GordonJohnson19. "If you're driving in a Tesla, some people have said it's like wearing a MAGA hat." pic.twitter.com/pSZwPMQMbm

— Squawk Box (@SquawkCNBC) December 14, 2022

Elon Musk seeks to do good for humanity: free speech and climate protection (I'm a huge fan of this).

— Meet Kevin (@realMeetKevin) December 13, 2022

However, his personal, partisan attacks risk undoing BOTH goals:

✅Bankrupting Twitter – ironically HURTS free speech.

✅Ruining Tesla brand value impedes climate goals.

Sad.

But Musk seems to be unfazed by declining Tesla share price, tweeting investors should “think long-term” and avoid leverage.

Think long-term & avoid leverage

— Elon Musk (@elonmusk) December 14, 2022

Tesla continues to face production hurdles–specifically at its Texas gigafactory–due to recruitment hurdles and problematic employer image. When the Berlin gigafactory first launched in March, the goal was to build 5,000 vehicles per week by the end of the year–even stretching this out to construct half a million Teslas in Berlin in 2022, as Musk told a German media. However, it is far from meeting its objectives due to serious recruitment issues—the company has only hired 7,000 individuals out of a planned 12,000.

READ: Tesla Misses Berlin Gigafactory Production Target As Hiring Continues To Be A Problem

The carmaker is also reportedly planning to reduce output by at least 20% from its Shanghai facility’s full production, bringing capacity levels on par with October and November. The voluntary move comes amid a slump in China’s demand for Teslas, indicative of the company’s recent onslaught of incentives and price cuts. The EV maker has also drastically reduced its delivery times, also suggesting that supply is outpacing domestic demand.

Musk is currently in a legal battle to defend why he’s worth the massive $50-billion Tesla pay package that helped make him the world’s wealthiest person.

Tesla last traded at $160.95 on the Nasdaq.

Information for this briefing was found via The New York Times, CNBC, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.