Tesla (NASDAQ: TSLA) appears to be immune to the ongoing and worsening global chip crisis, as the electric vehicle maker posted yet another quarter of record deliveries.

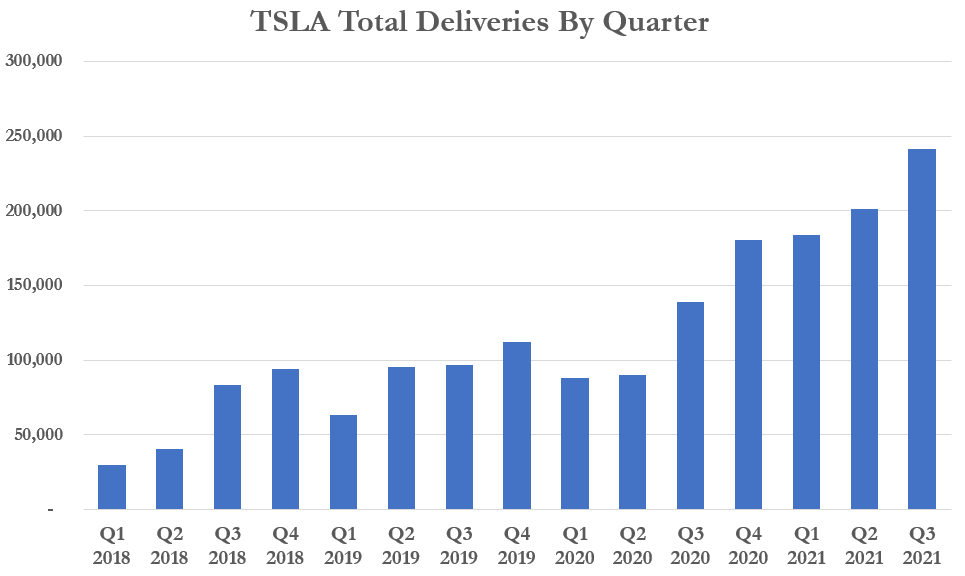

Despite having a tremulous relationship with Beijing at times, Tesla posted record deliveries for the third quarter, with the majority of the sales being its Model 3 and Model Y cars. Tesla delivered a total of 241,300 vehicles globally, against Refinitiv projections calling for 229,242 deliveries, marking an increase of 20% between July and October.

Compared to the same period a year ago, the automaker’s deliveries surged 73%, making the latest record increase also the sixth consecutive quarter-over-quarter gain.

Almost 96% of the EV maker’s deliveries were concentrated across its newer Model 3s and Model Ys, while deliveries of its Model X and Model S— which continue to be phased out— stood at 9,275 units. Tesla also boosted its production numbers to 237,823 units, marking yet another record. In September, Tesla CEO Elon Musk revealed the automaker underwent a substantial parts shortage at the beginning of the third quarter, but he allegedly urged his employees to make a last minute delivery push.

Tesla’s competitors, however, do not seem to be faring too well amidst the global semiconductor shortage. General Motors revealed that it delivered only 446,997 vehicles across the US in the third quarter, marking a decline of 218,195 units compared to the same quarter a year ago. GM pointed to the chip crisis as the main culprit behind the drop in deliveries, previously warning investors that its wholesale volumes would be at least 200,000 units lower in the second half of the year.

Information for this briefing was found via Tesla and GM. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.