Can someone please tell Cathie Wood that the gravy train flooding Wall Street is over?

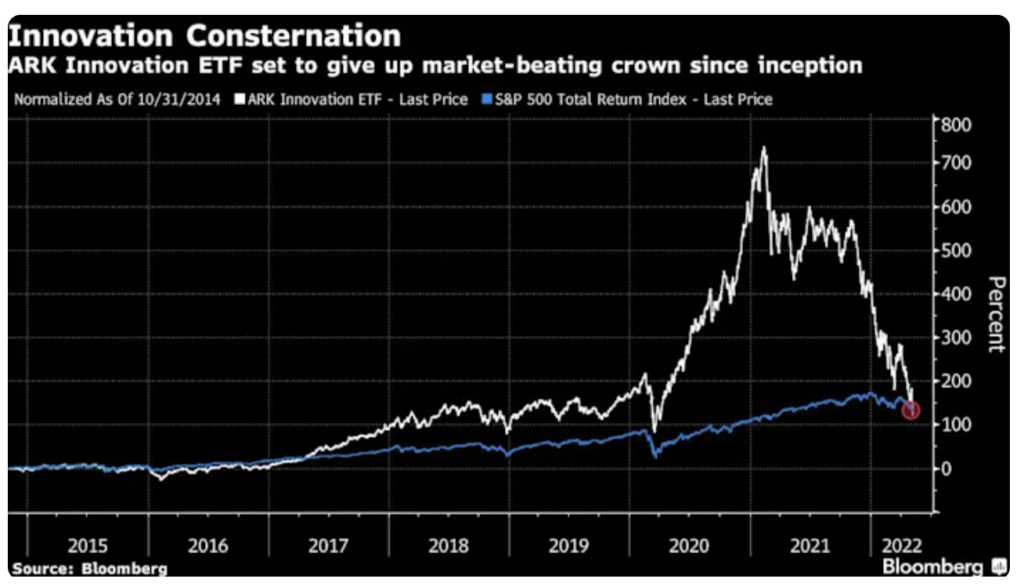

What were once jaw-dropping returns leaving Wall Street gawking at Cathie Wood’s ingenuity in active fund investing are no more: it appears that her flagship ARK Innovation ETF (NYSE: ARKK) has officially failed at outperforming the market in the long run. As Bloomberg reports, ARKK’s once outsized gains against the S&P 500 index are now down 10% as of Monday, meaning the ETF’s total return since its 2014 debut slumped to 122%, compared to a 128% return from the S&P 500.

Ouch.

While her flagship fund goes up in flames, Wood just last week continued to take slights at passive investing. “Passive funds prevented many investors from enjoying a 400-fold appreciation in $TSLA from a $1.6 billion market cap at its IPO in June 2010 to ~$650 billion when it entered the S&P 500 ten years later in December 2020,” she said in a tweeted response to Tesla CEO Elon Musk.

Passive funds prevented many investors from enjoying a 400-fold appreciation in $TSLA from a $1.6 billion market cap at its IPO in June 2010 to ~$650 billion when it entered the S&P 500 ten years later in December 2020. https://t.co/O7n8clt1tB

— Cathie Wood (@CathieDWood) May 4, 2022

The latest slump in sentiment comes as traders prepare for a substantially higher interest rate environment and a slowdown in economic output, subsequently putting companies speculating on future tech growth especially at risk. Remarkably, though, loyal investors continue to peddle Wood’s fantasy, with the ARKK ETF enjoying another $41 million worth of inflows as of Friday, Bloomberg data shows.

Ark storyline… or Cathie Wood roller coaster… #ARK #cathiewood

— Wall Street Silver (@WallStreetSilv) May 7, 2022

Sound On pic.twitter.com/893UsuNE0n

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.