Another day has come and gone, and another property developer enters default, further imploding the house of cards that is China’s real estate sector.

Modern Land Co., a Beijing-based rival of Evergrande, has officially succumbed to default status, after investors refused to push back the real estate developer’s proposed three-month extension on a $250 million bond payment due October 25. After suffering a significant decline at the beginning of the month, there wasn’t much room for Modern Land’s bonds to continue their dramatic descent, as its 11.8% February 2022 note fell another 1.6%, marking a staggering 80% discount from face value.

In a company filing published on Tuesday and seen by Bloomberg, Modern Land attributed the latest missed payment to “unexpected liquidity issues,” but said that it is working alongside its legal counsel and will soon bring financial advisors on board as well. Despite this, though, Modern Land’s coupon payment default caught the attention of Fitch Ratings, which downgraded the developer’s rating from C to Restricted Default.

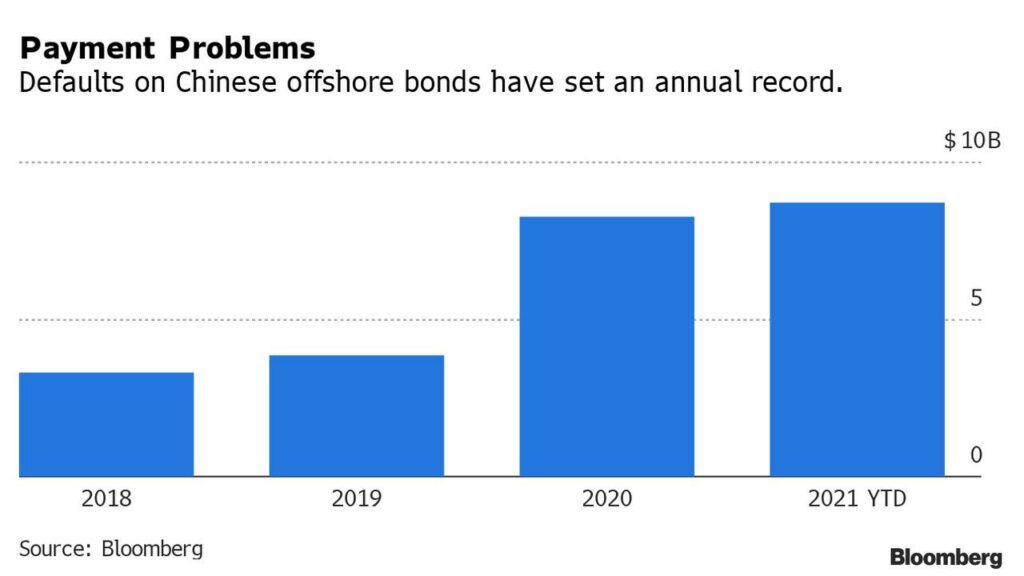

The newest default subsequently triggered widespread investor panic, which sent shares of other property developers down in unison. China’s CSI 300 Real Estate Index slumped 2.8%, China’s CSI 300 Real Estate Index fell 4.3%, while the Hang Seng Index receded 0.4%. Moreover, Modern Land’s delinquency on its coupon payments propelled the country’s real estate contagion even further, pushing the total value of offshore bond defaults by Chinese borrowers to a record $9 billion since the beginning of 2021, with the real estate sector responsible for one-third of the total.

The contagion of debt defaults have also made it increasingly more difficult for other Chinese property developers to secure liquidity, which is becoming evident as yields on Chinese junk bonds surge to 20%— the highest in over a decade. In a radical bid to avert a further catastrophic landslide, Beijing has even proposed that Evergrande’s founder, billionaire Hui Ka Yan, delve into his personal stash to help mitigate Evergrande’s surmounting $300 billion debt pile.

Speaking of Evergrande— which initially started the cascade of collapses across China’s real estate sector— the company has thus far been able to narrowly avoid an official default, after making a surprise $83.5 billion offshore coupon payment merely hours before the grace period ended. Despite this, though, Evergrande’s lenders are still bracing for what is appearing to be the inevitable: a debt restructuring that is going to be one of China’s biggest ever.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.