Canadian wealth management is a big universe. Many Canadian private wealth firms (companies that manage personal and family money, as opposed to institutional money), are among the largest in the world. They include CI Financial and Pembroke, each with hundreds of billions in assets under management (AUM), most of it for private clients.

Full-service wealth management has undergone a consolidation, and a growing share of it has been taken on by the banks who are slowly squeezing out all of the earnest little mom and pop investment firms in this country (sad!). So this column feels extra proud when we come across a good, honest, salt-of-the-earth, never-say-die boutique shop like Baskin Wealth Management.

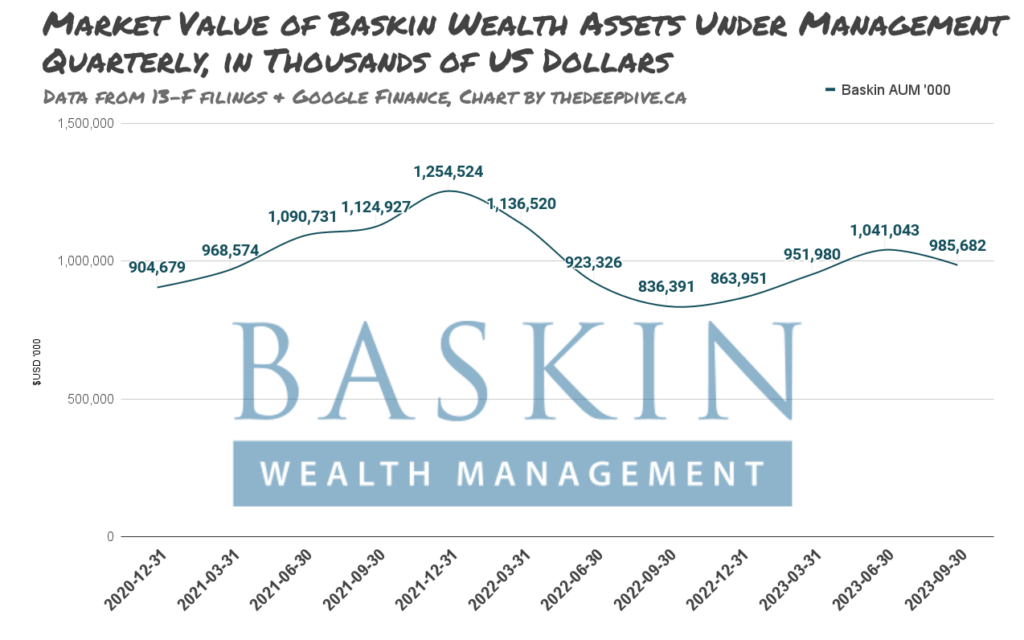

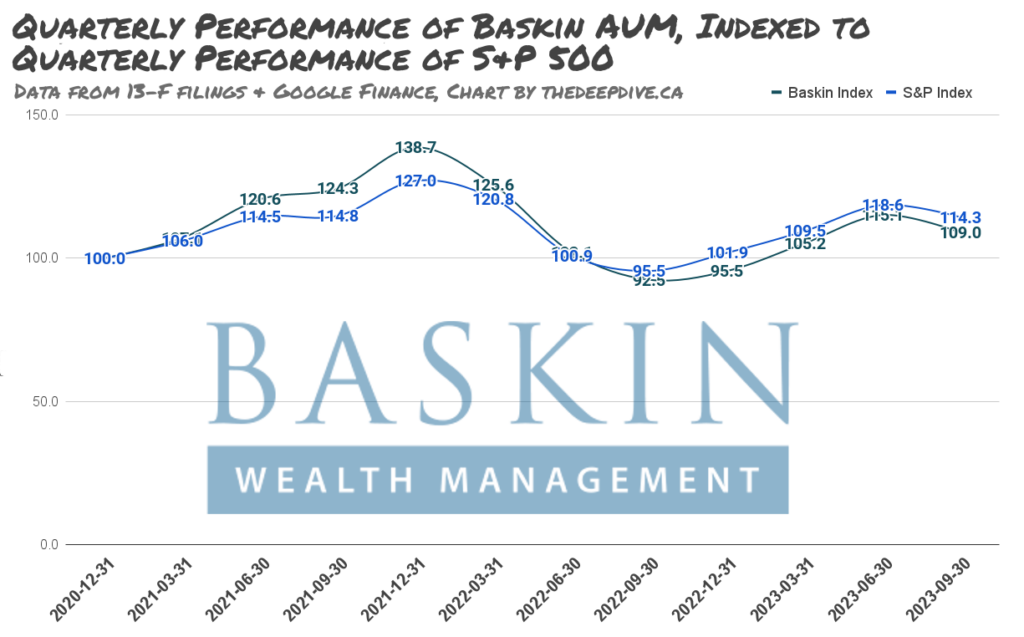

In a world dominated by big, heartless wealth managers whose only focus is making their clients’ money make more money, it’s refreshing to see an adorable little Toronto firm like Baskin managing the same $1 billion dollars or so sideways for the better part of three years.

We’re using 13-F data here, so we don’t know how much of this fluctuation has to do with Baskin’s clients inflows and outflows. Baskin may also manage client assets that aren’t 13-F eligible, in which case this chart wouldn’t represent the whole picture, but the firm’s profile on Wealth Management Canada lists an AUM figure that lines up with the 13-F data, so we expect we’re pretty close.

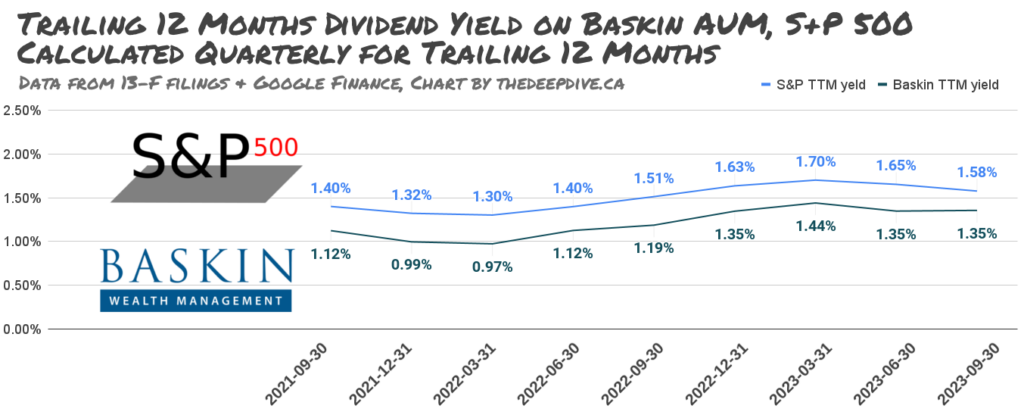

These things are usually what they look like, and this looks like a wealth management firm that earns private wealth fees from rich clients for parking their money somewhere it won’t get lost, and generating a return they might get out of the S&P 500…. almost.

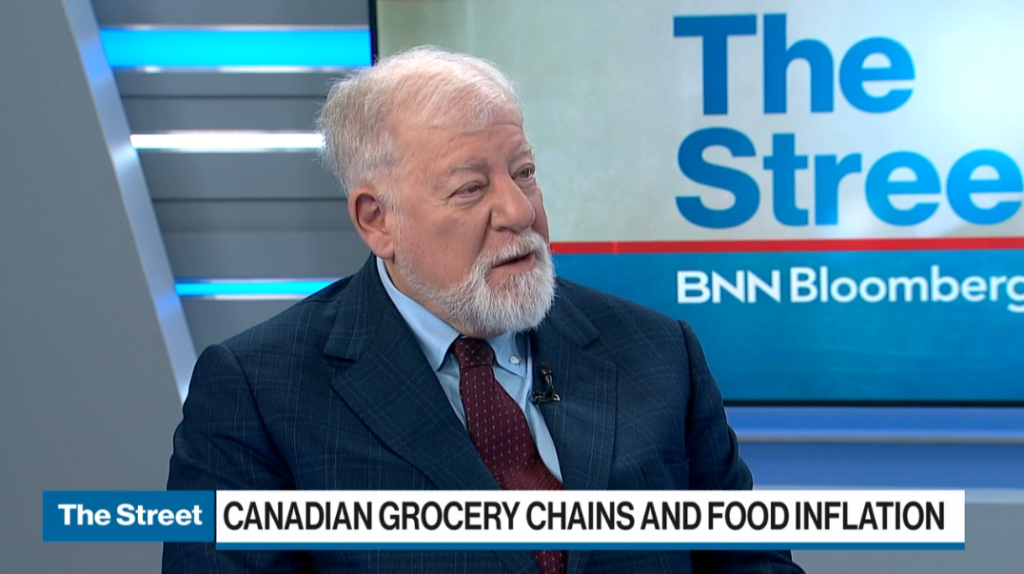

If Baskin seems irrelevant and uninteresting, it’s because it is. We’re only bringing it up because its CEO and namesake David Baskin is on television acting like he knows the first thing about business or economics, despite the fact that he clearly does not.

This column has gone on at length about how, yes, grocery store profits are absolutely a factor in the ever-rising price of groceries. We’ve demonstrated how they’re in fact the most identifiable factor, and the factor over which the grocery stores have the most control, but we haven’t yet heard from BNN about a guest spot.

75% of all statistics are made up on the spot

After a Dr. Phil-style chuckle about how one can learn a lot from doing arithmetic, Baskin’s nationally televised mathematical misadventure started with an input that sounded a lot like a guess.

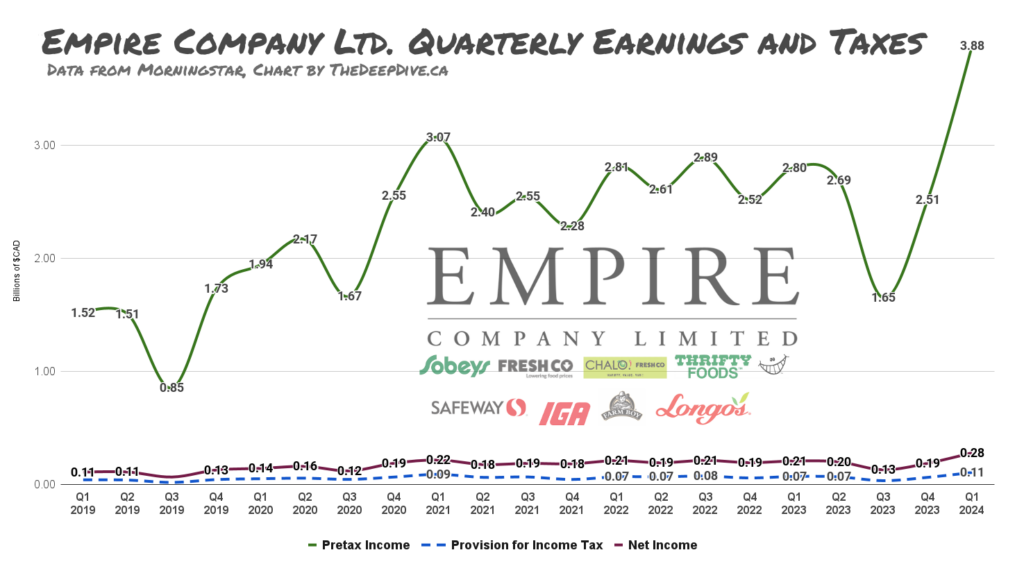

“The Canadian big grocery stores are going to make something like three and a half billion dollars in profits…”

Innumerate Canadian Wealth Management Professional David Baskin

Baskin doesn’t say which period he’s imagining referring to here, but he uses the present tense, so he might be trying to pass the abstract figure off as a 2023 projection.

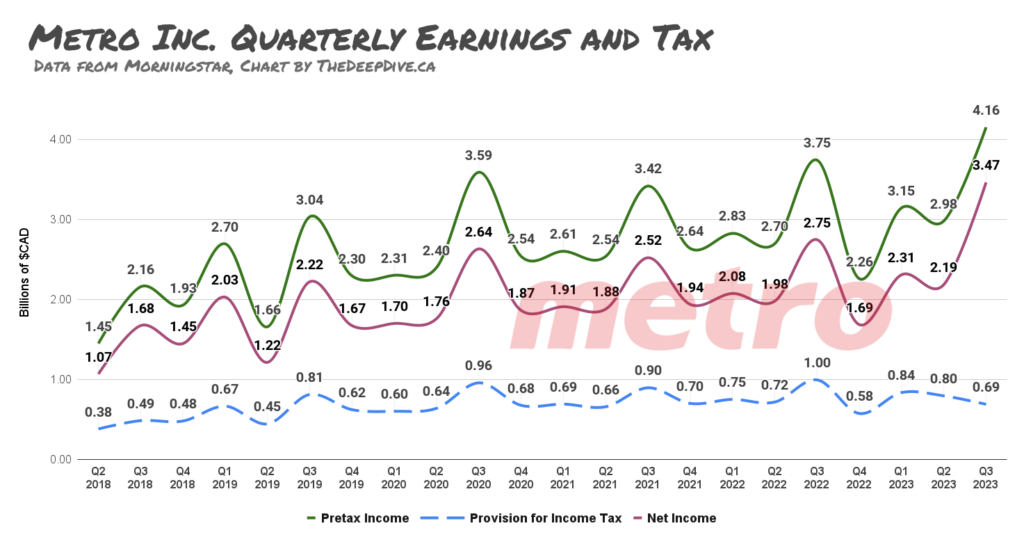

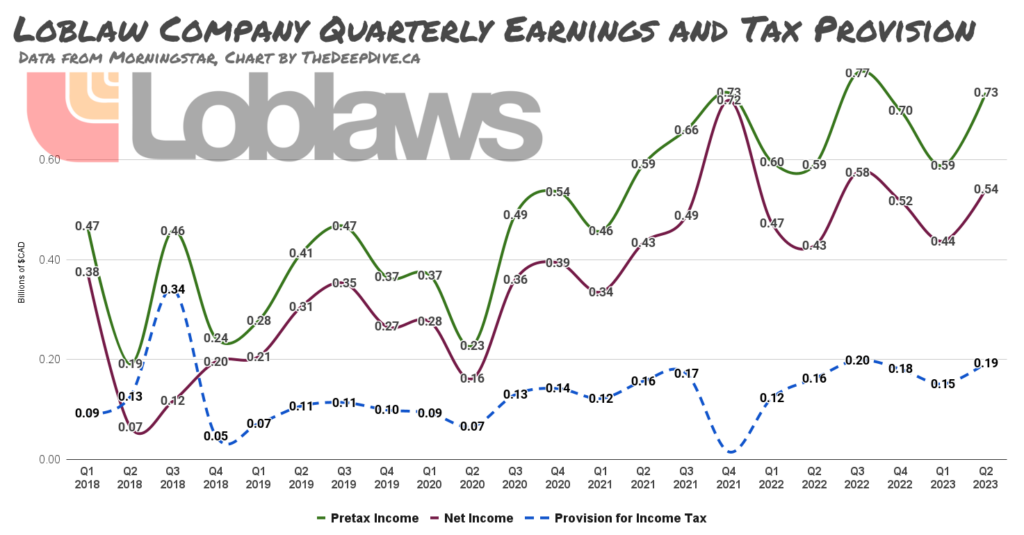

Canada’s three largest grocers, Metro Inc., Empire Co., and Loblaws have already reported a total of $7.11 billion in net, after-tax profits through the first half of 2023, more than twice Baskin’s figure.

In calendar 2023, those three companies are on pace to blow by their 2022 after-tax profit total of $10 billion dollars, and we haven’t even counted the Canadian profits of major US-based Canadian grocers Costco and WalMart.

Baskin goes on to divide his erroneous grocery profit figure evenly by 14 million Canadian households, then use the resulting (meaningless) figure to argue that the grocery profits don’t really amount to all that much, as if all of those households spend an equal amount on groceries, and as if a household’s grocery expense need not be evaluated in the context of that household’s income.

This isn’t a calculation, it’s a social permission slip

One doesn’t get the sense that repeating Baskin’s calculations back to him with the correct inputs would change his mind. The condescending lie about arithmetic that he opens with is a bad cover for the fact that the whole bit is an emotional appeal to the class of people he’s trying to court as clients of his overpriced, under-performing wealth management business.

Baskin is only interested in managing the money of people who have at least one million dollars of liquid assets to deposit, and are by definition financially detached from fluctuations in the price of groceries. More to the point, people with a million dollars that need managing are in a position to benefit from the inflated grocery, housing and fuel prices that will continue to drive the capital markets for as long as they remain unlimited. The members of that class that are inclined to give their money to a guy like Baskin, instead of just buying an ETF, making more money, and paying fewer fees, are the ones who would prefer not to think about it too much to keep it from conflicting with their humanity. They might welcome a fairytale about how their returns didn’t get squeezed out of poor people.

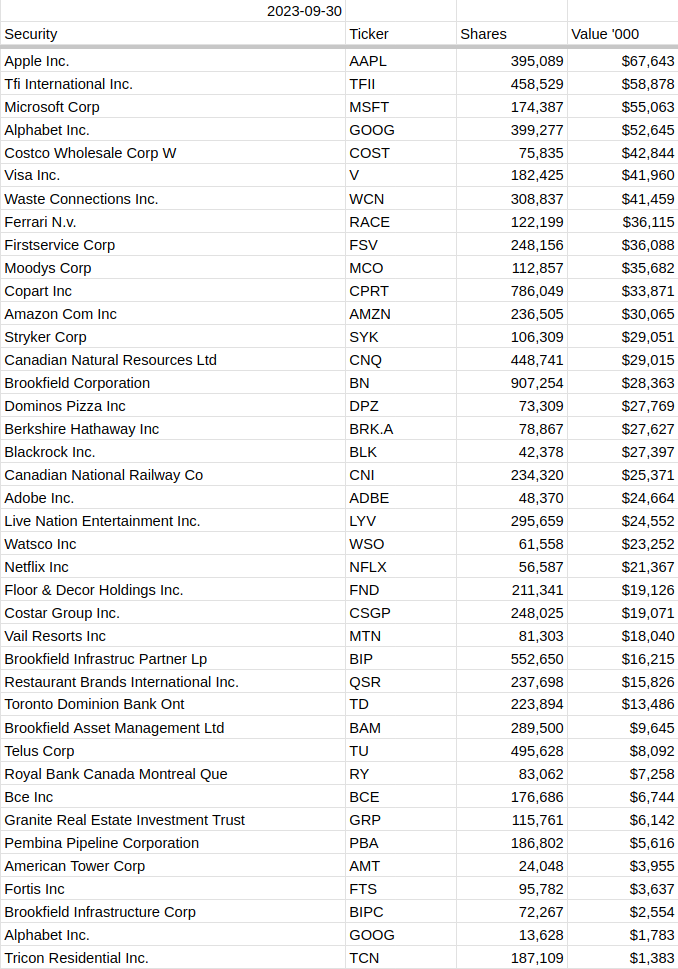

There are 15 more positions below these ones, and they’re all just as boring.

The only grocery store stock on the Baskin books at the end of September was Costco, but the Toronto shop has been a consistent owner of Brookfield’s various issues, which are major contributors to housing inflation, especially through their mortgage insurance cash cow Sagen, as are Tricon Residential, and TFI International. The firm also holds Visa, whose business involves selling people who can’t afford housing or food the money they need at a markup.

But blaming Baskin’s capital allocation for inflation would be silly. The billion dollars of client money it’s pushing sideways isn’t significant, and David Baskin is just doing what everyone does. That’s understandable, because his appearance on a stock market show to talk about managing money didn’t make him seem interested in his craft at all. He brushed the only question about stocks aside like it was a bland hors d’oeuvre (“They’re good. People aren’t going to stop shopping at the grocery stores.”), and promptly changed the topic to what a terrible development it would be if the government were to impede grocery store profits by, “taxing them away or something…”

…which would be terrible for his wealth management business.

The reason people blame high gas prices on oil companies, high rent on landlords, and expensive groceries on grocery stores is that, contrary to what David Baskin would have BNN’s audience believe, it really is that simple. Camping on a sure thing and milking it for every dime of rent drives up the price of the sure thing being camped on. It’s a great way to make money, and the money being made is the money of the people who are constantly being squeezed by the higher costs of food, shelter, gas, etc.

Baskin shouldn’t be worried about this government or the next making his kushy job more difficult by limiting rent seeking; Trudeau consistently bends over backwards to enable it, and Poilievre can’t wait to do the same thing. But we can see why the idea might terrify him: Baskin can’t even perform while dealing in the blue chips, where he can just throw a dart at the index and call it analysis. Having to fake it a few tiers up the risk curve where he’d have to identify and capture growth sounds like his nightmare.

Information for this briefing was found via BNN Bloomberg, Sedar, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.