One company owned by one bigger company is holding the whole housing market together… for now. And they’re making billions doing it.

The housing market remains bleak, as high(er) interest rates fail to contain inflation.

It’s a squeeze. A pickle. A real humdinger. We’ve spilled our share of pixels around here illustrating how it works, how bad it’s getting, and how it’s dooming us all to either debt or homelessness.

The mechanics of the hundreds of billions of dollars per year generated by the financialization of the housing markets and where they go are sort of complicated, but where they end up is actually pretty simple: the Banks, and Brookfield Asset Management (TSX: BAM).

Housing Market Capital Needs Mortgage Insurance

Banks like sure things, so to make them pillars of our housing market-based economy, the government-owned Canadian Mortgage and Housing Corporation insures the mortgages that banks write (if a buyer puts less than 20% down), acting like a sort of keystone that holds the whole home-lending structure together. Banks pay a premium to the CMHC for the life of the mortgage and, if the buyer can’t pay, the CMHC buys the remaining balance of the mortgage from the bank and goes after the borrower for the rest.

But some borrowers are too risky for the government to insure as borrowers, and also don’t want to sleep on the sidewalk. For them, there is private mortgage insurance. It works the same way, but is owned and operated by a private company.

You’re going to want to spread that housing market glue around… get good coverage…

Sagen (TSX: MIC.PR.A), formerly known as Genworth Canada, is the largest private mortgage insurer in Canada. And the people down at Sagen really want people who can barely afford it to take out a mortgage and buy a house.

Scott McGillivray brands himself as a sort of working man’s real-estate entrepreneur. His natural habitat is his very own HGTV digital series, Buying In, where he drives prospective first-time home owners around and shows them different properties, stopping every once in a while to have a video call with a friendly mortgage broker.

In season two, a very warm McGillivray, in jeans and a flannel shirt, shows first time home buyer Shannon an Oakville, Ontario bungalow that would be perfect for her and her two adorable dogs! (Shannon works for Dog Guides Canada and loves dogs. Don’t you just love dogs? We love dogs, too!)

The place is a bit run-down, though, and she doesn’t want to live in a dump. Luckily, some timely entrepreneurial wisdom occurs to Scott organically at 1:13 of the video:

Scott McGillivray. Real Estate Entrepreneur and Brand Ambassador

“You might want to consider doing, like, a Sagen insured mortgage? That way, you can buy it with 5% down, and keep some of your cash so that you can do upgrades like the floor, the railings, a paint job. All of those things are going to add value to the house, so that you’ll earn back your investment in equity.“

That’s objectively investment advice and, since Scott didn’t frame the lift on the house’s equity as a potential, it could even be considered a guarantee. It doesn’t seem that way, because Shannon isn’t shopping for an investment; she just wants to move herself and the dogs out of her parents’ basement. But Sagen didn’t hire Scott to tell his viewers there’s a downside in this housing market, it hired him to pretend it cared about helping Shannon.

And it does care, so long as she can borrow 95% of the value in the house from the bank. The bank will use Sagen to insure their investment in Shannon making her mortgage payments, and pay 3.52% of the loan’s value to Sagen as an insurance premium.

As of Q3 2022, Sagen insured $195.4 billion worth of residential mortgages held by Canadian banks… with a $6 billion balance sheet. That’s a neat trick, and we will look into how it’s done in a future episode, but right now we’d like to focus on just how lucrative this business is.

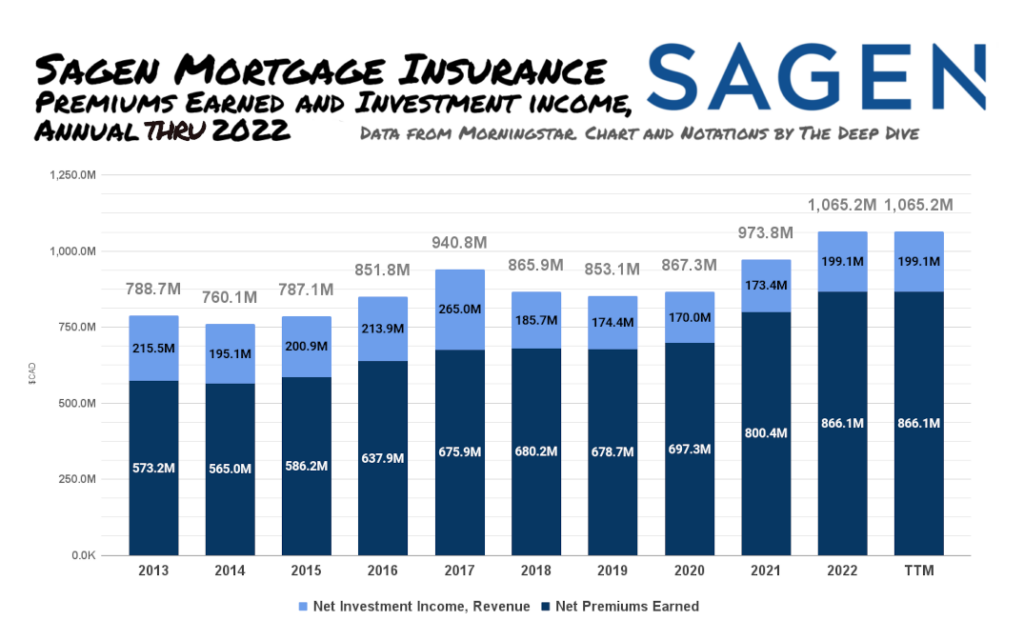

Between the mortgage insurance premiums collected from banks, and income from investing the $6 billion in reserves, Sagen pulls in roughly $800 million to $1 billion every year for their part in gluing borrowers to their lenders, and keeping the housing market together. They aren’t going to just let all that capital sit around collecting dust.

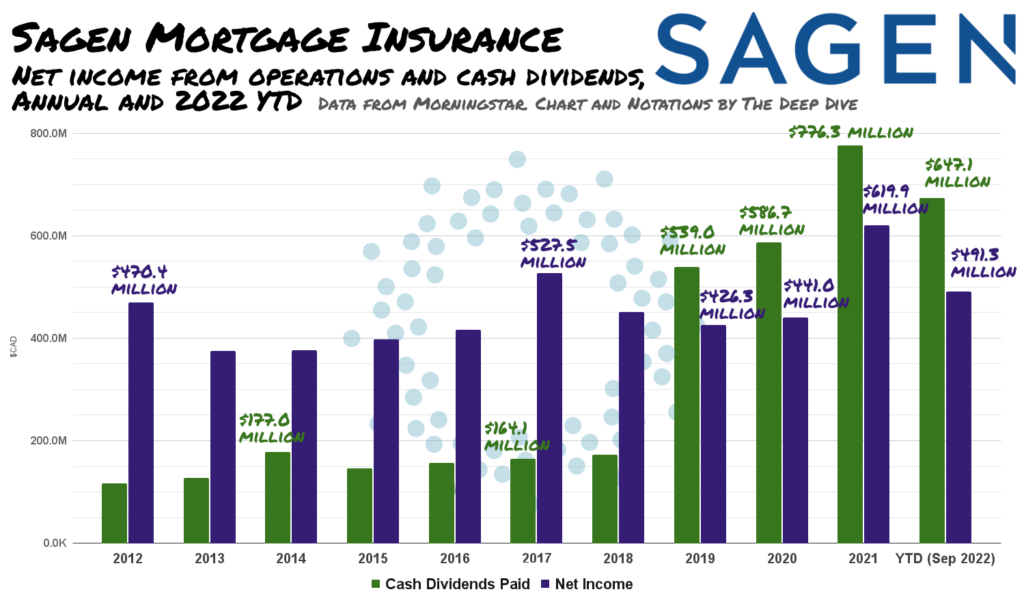

If you’re wondering what kind of a business can pay out dividends greater than its net income for four years in a row, the answer is: a really lucrative one, owned by an even larger business that uses it like a money tree.

Brookfield Asset Management

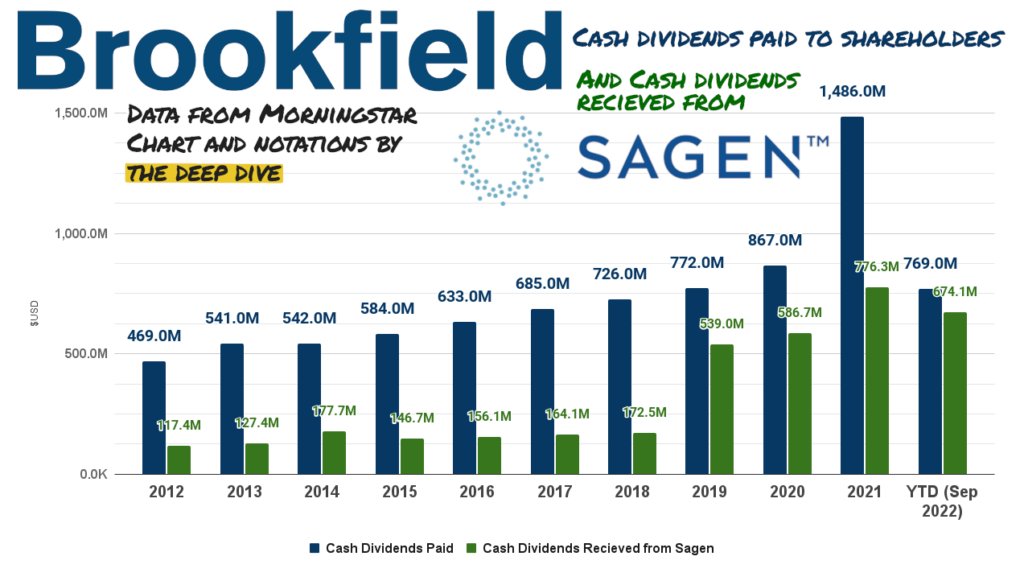

Sagen has paid its majority shareholders Brookfield Asset Management $2.57 billion in dividends since the beginning of 2019. The dividends that Sagen paid to Brookfield amounted to 66% of the value of the dividends that Brookfield itself paid out to its own shareholders over that same period.

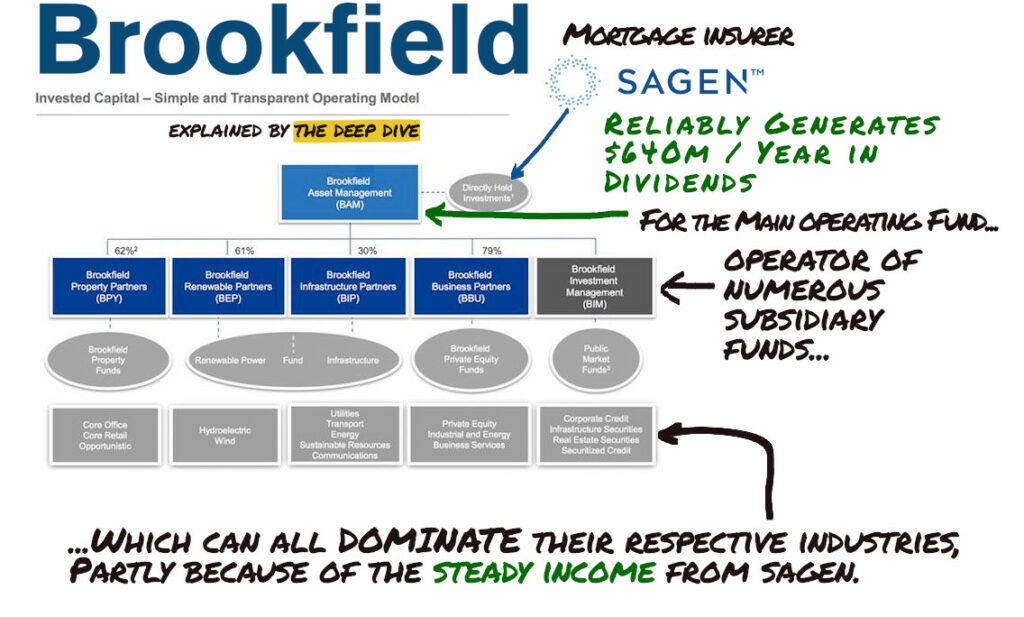

It can be a lot more complicated than that for anyone who wants to make it that way. Brookfield is Canada’s largest private equity investment firm. It’s an enormous, hyper-efficient capital juggernaut that takes investor money and applies it across various divisions like real estate, renewable energy, infrastructure, etc. All of the sectors are separated into separate funds that function like operating subsidiaries, all managed and operated by the mother fund. Most of the divisions pay an interest off the top each quarter to minority shareholders in the individual funds, and have plenty left over to make contributions to the mother fund, because Brookfield generates cash like a giant tire fire generates smoke, and it couldn’t stop if it tried.

Brookfield Asset Management is a $260 billion enterprise that generates $45 billion a year in revenue and pays out a 4.62% yield… AFTER breaking off $8.1 billion off the top for its minority equity partners.

Sagen isn’t held in any of the Brookfield subsidiary funds. The Sagen dividends go directly into the Brookfield corporate operating fund, because it’s a consistent river of cash that can be used to re-capitalize the more volatile subsidiary businesses. When they’re lean, it can be used to keep them liquid. When the respective subsidiary fund sectors go into slumps, Brookfield can get aggressive and buy up chunks of the depressed sector without having to worry about cutting distributions or dividends.

The dividends that Sagen wrings out of the housing market might not take a direct path to the dividend Brookfield pays out, but they call them capital “pools” for a reason, and steady inflow has everything to do with steady outflow.

If we trace Brookfield’s steady inflow backwards, it’s going to make stops in the enormous, deep, growing lakes at Sagen and the banks it insures, before branching off into tens of millions of small streams and creeks that all start with the individual monthly payments of people who live in houses. Sometimes the payments stagnate in a landlord swamp before joining the larger river, some local real estate agent having convinced someone that there’s no sense sending all that juicy flow straight downstream right away. Might as well hold on to it a while, see how much they can accumulate while the people upstream are still making it rain. It’s a good bet they always will, as long as they’re able.

But the Brookfield, Sagen and Bank lakes aren’t likely to let their water levels drop just to keep the dividend outflows steady. Not if they can keep wringing it out of all the Shannon’s that the Scott McGillivray’s have so kindly aggregated into a watershed, as they do their part to keep this housing market together.

Information for this briefing was found via Sedar, Sagen, Brookfield Asset Management and the sources mentioned or linked. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Thanks for this information about this housing market. This is really helpful and I am glad to know more about loans mortgage company.

Thanks for reading!