In an in-depth analysis by Brent Sadler, Senior Research Fellow in the Allison Center for National Security at The Heritage Foundation, the precarious state of the U.S. Strategic Petroleum Reserve (SPR) is laid bare, highlighting significant concerns about the nation’s energy security amid escalating global tensions.

“Well the fuel problem is bigger than thought,” Sadler starts on his post on X. His analysis parallels with the jet fuel shortage in Japan, resulting in international airlines postponing plans to expand flights to the Asian nation. Officials at Narita Airport, Japan’s main gateway for air traffic, have revealed that airlines have shelved plans to add 57 flights to the weekly schedule. The number of canceled or postponed flights could continue to rise. Inbound tourism, now a key source of export income for Japan, has almost doubled over the past year, but airlines are hitting a wall as they cannot secure enough fuel for return flights from Japan.

Well the fuel problem is bigger than thought…

— Brent D. Sadler (@brentdsadler) July 2, 2024

Japan is having to make cuts to flights and scale back expansion in routes due to jet fuel limitations…

This is eerily similar to the problems building in the U.S. detailed in a recent report:https://t.co/NjCS8LTqDV

See the… pic.twitter.com/k6nqfTHJAm

The crisis extends beyond Narita, affecting other regions like Hokkaido, where airlines such as Qantas and Singapore Airlines have canceled seasonal flights due to fuel shortages. The Japanese government has established a task force to address the issue, attributing the fuel shortage to a reduction in oil refineries and labor shortages in trucking and shipping.

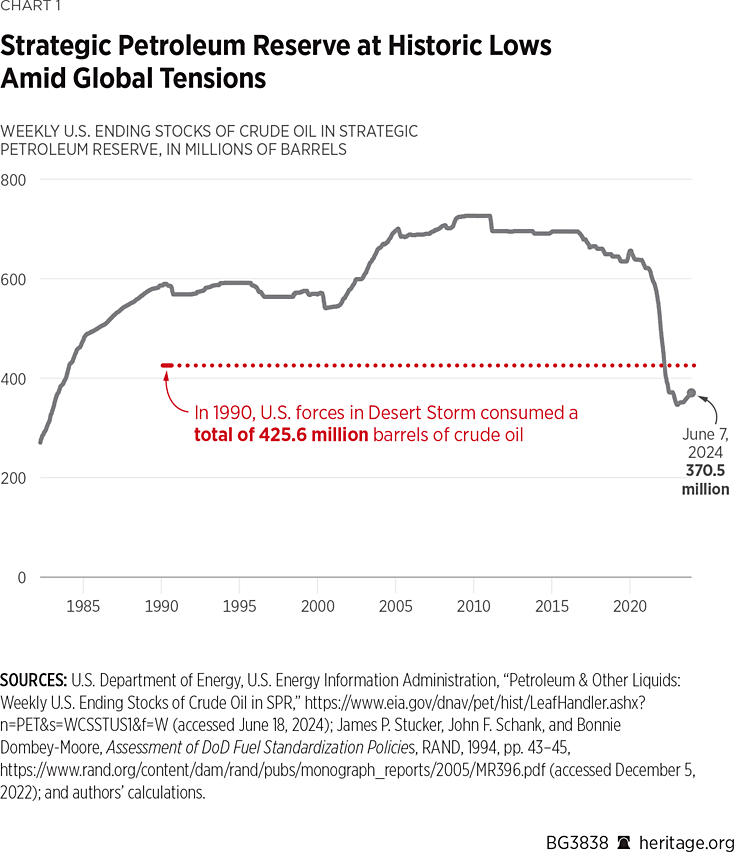

Sadler compared this phenomenon to what’s been happening to the U.S. SPR. In his article, Sadler noted that the SPR, a critical buffer against severe supply disruptions since its establishment in 1975, now holds only 370.5 million barrels of crude oil as of June 7, 2024. This is a sharp decline from its peak of nearly 700 million barrels in 2010, and a far cry from the reserves needed to manage potential future energy crises.

The SPR was created in response to the 1970s oil embargo to provide the U.S. with a strategic reserve of petroleum to mitigate severe supply disruptions. However, recent years have seen a dramatic decrease in reserves, particularly following the Biden administration’s decision to release 180 million barrels in 2022 to alleviate soaring fuel prices.

While this move provided short-term relief at the gas pump, it left the U.S. vulnerable to future supply shocks. Sadler emphasizes the gravity of this situation, stating, “The U.S. military’s reliance on petroleum means any significant disruption could cripple our defense capabilities during prolonged conflicts.”

The military implications of this decline are profound. During the 1990-1991 Gulf War, U.S. forces consumed a total of 425.6 million barrels of crude oil. The current reserves would be insufficient to meet similar demands in a future conflict, not only affecting military readiness but also economic stability, as energy shortages could lead to increased prices and logistical challenges across various sectors.

“The SPR’s current levels are inadequate to sustain military operations and domestic economic stability in the event of a major crisis,” Sadler further explains.

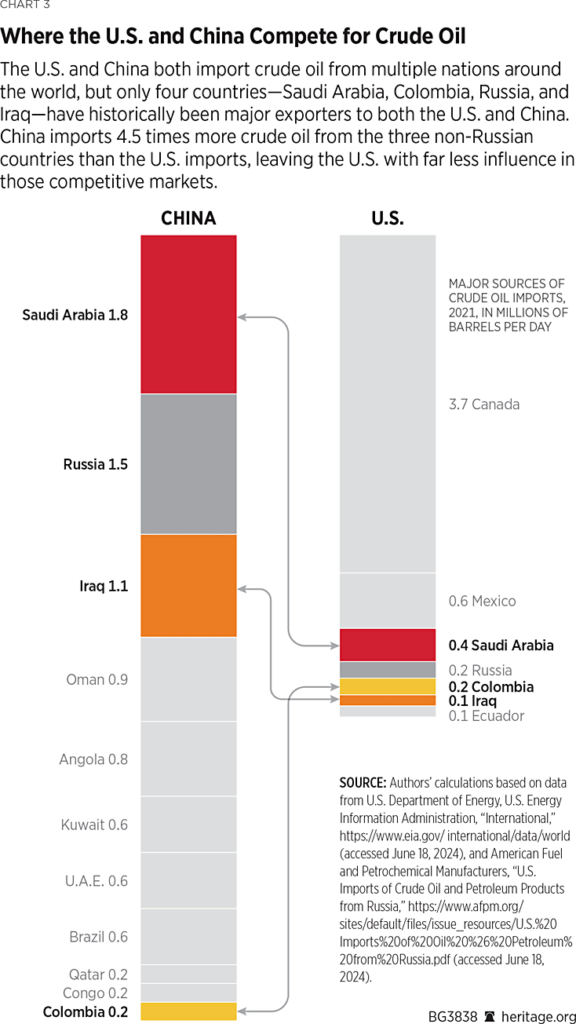

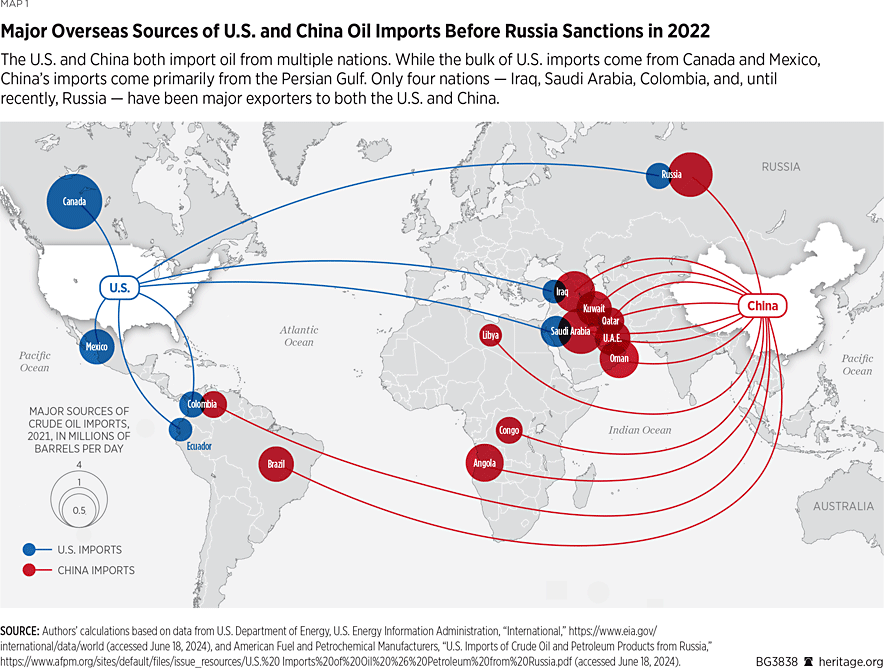

Globally, the competition for crude oil is intensifying, particularly between the U.S. and China. China has been aggressively securing oil imports from key producers such as Saudi Arabia, Russia, and Iraq. In fact, China imports 4.5 times more crude oil from these countries than the U.S. This disparity in import levels is a strategic concern, as it leaves the U.S. at a disadvantage in accessing crucial resources during emergencies.

CO2 emissions trends

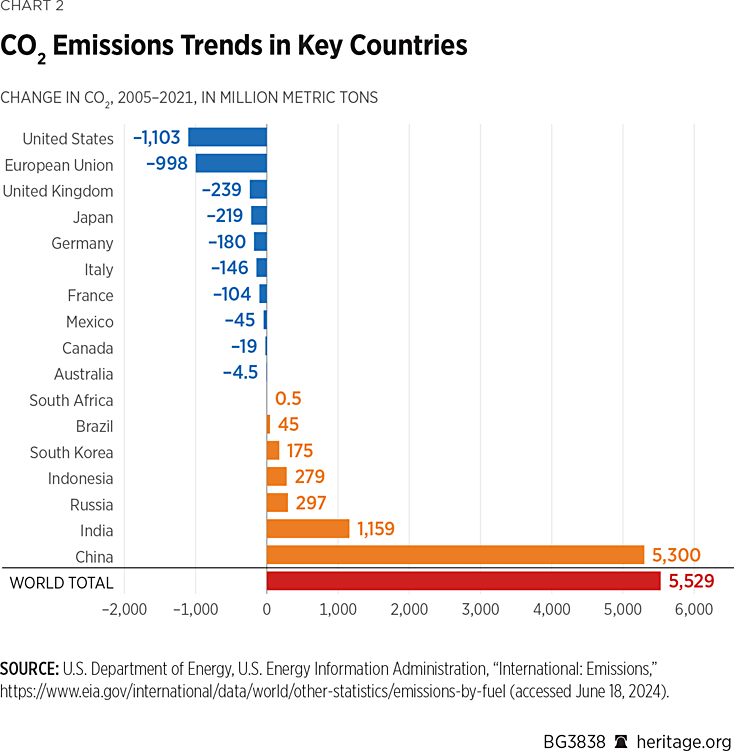

In his piece, Sadler also delves into the contrasting CO2 emissions trends between the U.S. and China, revealing how energy policies have diverged significantly. The U.S. has made considerable progress in reducing its carbon dioxide (CO2) emissions, cutting over 1,100 million metric tons between 2005 and 2021. These reductions have been driven by policies promoting renewable energy and a shift from coal to natural gas, resulting in significant environmental benefits.

However, China’s emissions have surged by 5,300 million metric tons during the same period, reflecting its rapid industrial growth and heavy reliance on coal.

In the U.S., stringent environmental regulations and substantial investments in renewable energy sources have driven emissions reductions. The U.S. has seen a marked decrease in emissions due to the adoption of natural gas, wind, and solar power, as well as improvements in energy efficiency. However, these reductions are juxtaposed with China’s growing emissions, which now account for a substantial portion of the world’s total.

Sadler emphasizes the need for a balanced approach to energy security that includes both renewable energy and traditional fossil fuels. “Relying solely on green energy, particularly when controlled by geopolitical rivals like China, could compromise national security,” Sadler warns.

He advocates for policies that promote energy independence while also addressing environmental concerns. “We need to ensure that our transition to renewable energy does not leave us vulnerable to external threats,” he adds.

Competing for crude oil

Diving deeper into the competition between the U.S. and China for crude oil, Sadler provides a detailed analysis, noting that China significantly outpaces the U.S. in imports from key producers like Saudi Arabia and Russia. China imports 1.8 million barrels per day from Saudi Arabia, compared to the U.S.’s 0.4 million barrels per day.

The strategic implications of this competition are profound. China’s extensive import network not only enhances its energy security but also gives it leverage in global energy markets. In a potential conflict, this leverage could be used to disrupt U.S. access to vital energy supplies. Sadler emphasizes the need for the U.S. to diversify its energy imports and bolster domestic production capabilities.

“Building robust alliances and enhancing domestic oil production are crucial to mitigate the risks posed by China’s dominant position in global energy markets,” he advises.

In his comprehensive analysis, Sadler also highlights the alarming decline in U.S. refinery capacity since 2020, from 19 million barrels per day to 18.4 million barrels per day in 2024. The reduction in refinery capacity limits the U.S.’s ability to meet domestic fuel demands, especially during emergencies when demand surges.

“The ability to refine and distribute fuel efficiently is a cornerstone of both economic stability and military readiness,” Sadler underscores.

Sadler provides a detailed examination of operationally important fuels such as jet fuel, diesel fuel, and motor gasoline. He notes that the production and consumption of these fuels have been affected by reduced refining capacity and policy decisions that have prioritized renewable energy.

For example, the production of jet fuel, a critical resource for both military and commercial aviation, has been constrained, leading to supply issues and increased costs. Jet fuel consumption had led production prior to 2020 but was significantly impacted by the COVID-19 pandemic. Demand matched production in 2022 but is expected to widen further with the return of pre-pandemic levels of air travel.

Diesel fuel, which powers a large portion of commercial and military logistics, has also seen a narrowing margin between production and consumption. Sadler highlights that any disruption in the supply of these fuels could have severe consequences for both civilian and military operations.

Steps to take

In light of these challenges, Sadler argues for a reimagined role for the SPR to ensure it meets current and future national security needs. The SPR, originally designed to address short-term supply disruptions, is not adequately structured to support the U.S. during a prolonged military conflict.

“Today’s reserve does not function to meet national or military needs for various types of fuels in a prolonged war,” Sadler explains. He suggests that future strategic reserve legislation should ensure the nation has robust access to energy markets in peacetime and during times of conflict. This includes maintaining adequate fuel reserves and refinery capacity to avoid coercion by foreign adversaries.

Sadler outlines several key policy recommendations to enhance U.S. energy security:

- Unshackle American Refiners: Global refining capacity is being artificially suppressed by net-zero and ESG policies. Sadler calls for the removal of regulations that hinder investment in cleaner and more efficient domestic petroleum refining. “The President and Congress should work together to remove barriers that suppress investment in domestic refining capacity,” he advises.

- Tap into Domestic Petroleum Reserves: The President should approve the expansion of domestic oil drilling on federal lands and direct purchases over time of domestic crude oil to restock the SPR. Sadler emphasizes the need to balance environmental concerns with energy security. “We must leverage our vast domestic resources to ensure national security,” he states.

- Enhance Pipeline Infrastructure: The examples of New England and California highlight the need for more pipelines to safely and efficiently move energy across the country. Sadler points out that the persistent shortage of U.S.-flagged tankers to move fuels during a crisis exacerbates the issue. “Pipelines are a critical component of our energy infrastructure,” he asserts.

- Strengthen Foreign Assurances for Fuel Supplies: Sadler suggests that the Secretary of State and Secretary of Commerce should pursue agreements with key crude oil–producing and refined petroleum–producing nations to ensure energy supplies during conflict. “These agreements should be elevated to the status of treaty obligations,” he recommends.

- Reform the Jones Act: Sadler calls for easing the Jones Act restrictions by allowing ships registered, flagged, and crewed by defense treaty allies to provide services between U.S. ports. “We need to focus on regaining American maritime competitiveness while leveraging allied shipping capabilities,” he explains.

- Prioritize Energy Resilience Diplomacy: The President should refocus diplomatic and economic engagement away from a myopic ESG and climate agenda to one that supports energy resilience. Sadler argues that current policies have increased dependence on China for renewables, undermining U.S. energy independence. “Energy resilience should be at the forefront of our diplomatic efforts,” he asserts.

“Ensuring a resilient and diversified energy strategy is paramount for national security and economic stability in the face of global uncertainties,” Sadler concludes.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Biden sold much of the Strategic Oil Reserves to the CCP.. Hunter Biden brokered the deal. Now I wonder, how much was paid into the Government coffers? How much Was Hunter paid for his service? Just another slap at Trump who was so proud to have filled the AMERICAN OWNED oil asset to the brim at $ 40,00/per barrel and Americans never had a chance at the American owned asset, the Biden gift to the CCP.