Last week, Cantor Fitzgerald updated their estimates on a bundle of Canadian License Producers. In every case, they slashed the 3 largest license producers’ price targets. Cantor Fitzgerald lowered their 12-month price target on Tilray Inc (TSX: TLRY) (NASDAQ: TLRY) to C$18 from C$19 and reiterated their overweight rating.

Tilray currently has 20 analysts covering the stock with an average 12-month price target of $16.57 or a 4% upside. Out of the 20 analysts, 2 have strong buys, 3 have buys, 13 have hold ratings and 2 have sell ratings. The street high sits at $27 while the lowest comes in at $1.27.

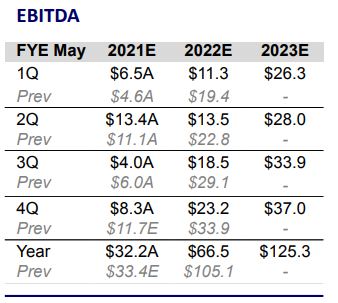

Cantor Fitzgerald says they are lowering their price target and reducing their 2021 estimates but raising their 2022 estimates. For 2021, they believe that Canada is still facing a slower ramp-up than during the pandemic and that COVID-19 headwinds will continue to impact their ancillary businesses.

With the recent approval of Tilray issuing new shares, Cantor believes Tilray will go on a shopping spree to continue to build up their option agreements in the U.S. They believe this will have to happen, as management has guided for $4 billion in top-line revenue by 2024. They also walk back their recent comment about Tilray being the next Coca-Cola, saying that the comment was pre-mature, but “only a few companies are on that trajectory, and we could put TLRY in that group.”

Cantor, in another paragraph, talks about what they believe will drive stock performance. They say that historically, it’s been investors’ outlook for U.S federal level reform/legalization. But they believe that, for the Canadian producers, “credible vision articulation” will be the key driver of stock performance.

Below you can see Cantor’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.