London tin prices soared past the $30,000-mark for the first time in 15 months, continuing the rally seen early this year and echoing the climb seen across other base metals. The surge comes amid growing optimism regarding heightened global demand and a landscape of uncertain supply.

Crazy how literally nobody on Twitter is talking about the fact tin is trading >$30,000/ton

— WTI Realist 🇸🇦🇻🇪 (@WTIBull) April 10, 2024

The benchmark three-month tin on the London Metal Exchange (LME) surged to $31,730 per metric ton, marking its highest point since January 2023. Similarly, the most-traded May tin contract on the Shanghai Futures Exchange experienced a notable uptick, climbing 5.3% to 250,810 yuan ($34,679.15) per ton. Earlier in the session, it peaked at 251,350 yuan, marking its highest level since June 2022.

Driving this surge is the significant decline in LME tin inventories, which have plummeted to 4,285 tons, representing the lowest levels since July 2023. Since the year began, stockpiles have dwindled by a staggering 44%, underscoring tightening supply conditions in the market. The LME cash tin contract was seen trading at a $26 a-ton premium to the three-month contract on Tuesday, indicative of the acute tightness in near-term supplies.

In contrast, China, the world’s largest tin consumer, witnessed an accumulation of inventories in warehouses tracked by the Shanghai Futures Exchange. Recent data revealed that stocks reached a record high of 12,823 tons last week, reflecting differing market dynamics between China and the rest of the world.

The resurgence in tin prices also comes on the heels of Indonesia’s decision to recommence its metal mining operations. The move follows the issuance of new production quotas by the government, earmarking over 40,000 tonnes of tin for extraction this year. Indonesia, a key exporter of tin, encountered setbacks due to bureaucratic delays earlier in the year, leading to the suspension of mining activities and a near halt in exports in January.

The one benefit of not sleeping due to a newborn is that you can check tin prices before most of your commodity degenerate friends are awake.

— Brandon Beylo (@marketplunger1) April 10, 2024

Up another 6% this morning.

Good Lord. #tin https://t.co/jvqJkhqCrd pic.twitter.com/18PmmJEc9m

Furthermore, the rally in tin prices received a boost from a broader surge in other base metals. Traders observed short position holders covering their positions ahead of the release of the recent U.S. inflation data.

Among other base metals, LME copper advanced 0.6% to $9,472.50 a ton, aluminium increased 0.7% to $2,476, nickel was up 0.2% at $18,250, zinc climbed 1.6% to $2,753.50, and lead edged up 0.2% at $2,166.

Similarly, SHFE copper advanced 0.5% to 76,700 yuan a ton, aluminium climbed 1.4% to 20,485 yuan, nickel jumped 1.8% to 139,520 yuan, zinc rose 3.1% to 22,550 yuan, and lead edged up 1.5% at 16,825 yuan, reflecting the broader market optimism across the base metals sector.

The tin story

As tin prices surge to over a year high, the metal finds itself at a critical juncture, grappling with supply challenges amidst a transformative period dubbed the “Great Electrification.” In a primer by Brandon Beylo on Macro Ops, he elucidated the intricacies of the base metal to provide insight into the current dynamics shaping the market.

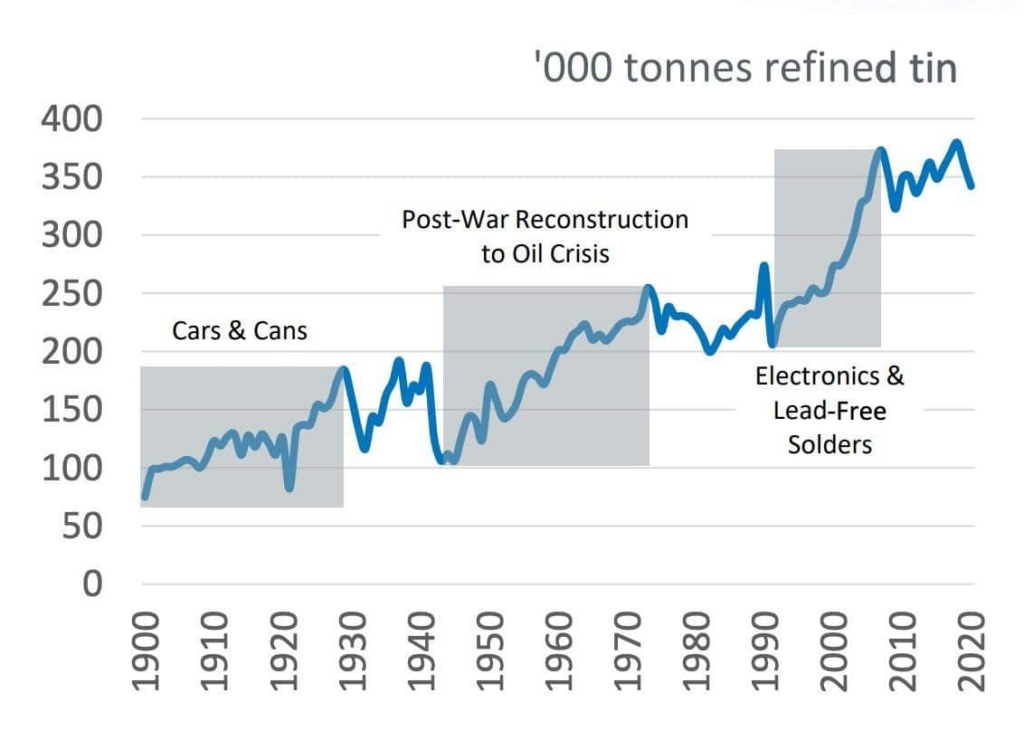

Similar to uranium, tin’s historical narrative unfolds in distinct boom periods, each characterized by unique drivers and industrial applications. From the early days of the Bronze Age, where tin played a pivotal role in the creation of bronze alloys, to its modern-day utilization in consumer electronics, tin has been a significant metal for centuries.

Today, tin’s versatility is reflected in its myriad applications, ranging from soldering and chemicals to tinplate and batteries. Notably, soldering emerges as a dominant use case, constituting approximately 49% of tin demand. The ban on lead-based soldering in 2006 propelled tin into the spotlight as the preferred alternative due to its conductivity, low melting point, and cost-effectiveness.

The surge in tin demand, particularly in the realm of consumer electronics, underscores the metal’s indispensability in powering the digital age. However, this burgeoning demand is met with supply constraints, as global tin production remains highly concentrated, with 75% originating from just four countries: China, Indonesia, Myanmar, and Africa.

Moreover, tin mining operations face inherent challenges, ranging from declining ore grades to the adoption of unconventional extraction methods like offshore dredging. The depletion of high-grade reserves in regions such as Gejiu, China, and the shift towards lower-grade, higher-cost mining underscore the complexities inherent in sustaining primary production.

Indonesia, the world’s second-largest tin producer, confronts similar hurdles, with the exhaustion of easily accessible ore necessitating offshore dredging as a viable albeit precarious alternative. The decline in production volumes over the years serves as a reminder of the industry’s battle against diminishing reserves and escalating extraction costs.

Across the globe, major tin producers contend with the task of maintaining output levels amidst a backdrop of diminishing reserves and stagnant production growth. Myanmar struggles with reserve depletion, while South America and Africa face challenges in reviving once-flourishing tin industries.

In light of these supply constraints, secondary sources of tin supply, such as scrap recycling and refining, assume heightened importance. While scrap recycling contributes a significant portion to annual supply, refineries and recycling facilities must operate at near-maximum capacity to meet demand.

Tin futures’ future

Reporting agency Fastmarkets suggested earlier this year that the current uptick in tin prices may represent a bear market rally, echoing sentiment from previous assessments. The agency correctly estimated that LME tin price will surpass the $28,000 to $29,000 per tonne mark, driven by global supply uncertainties, particularly stemming from the Myanmar Wa state.

Additionally, positive macroeconomic indicators and favorable seasonality could attract fund managers to re-enter the market, turning net long on tin once again.

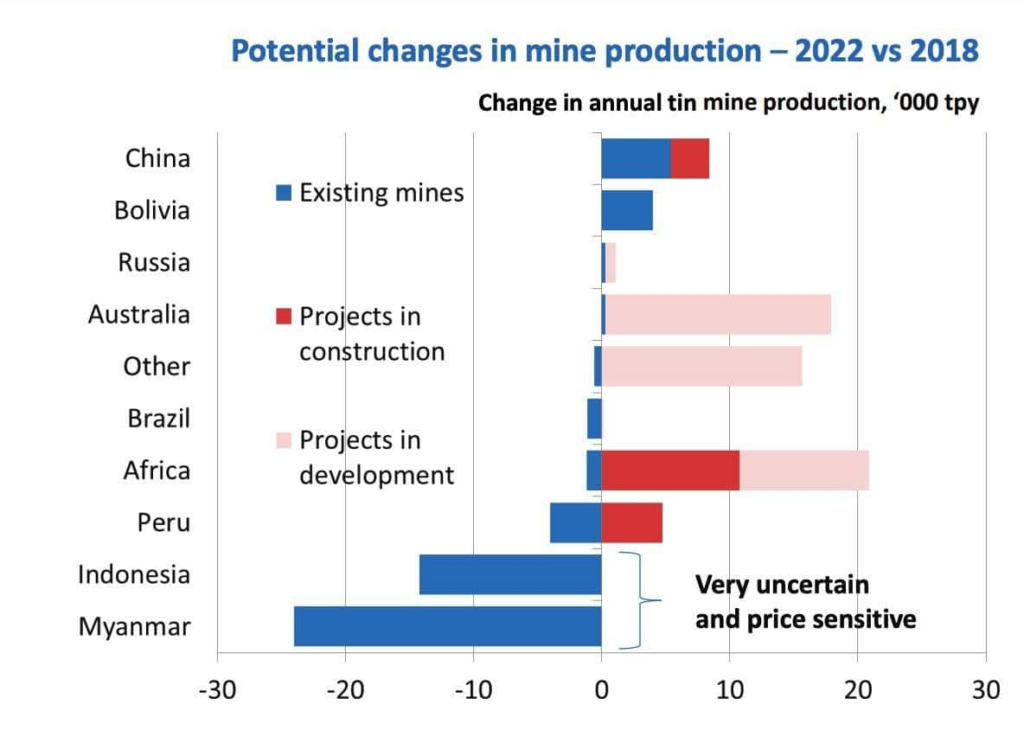

However, Beylo provides a more cautious perspective, highlighting the challenges facing tin’s supply pipeline. He highlights the discrepancy between potential supply additions and actual production, citing issues such as incentive prices, government policies, and geographic feasibilities.

Adrian Godas, the resident metals and mining expert at Macro Ops, estimates a modest increase of approximately 34Kt in annual supply by 2026. However, this projection hinges on tin prices exceeding the $30,000 per tonne mark, indicating a lack of incentive for new supply to enter the market.

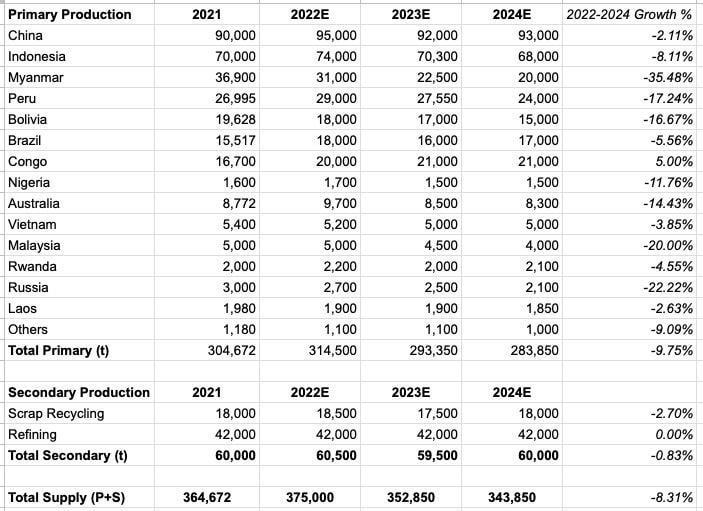

Beylo’s analysis further underscores the need to monitor primary and secondary production figures closely, considering factors such as declining primary production due to shifting extraction methods in Indonesia and dwindling reserves in China. Secondary supply, expected to remain stable at around 70Kt per year, serves as a crucial buffer in mitigating supply constraints.

Information for this briefing was found via Reuters and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.