On December 21, Canada’s government rejected the sale of TMAC Resources (TSX: TMR), a gold mining company operating the Hope Bay gold mining project in Nunavut, to China’s Shandong Gold Mining Co., citing the need to “safeguard national security.” While not explicitly stated, poor relations between the two countries’ governments in the aftermath of Canada’s 2018 arrest of a Huawei Technologies executive likely played an important role in the Trudeau Administration’s decision.

About six months ago, Shandong agreed to acquire all TMAC common shares outstanding for $1.75 per share, or around $230 million in total. TMAC shareholders approved the transaction in late June 2020, as did the Ontario Superior Court of Justice. However, in mid-October, Canada ordered a security review of the transaction under the Investment Canada Act, which culminated in the government’s December 21 rejection decision.

Perhaps the most surprising result of that order: the stock is now trading higher than before the announcement, a very unusual result when a merger is scuttled. TMAC’s price action is likely due to two factors. First, the large merger spread ($1.75 versus the Dec. 18 closing price of $1.30) suggests the risk arbitrage community believed there was substantial risk of rejection by the Canadian government. Second, the company has solid fundamentals, perhaps most importantly solid cash flow generation, suggesting that the stock may have noticeable upside potential.

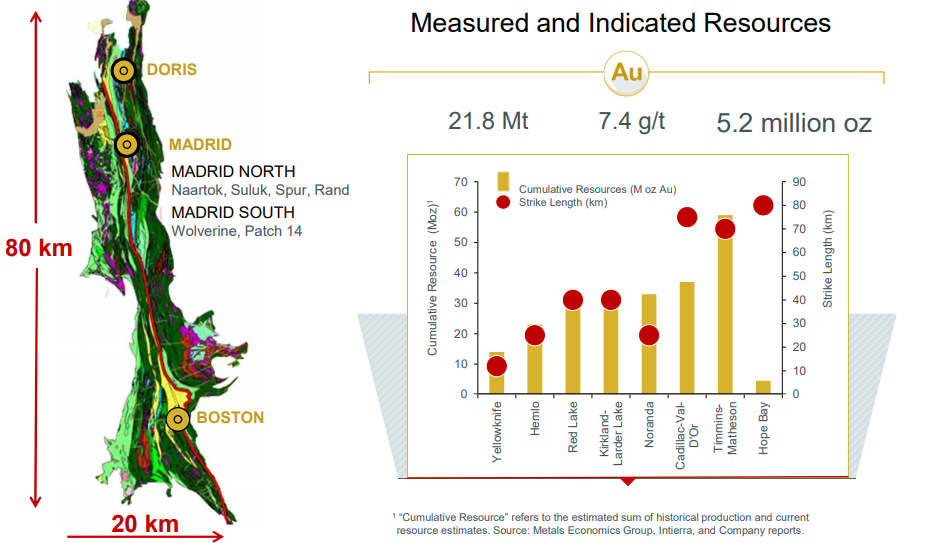

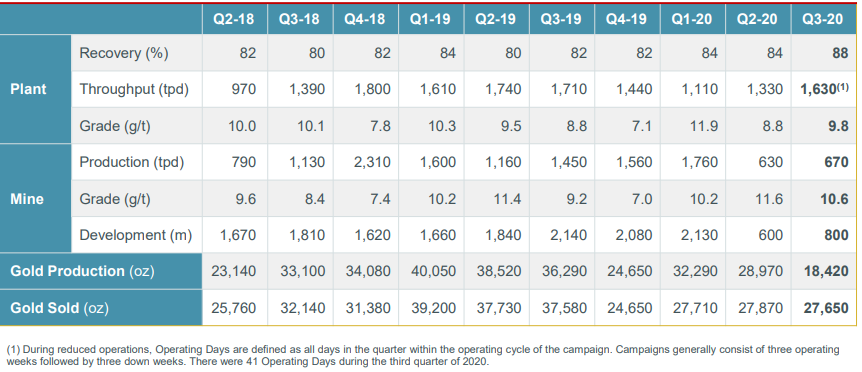

TMAC produced 18,420 ounces of gold at its high-grade Doris Mine in the third quarter of 2020, an impressive figure for a junior miner, but down from normal levels due to a COVID-19 outbreak during the quarter. Typical production rates are 30,000+ ounces per quarter. On the whole, the entire Hope Bay property contains 16.9 million tonnes of proven and probable reserves at a gold grade of 6.5 grams per tonne (g/t). This equates to more than 3.5 million contained ounces of gold.

Cash Flow Has Increased As Gold Prices Have Risen

As gold prices have risen, TMAC’s earnings and cash generation have similarly increased. Indeed, over the 12 months ended September 30, 2020, the company generated nearly $90 million of adjusted EBITDA. TMAC’s enterprise value (EV) is around $245 million, so its EV/trailing EBITDA multiple is only 2.75x.

| (in thousands of Canadian $, except for EPS and shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Adjusted EBITDA | $32,700 | $28,400 | $21,600 | $6,700 | $38,000 |

| Operating Cash Flow | 28,800 | 7,800 | 16,700 | (2,300) | 30,100 |

| Sustaining CAPEX | 2,400 | 1,100 | 10,900 | 13,400 | 17,100 |

| Total Cash | 99,400 | 73,600 | 46,200 | 50,100 | 76,800 |

| Unrestricted Cash | 71,500 | 45,600 | 18,200 | 20,700 | 47,400 |

| Debt – Period End | 169,700 | 168,600 | 120,600 | 152,000 | 154,900 |

| Earnings Per Share – Recurring | $0.13 | $0.13 | ($0.16) | ($0.07) | $0.07 |

| Shares Outstanding (Millions) | 130.9 | 124.1 | 115.2 | 115.0 | 118.5 |

TMAC’s cash balance has increased to $99.4 million, $71.5 million of which is unrestricted. Offsetting this is $169 million of debt. Per a covenant of the debt agreement, that entire balance now becomes due on July 1, 2021 as a result of the dissolution of the Shandong merger agreement. Refinancing this debt, coupled with the cost of sealifting supplies like consumables and diesel fuel to the company’s remote Canadian Arctic location, now represent TMAC’s key near- and intermediate-term financial challenges.

It is of course possible that TMAC will have difficulty refinancing its nearly $170 million of debt. In addition, the break-up of the merger with Shandong effectively eliminates any chance of reaching a merger agreement with another Chinese company. (Given the situation, we do not believe this would chill possible future merger discussions with another Canadian or US-based company.)

TMAC’s valuation is similar to a number of pre-revenue, even pre-feasibility study junior miners, yet the company produces around 30,000 ounces of gold in a typical quarter and earned $0.13 per share in each of the last two quarters. The stock’s positive price action after news that the Canadian government ended Shandong’s takeover is possibly quite telling. Investors are focusing on TMAC’s valuable gold reserves – although admittedly in a remote location – and its cash flow, which should remain strong for some time.

TMAC Resources is trading at $1.59 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.