All bubbles burst eventually, said this writer when the Canadian housing market boomed in 2020. Two years later and a new report from Swiss bank UBS shows that Toronto holds the highest housing bubble risk in the world — and trailing just half a point and 5 spots behind is Vancouver.

The UBS Global Real Estate Bubble Index ranks 25 major cities in the world based on the risk of a market collapse, assigning index scores to the housing market in each city, with scores over 1.5 signaling that a city is likely in a bubble.

The index warns that Toronto, with a score of 2.24, and Vancouver, with 1.70, are the two most at-risk cities in North America – while Toronto is the most at risk globally.

While pricing bubbles are common in property markets, their existence cannot be proven until they burst. The UBS index gauges the risk based on patterns of property market excesses, citing a decoupling of prices from local incomes and rents and imbalances in the real economy, such as excessive lending and construction activity as the typical symptoms.

In the case of Canada, the pandemic drove interest rates to a record low of 0.25% in March 2020, causing a massive surge in home prices, with average prices going up 18.5% by August of the same year versus the year before.

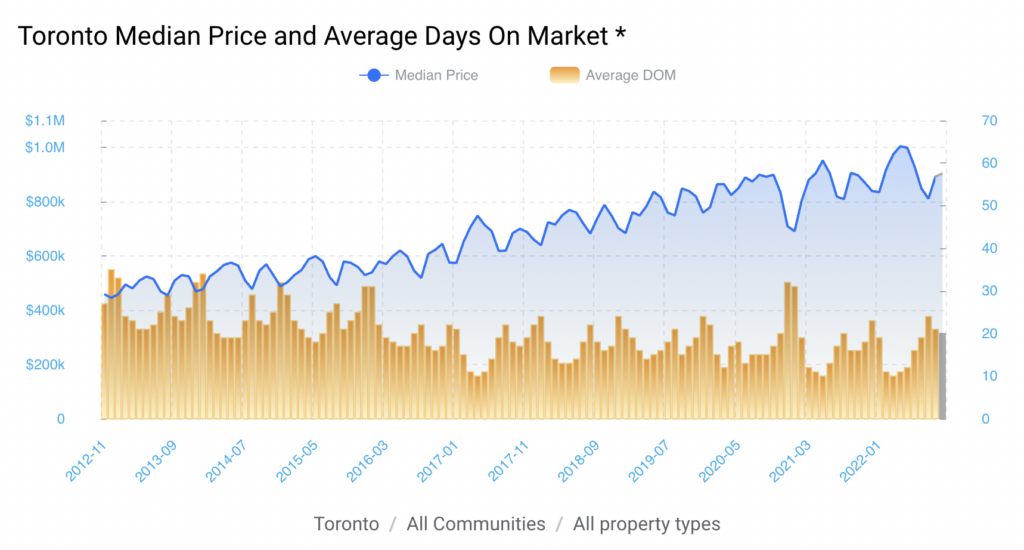

“Imbalances are sky-high in both analyzed Canadian cities,” the report said, underlining that real house price levels in Toronto and Vancouver “have more than tripled in the last 25 years.” Price growth in the two cities saw their sharpest increase in the last five years, with home prices now respectively 14% and 17% higher than the previous year.

But price correction in the two markets is “already in the making.” Housing affordability in Canada is continuously eroding and with the recent rate hikes by the Bank of Canada to quell inflation, buying a home — which means being required to make higher incomes to qualify for a mortgage that’s becoming more expensive to finance — becomes ever more unattainable.

Toronto median home prices, while still up 33% from five years ago, was down 1.5% year on year in September, and down 11.19% from the 2022 peak in April. Rental price, meanwhile, is another story.

Information for this briefing was found via UBS, HouseSigma, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.