The multi-well drill program at the SASB gas field in the Black Sea is officially underway for Trillion Energy (CSE: TCF) as of this morning. The much-anticipated program will see a total of seven wells drilled under the initial phase of the program, which will then be followed by a ten well phase two drill program.

The drill rig, known as Uranus, is currently situated at the Akcakoca platform, where it will drill three directional wells as well as conduct the recompletion of an existing well that is already in place. The firm has previously indicated that it expects to bring a new well online approximately every 45 days under the current program, which it reiterated this morning by stating that the four wells are expected to be completed within six months.

The commencement of the program follows the closely-watched movement of the Uranus drill rig via open-source websites like VesselFinder.com, with investors anxiously tracking the floating rig for signs of movement, following delays due to required maintenance and weather conditions in the region. Transport managed to get underway on September 11, leading to the official announcement this morning of the drill program beginning.

With production infrastructure already in place, including an eighteen kilometre pipeline to shore that is tied into a production plant, the firm expects production to begin immediately as each well is completed. The production plant has ample room for additional gas flows, with the facility being capable of 75 MMcf/d of production, and is expandable to 150 MMcd/d. The first gas to be produced is expected as early as November as a result.

Once the initial four wells are completed, the drill rig is then expected to the next platform within the SASB gas field to drill further wells.

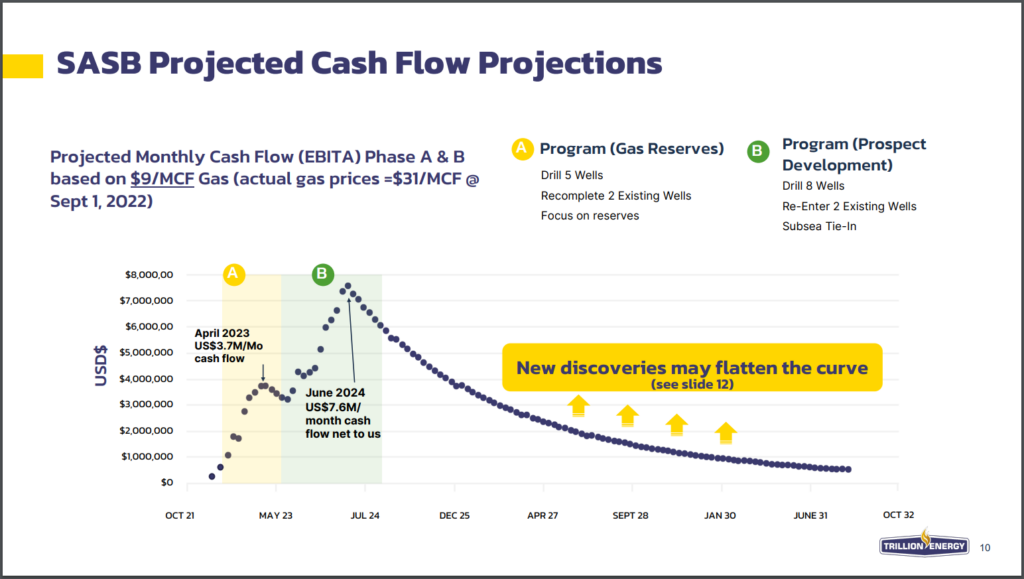

The first phase of the operation, which consists of a total of seven wells that are to be drilled, is expected to result in monthly cash flow of approximately US$3.7 million by April 2023. This figure, however, is based on natural gas pricing of just US$9.00 per MCF, which is the historical average for the region. Recent pricing however has been much higher, with BOTAS, Turkey’s state-owned energy trading company, as of September 1 increasing the price of industrial natural gas by 47% to that of US$30.68 per MCF. This translates to a significant free cash flow bump to Trillion and other producers in the region on a per MCF basis.

Trillion’s CEO Arthur Halleran was also recently featured on The Deep Dive’s SmallCapSteve Live!, wherein he commented that the company currently expects to produce $7.0 million in free cash flow per month in the near term, while also providing commentary on the current state of the natural gas market in Europe, which has been hit with all-time-high energy prices amid the ongoing invasion of Ukraine by Russia.

“The commencement of drilling operations marks a transformative step towards the Company’s bright future, with drilling to lock in much-needed locally sourced gas supplies for the winter months at prices over US$30/mcf. These long reach advanced engineering production wells will allow gas production to immediately be sold under our existing gas contract where we get paid monthly and can then use the revenues to continue to drill new wells,” said Arthur Halleran, CEO of Trillion, with this mornings announcement.

The uniqueness of the oil and gas story, with offshore drilling expected to come online immediately after well completion, has recently lead to Research Capital, formerly known as Mackie Research, to take notice of the company. The research firm last week initiated coverage on Trillion Energy, assigning a buy rating as well as a $1.35 per share twelve month price target.

Among the highlighted items within the initiation report, is the US$608 million that has previously been invested into the construction of the four production platforms within the SASB gas field, as well as an independent reserve calculated in 2020 for the field that estimated the remaining proven plus probable reserves net to the company currently sits at 20.1 bcf. Research Capital also commented that the gas field has “low-risk resource upside from six appraisal prospects,” while the current program is fully funded via monies already raised by the company.

Production for the SASB gas field is estimated as initially being in the 5 to 10 MMcf/d range once the initial seven well program is complete, with production to climb to upwards of 35 MMcf/d upon the completion of the phase two ten well drill program.

Trillion Energy last traded at $0.47 on the CSE.

FULL DISCLOSURE: Trillion Energy is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Trillion Energy on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.