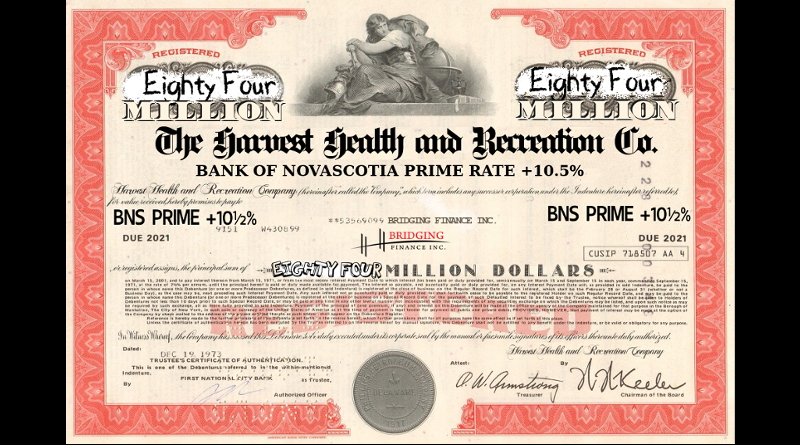

Trulieve Cannabis Corp (CSE: TRUL) announced it is conducting a senior secured debenture financing this morning. Details were scarce on the matter, aside from the fact that it will be conducted in conjunction with its previously filed base shelf prospectus.

Little information is currently available on the financing. What is known, is that notes offered will bear interest at a rate of 9.75% per annum, with maturity occurring in 2024. The notes themselves will be senior secured. Warrants will be attached to each unit, however the conversion price of such securities, as well as the conversion ratio of the debentures, is yet to be determined.

Cannacord Genuity Corp is acting as the exclusive agent, with the financing conducted on a “best efforts” basis. Proceeds raised will be put towards acquisitions, capital expenditures, and general corporate purposes.

Upon completion of the convertible debenture financing, Trulieve will apply to the Canadian Securities Exchange to list both the notes as well as the warrants.

Trulieve last reported its financials for the period ended June 30, 2019. At the time, the firm indicated it had approximately US$54.0 million in cash on hand along with US$85.2 million in inventories.

Trulieve Cannabis Corp last traded at $13.41 on the Canadian Securities Exchange.

Information for this briefing was found via Sedar and Trulieve. The author holds no securities of the organization discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.