Last week Stifel released their Q3 earnings preview for all the MSO’s while stating that Green Thumb Industries (CSE: GTII), TerrAscend (CSE: TER), and Cresco Labs (CSE: CL) are set to outperform. A number of price targets were raised on multi state operators, while others saw their current ratings reiterated.

Andrew Partheniou, Stifel’s analyst, says, “With state markets having largely released Q3/20 macro data, we see the strength of underlying fundamentals in H1/20 extending through the summer. With MA and NV rebounding more rapidly than anticipated and sustained impressive growth across country.”

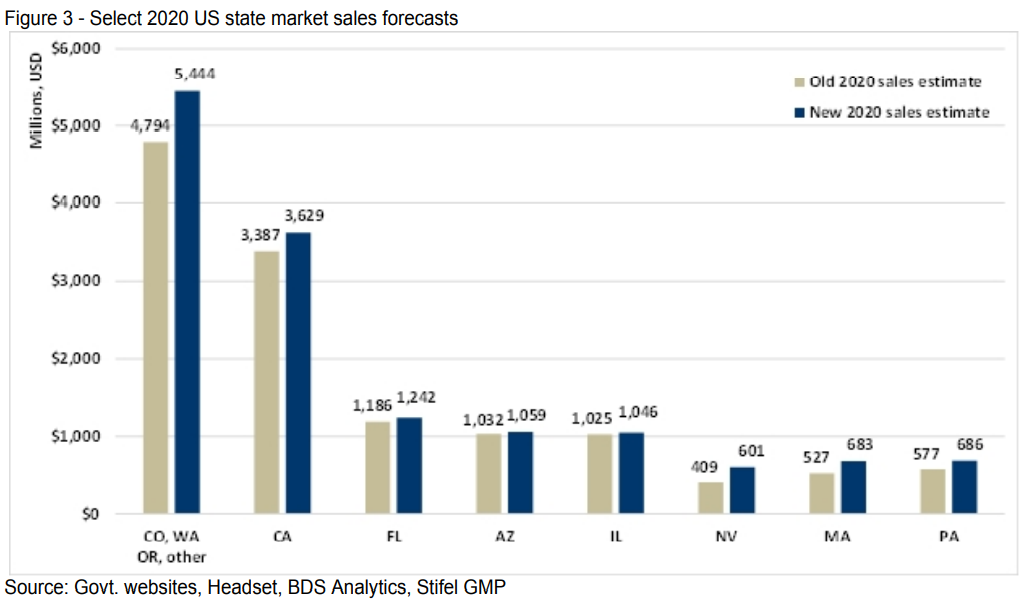

Before going into the earnings preview, Partheniou says that they are “increasing our 2020/2021 US industry sales forecast by ~7%/~5% to ~$16b/~$20b,” as data is showing market trends growing faster than their prior estimates. They attribute this strong growth to rising wholesale prices, most notably in the West Coast markets for the first time in two years. The other reasons provided include:

- The rapid rebound in Nevada sales driven by counties outside the Las Vegas area insulated from tourism weakness.

- The likely dual effect of record-setting wildfires reducing supply while demand rises in most West Coast mature markets.

- The rest of the US largely experiencing higher than anticipated sales growth.

Below you can see the 2020 and 2021 old vs. new select states estimates.

Stifel GMP raised price targets for Cresco Labs, Green Thumb, and TerrAscend, while reiterating their Curaleaf (CSE: CURA), Harvest Health (CSE: HARV), and Trulieve (CSE: TRUL) price target, which are further outlined below.

The justification for Partheniou raising the price targets on these operators is a result of their involvement within Illinois, Massachussett, and Pennsylvania. In these localities, state sales are ~27% above their previous third quarter 2020 forecasts.

Partheniou comments, “we have less conviction on TRUL and CURA for an outperformance in Q3/20 results.” Elaborating further on this, the analyst states that based on their data, Trulieve has lost roughly 200 bps quarter over quarter of volume share in Florida, mainly driven by flower. Partheniou also adds that rising competition could compress margins.

Onto Curaleaf, Partheniou warns that although results will include Grassroots for the first time, “the majority of Grassroots’ platform [was]undergoing production expansions in the quarter and limited synergies [are] likely to have been realized immediately upon closing.” He expects margins will be negatively affected but will rebound in later quarters as cultivation capacity will come online.

In reference to Harvest Health, Partheniou states, “HARV’s improved operating profile may still require de-risking.” He says that the ~$90 million cash position, the profitable quarter, and its more focused platform is enormously benefitting from the growth in Arizona, Pennsylvania, and Maryland. He then says that they expect their operating profile and EBITDA margin to continue to be the focus for improvement. Their Franklin and Natural Selections acquisitions have made Harvest vertically integrated in both Pennsylvania and Arizona. To end it, he says, “However, we remain neutral on the name due to its debt-heavy balance sheet and significant capital needs, limiting the MSO’s flexibility to execute on its growth plans.”

Moving the focus to earnings and what to watch for, the first firm addressed is TerrAscend. Partheniou expects a 30% quarter over quarter rise in their revenues to C$61.38 million and their adjusted EBITDA margin to grow to 29%. He is watching for more colour on the progress of Ilera’s additional 25% production expansion as well.

For Green Thumb, their revenues are forecasted to grow roughly 20% to C$143.22 million from C$119.64 million and adjusted EBITDA margin to come in at 33.2%, up from 29.6% last quarter. He says that investors should be watching for more data or management commentary on their Nevada platform, “given delays in macro data, any potential timing in the opening of the MSO’s 2 remaining REC stores in IL,” and is hoping to get insight on the sustainability of the recent wholesale price increases.

Cresco Lab’s revenue is forecasted to grow 30% to C$122.51 million by Stifel, and the adjusted EBITDA margin is expected to double to 18.9% from 9.8% last quarter. Partheniou is watching for management to explain how progress is going on its production ramp in Illinois and Pennsylvania, as the company has guided for full production in the first quarter of 2021.

Trulieve’s revenue is expected to grow 10% to C$132.91 million, and the adjusted EBITDA margin is anticipated to be 47.6%, down from 50.1% last quarter. Partheniou adds that he is listening for management commentary on underlying price trends and current uptake on edibles.

Lastly, Curaleaf’s revenue is expected to grow 65.8% quarter over quarter to $201.28 million, and the adjusted EBITDA margin is anticipated to be 19.6%, down from 23.8%. Partheniou says that he is watching for additional colour on construction and plant growth in all the production expansions occurring in the fourth and first quarters. He adds, “we believe management could have key insights on the sustainability of not only wholesale price growth across key markets, but also underlying demand trends amid the COVID pandemic.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.