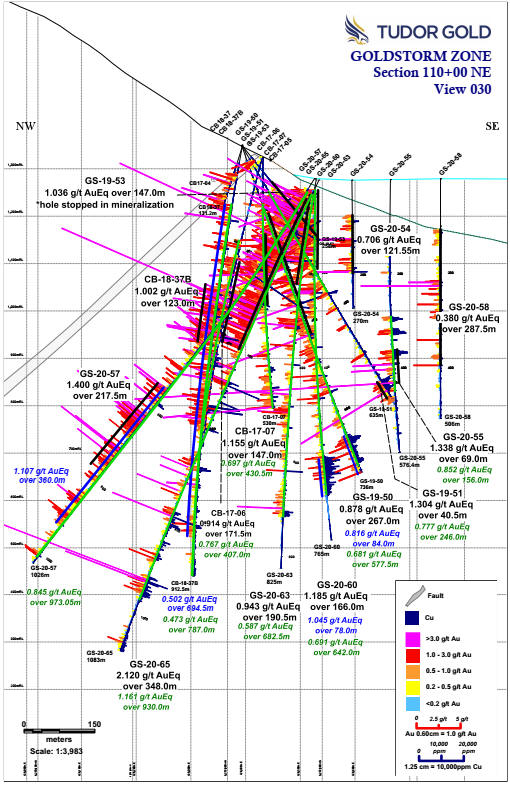

Tudor Gold Corp (TSXV: TUD) this morning released further assay results from its Treaty Creek joint venture located in the Golden Triangle in British Colombia. Highlights include an intercept averaging 2.12 grams per tonne gold equivalent over 348 meters, within a total intercept of 930 meters that averaged 1.16 grams per tonne gold equivalent.

Speaking to the drill program itself, the company indicated that three additional drill rigs have been mobilized to site, which add to the two currently already conducting drilling. A sixth drill is also enroute to the project, with the drill program for 2020 expanding from 20,000 meters to 40,000 meters, which is fully funded. The current program is looking to delinate the Goldstorm system, which remains open in and all directions and to depth. All six drill rigs are required to complete this task in the current season.

The results highlighted above come from a single drill hole, GS-20-65. Portions of that hole revealed high-grade intercepts, including 19.7 grams per tonne gold over 1.5 meters at 145.5 meters of depth, 22.5 grams per tonne gold over 1.5 meters at 310.5 meters of depth, and 34.2 grams per tonne gold over 1.0 meter, at 921 meters of depth.

The current program has been designed to complete the exploration drilling to the limits of known mineralization, with the company planning to drill up to 1,400 meters deep in certain locations. Mineralization on site is known to extend to at least 1,199 meters.

The Treaty Creek project is 17,913 hecatres in size, with Tudor Gold owning a 60% interest in the project. Partners American Creek Resources (TSXV: AMK) and Teuton Resources (TSXV: TUO) each own a 20% stake in the project. Full results from the company can be found here.

Information for this briefing was found via Sedar and the companies mentioned above. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.