to the shock of markets and the rest of the developed world, Turkey’s central bank cut interest rates once again, even as inflation soars over 80%.

The Central Bank of the Republic of Turkey on Thursday cut its key rate by 100 basis points from 13% to 12%. Data from August showed the country’s inflation rate hit 80.2%, marking 15th straight month of increases and the highest level in almost 25 years. The central bank has been continuously cutting rates since the end of last year, largely under pressure from President Recep Tayyip Erdogan’s unorthodox economic perceptions which maintain that reducing borrowing costs will curtail inflation.

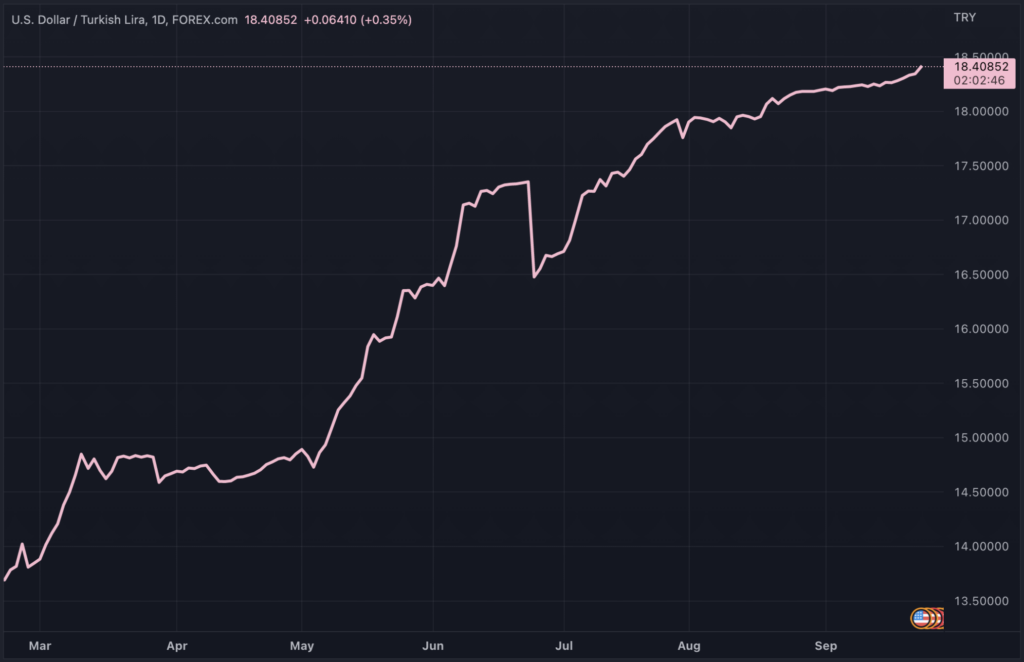

According to the central bank, “the updated level of policy is adequate under the current outlook,” and the interest rate cut was crucial given the slowdown in economic growth and demand. However, rather than providing inflationary relief, Turkey’s unconventional monetary policies have instead sent the country’s currency spiralling into a crisis. Since the beginning of the year, the lira has lost about 27% of its value against the US dollar, and about 80% over the past five years. The currency is trading at a new low of 18.40 to the dollar.

Some economists suggest Erdogan’s renewed pressure on the central bank comes in preparation for next year’s elections. “Given upcoming elections, a disproportionate focus will remain on propping up short-term economic growth, putting further upward pressure on inflation as well as the lira,” said Stockholm-based Handelsbanken Capital Markets economist Erik Meyersson, as cited by CNBC. “The Turkish government’s ability to avert a deeper financial crisis may appear to be a success, but its more important failure is the slow strangulation of the country’s economic potential.”

Information for this briefing was found via Reuters and CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.