Equity markets continue to rally on the hopes of some combination of peak inflation, a coming slowing in the rate increase cycle by the U.S. Federal Reserve, a possible Fed pivot in perhaps six months when it begins cutting rates, the potential for just a mild 2023 recession (or to avoid it completely), and a Santa Claus rally — the precise reasons change daily.

Of course, economic or company-specific data which could poke holes in these arguments are released from time to time, but investors have successfully batted these notions away for the last few months. Another such announcement was made on December 1 by the U.S. Commerce Department — this time on the U.S. personal savings rate — and investors dutifully ignored it. Perhaps they shouldn’t.

The U.S. personal savings rate as a share of disposable income fell to 2.3% in October. This represents the second lowest percentage ever; only the 2.2% reading in July 2005 (around the peak of the real estate bubble which preceded the Great Financial Crisis) was smaller. The savings rate was 7.5% as recently as December 2021.

High inflation and rising borrowing costs are eroding the comfortable savings levels Americans had accumulated, courtesy of government stimulus checks and other assistance, during the COVID pandemic. Economists estimate Americans’ excess savings reached as high as $2.3 trillion during the crisis. However, JPMorgan recently warned that, based on the current trends, all $2.3 trillion could be depleted by mid-2023. In other words, very little cushion may be left if/when an economic downturn hits next year.

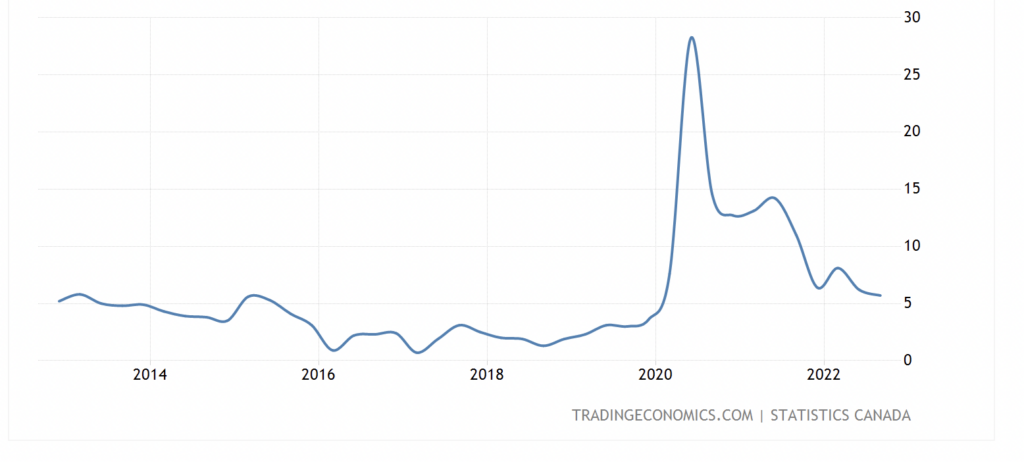

By comparison, Canada’s household savings rate is likewise decreasing, but at a slower rate and not to the unplumbed depths that the U.S. is experiencing. Canada’s savings rate was 5.7% in 3Q 2022, down from 6.2% in 2Q 2022, but well above levels seen in the 2010-2020 decade.

Unfortunately, falling U.S. savings are pressing the economy at the same time that household debt is rising rapidly. Indeed, total U.S. household debt increased US$351 billion in 3Q 2022, the largest nominal quarterly jump since 2007. Moreover, aggregate 3Q 2022 credit card balances were about 15% higher than in 3Q 2021. The savings and debt issues are of course linked as consumers are trying to maintain living standards by relying on credit cards.

A positive in all this is that, despite rising debt levels, delinquency rates remain low by historic standards. New York Fed researchers say, “consumers are managing their finances through the period of increasing prices.”

Information for this briefing was found via Trading Economics, Bloomberg, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.