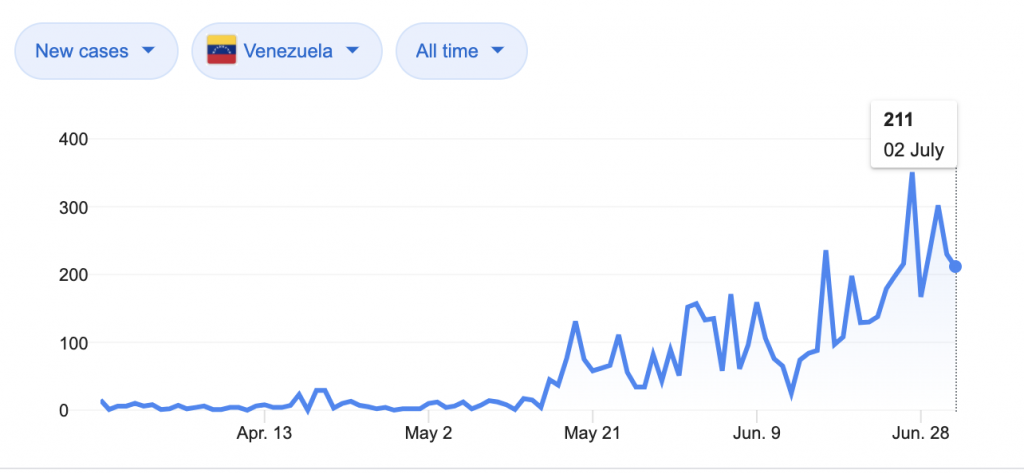

A bizarre legal battle has ensued between the UK government and the Venezuelan government, over $1 billion worth of gold bullion. As Venezuela continues to face domestic fuel shortages, food scarcity, and increasing poverty brought on by crippling US sanctions, it is also batting the coronavirus pandemic. As a means of obtaining life-saving medicine and equipment against the coronavirus, the country’s central bank is asking the UK for its gold back.

However, the UK High Court does not recognize elected leader Nicolas Maduro as the legitimate president, opting to instead assign the role to self-proclaimed leader Juan Guaido. The Bank of England (BOE) currently holds approximately $2 billion worth of Venezuela’s gold for safekeeping, but now that both Maduro and Guaido are claiming the commodity, the High Court has decided to acknowledge the latter.

Although Venezuela’s central bank promised to sell the gold and then transfer the funds to the United Nations Development Program (UNDP) for safekeeping, opposition leader Guaido insists that the money would instead go towards paying off Maduro’s foreign allies. As a result, Guaido, who has been self-identifying as Venezuela’s interim president since 2019, has been trying to lay claim to the gold instead.

Back in January, Venezuela made a request to the BOE to withdraw its gold, but the request was rejected on the command of US officials. As a result, Venezuela’s central bank filed a claim with the UK High Court against the BOE. In its claim, Venezuela points out the disparity between the UK Foreign Office continuing diplomatic relations with Maduro, while at the same time recognizing self-proclaimed leader Guaido as the head of state.

It appears that if you don’t hold your own gold, you don’t really own it.

Information for this briefing was found via The New York Times. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Gold Rush 2020: The Excitement Has Begun

The images are burned in many of our imaginations. The Klondike. The California Gold Rush....