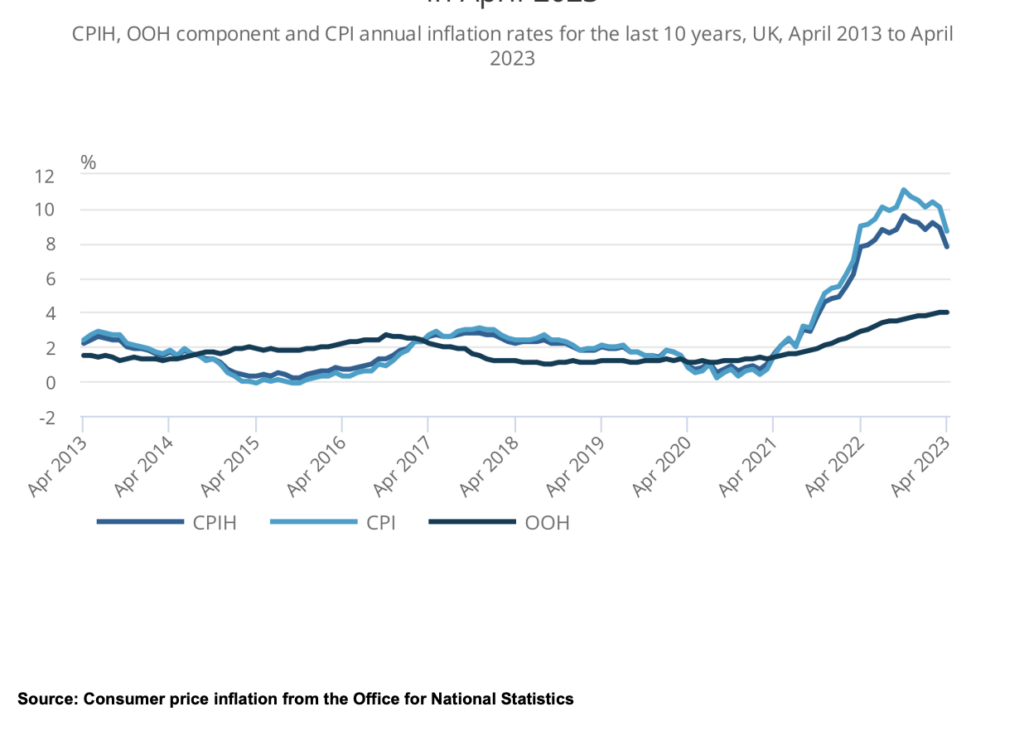

UK’s inflation rate, which was expected to fall more significantly, dropped marginally to 8.7% in April from 10.1% in March, keeping it at par with Italy for the highest inflation rate among the G7 countries.

Economists had projected a fall to 8.2%, distancing it from the October’s 41-year high of 11.1%. The BoE’s main inflation indicators— core inflation and service sector price increases, soared to the highest levels since March 1992. Food and drink price inflation has also remained high, decreasing only slightly from 19.2% in March to 19.1%. This inflationary pressure has continued to impact workers’ purchasing power negatively, particularly as wages fail to rise at the same pace.

Such elevated levels of inflation have increased the possibility of additional interest rate hikes, with policy makers forecasting a 100% probability of a 25 basis-point increase in June. Meanwhile, Citi bank revised its expectations, predicting two additional BoE rate hikes instead of one, dismissing any chances of a rate cut in November. Despite inflation’s more hawkish trajectory, Citi remains optimistic, noticing dovish elements, particularly in the services sector, and continues to predict sharp rate cuts through 2024 due to easing cost pressures.

On the other hand, some positive indications are emerging. Prices paid by factories rose at their slowest pace in over two years, at 3.9% from April 2022. The prices factories charged increased by 5.4%, the smallest increase since July 2021, suggesting a potential slowdown in the rise of goods prices which could alleviate some burden for consumers.

Information for this briefing was found via the Office for National Statistics and Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.