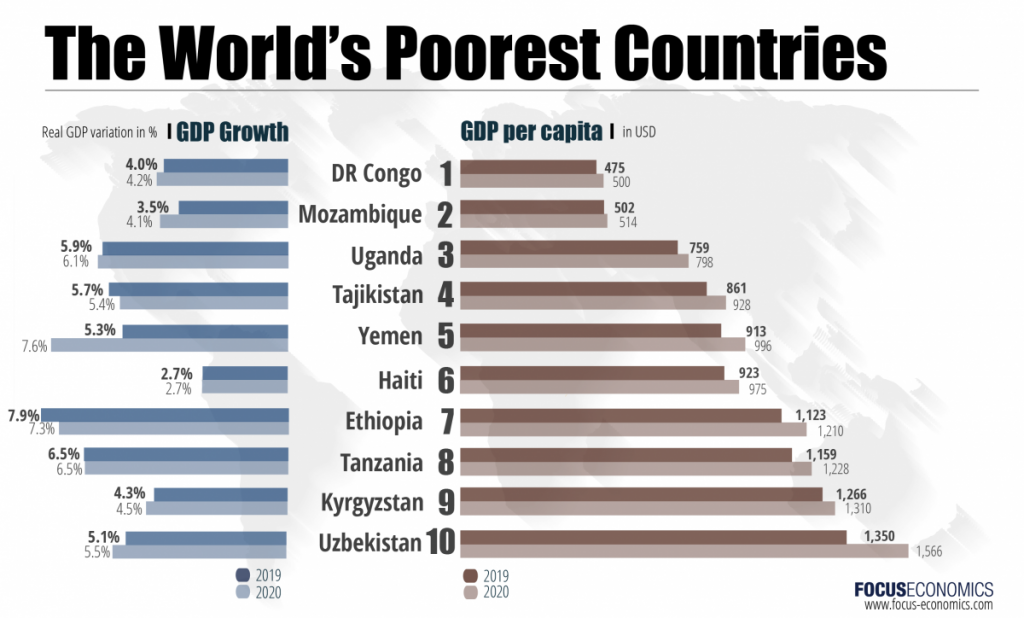

The United Nations recently issued a statement regarding the fight against COVID-19 in developing countries. In order to successfully mitigate the spread of the deadly virus, at least $1 trillion in debt held by developing countries would need to be forgiven in order to soften the disastrous economic impact the virus has caused thus far.

According to the UN’s trade and development agency, UNCTAD, an immediate debt forgiveness needs to be initiated for developing countries, so they can allocate their already-scarce funds towards the fight against COVID-19. There is approximately $3.4 trillion owed in obligations by third world countries, which when faced with an unprecedented pandemic will evolve into a serious sovereign debt crisis. Many developing countries are currently grappling with increased health care costs all while losing vital revenue from lower commodity prices and decreased trade of non-essential goods.

Thus far, a total of 20 well-off countries have decided to temporarily defer debt in the amount of $20 billion for some of the world’s poorest countries. However, it is only a temporary relief, and does not constitute as an initiative to forego the debt altogether. Thus far, the only financial body to actually forgive debt accumulated by developing countries has been the World Bank and IMF, which earlier on in the month announced they would issue a debt cancellation program for a total of 111 countries.

Information for this briefing was found via Bloomberg, Yahoo Finance, International Monetary Fund, World Bank. and Focus Economics. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.