Ahead of the scheduled shareholder vote to decide on the proposed merger, Spirit Airlines, Inc. (NYSE: SAVE) amended the terms by adding a US$250 million reverse termination fee that Frontier Airlines, Inc. (Nasdaq: ULCC) would have to pay if the transaction falls through. The breakup fee, unanimously approved by Frontier’s board, offers “greater stockholder protections” according to the companies’ joint statement.

The other suitor JetBlue (Nasdaq: JBLU), whose buyout offer has been rejected by Spirit, believes the amendment demonstrates a lack of confidence in getting the merger with Frontier a nod from the airline’s shareholders.

“Spirit’s Board only went back to Frontier under pressure, when it became increasingly clear their shareholders would decisively reject the Spirit Board’s flawed process and Frontier’s inferior transaction,” JetBlue said in its statement.

The offers

In February 2022, Frontier announced the definitive merger agreement with Spirit which offers 1.9126 Frontier shares and US$2.13 in cash for each Spirit share. The transaction is valued at roughly US$2.9 billion, or effectively US$25 per share, but pushes north of US$6.6 billion if the assumed debt and operating liabilities as part of the agreement would be included.

Frontier would own 51.5% of the merger, with its chairman William Franke leading.

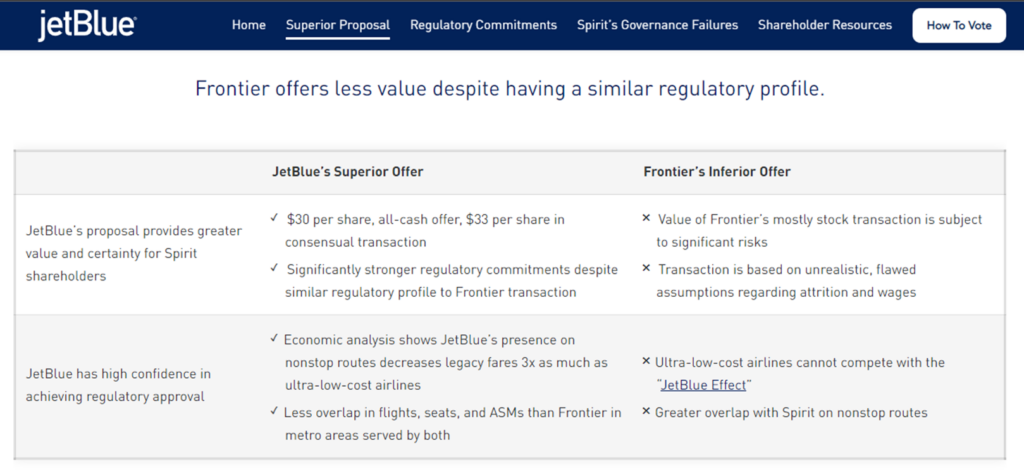

Come April, JetBlue enters the frame with an unsolicited US$30 per share offer for 100% ownership of Spirit–roughly valued at US$3.3 billion. The all-cash deal is expected to retire the Spirit brand.

In May, Spirit rejected the offer, saying that the transaction would be unlikely to get regulatory approvals.

JetBlue fights

The rejection did not sit well with JetBlue. The New York-based airlines went to Spirit stockholders instead, initiating a hostile takeover attempt and convincing the latter that Frontier’s offer is “inferior, high risk and low value.”

“We urge Spirit shareholders to vote against Frontier’s inferior offer,” the company said on its website jetblueoffersmore.com. “Why hasn’t the Spirit Board ever sought out any other transaction? Why did they refuse to negotiate with us in good faith? We believe the answer is a clear conflict of interest.”

On the added reverse termination fee, JetBlue–itself has a US$200 million reverse termination fee rider in its offer–said that the amendment “is simply an acknowledgement that the regulatory profiles and timelines of both deals are indeed similar,” contrary to Spirit’s reasons for rejecting the buyout offer.

Further, JetBlue is raising the ante, declaring that it is “prepared to negotiate in good faith a consensual transaction at US$33 [per share].”

Reverse termination fee

Aside from JetBlue, proxy advisory firm Institutional Shareholder Services has also advised Spirit shareholders to vote against the merger with Frontier. This presumably prompted the last-minute amendment to the deal as the firm cited the lack of a reverse termination fee as a potential red flag.

“The [Spirit] board’s view that a Frontier merger has a safer path to regulatory approval is not supported by any guarantee of value for shareholders in the event of regulatory rejection,” the advisory firm said.

Spirit CEO Ted Christie, however, is confident that the proposed merger will secure the approval of its shareholders, saying “ISS appears overfocused on the absence of a reverse termination fee in that deal”. Days later, the reverse termination fee amendment was added to the Frontier-Spirit merger deal.

The transaction then got the support of another advisory firm Glass Lewis, commenting that Frontier’s offer is the “best available” at this time.

“We believe the Frontier Merger Consideration provides Spirit shareholders with a fairly compelling valuation and premium for their Spirit shares, on balance,” the firm said in its report.

It also highlighted the newly added reverse termination clause “added protection” for the shareholders from potential regulatory risks.

Where will the flight of this tumultuous triangle story land? It all comes down on June 10 when Spirit shareholders finally decide on the proposed merger with Frontier. But the destination is still pretty much up in the air.

Spirit Airlines last traded at US$21.11 on the NYSE.

Information for this briefing was found via Reuters, MarketWatch, South Florida Business Journal, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.