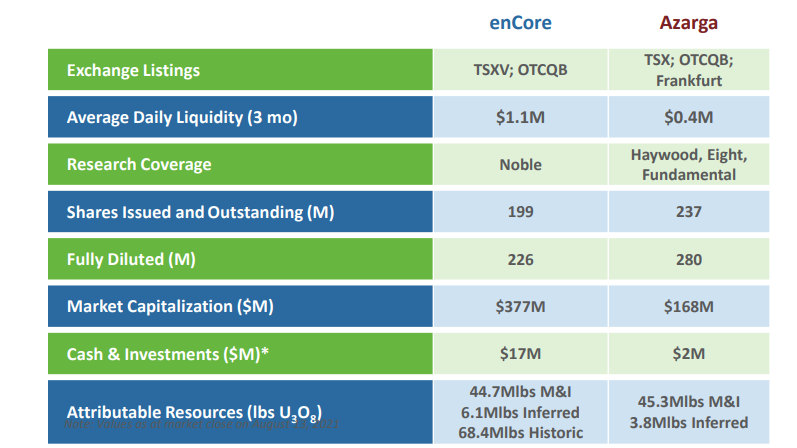

On September 7, enCore Energy Corp. (TSXV: EU) announced an agreement to buy Azarga Uranium Corp. (TSX: AZZ) in a share-for-share exchange agreement. Shareholders of Azarga, a U.S.-focused uranium development company, will receive a minimum of 0.375 shares of the bigger company enCore, a firm with a similar focus, per share held.

The exchange ratio could potentially increase to as high as 0.49 shares if the 15-day VWAP of enCore stock prior to the transaction closing were to weaken from current levels.

The companies cited the opportunity to create a top-tier U.S. uranium in situ recovery (ISR) mining company with a large resource base (90 million pounds of uranium on a Measured & Indicated basis and 9.9 million additional pounds on an Inferred basis) as the key reason for the merger. ISR mines use fluid to recover valuable minerals from the ground without digging and moving giant chunks of earth.

Closing of the transaction requires approval by two-thirds of Azarga shareholders at a special shareholders meeting to be held in October or November. Assuming that a sufficient number of Azarga shareholders vote to approve the combination, the merger is expected to close in November.

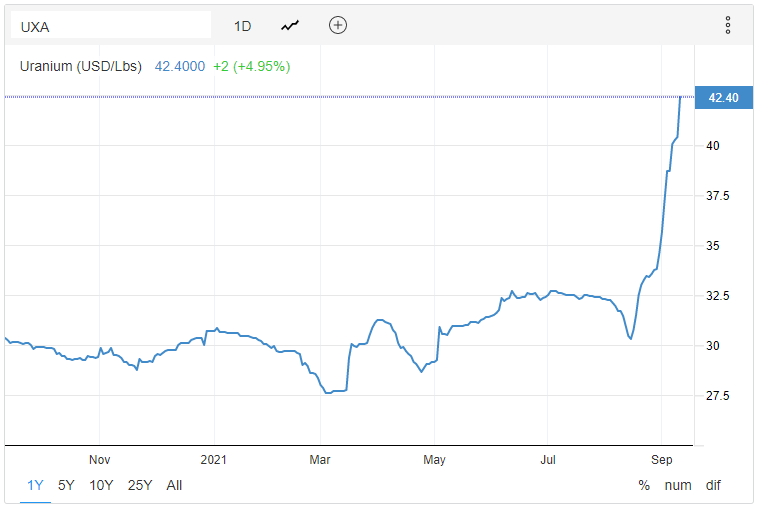

Both stocks have soared in recent weeks — since mid-August, enCore shares have gained around 60% and Azarga shares have approximately doubled — primarily on the basis of a 30% increase in the spot price of uranium over this time frame. Many uranium industry observers credit the creation of the Sprott Physical Uranium Trust, a commodity fund that buys and holds physical uranium, as a key reason for uranium’s recent price action. In Twitter postings, the trust said it bought 900,000 pounds on August 21 alone and an additional 1.1 million pounds through the end of last month.

In turn, uranium spot prices have increased to the low-US$40 per pound level. The rub in all this is that uranium miners generally acknowledge that a price of US$60 or more must be achieved before it becomes economic to re-start or open new mines. Attainment of that price level seems like a distant prospect.

Neither enCore nor Azarga have recorded any revenue for some time, and, based on the price dynamics noted above, recording any future revenue seems unlikely for some time. As a result, enCore and Azarga shareholders may want to consider capturing some recent share price gains by lightening their positions.

enCore’s Cash Flow Deficit Has Widened in 2021

enCore’s operating cash flow shortfall expanded noticeably in the first half of 2021, reaching $5.5 million, up from $0.6 million in 1H 2020 and $1.4 million in the full year 2020. Shareholder dilution has been significant, as shares outstanding have risen nearly 70% over the last 2 ½ years.

| (in thousands of Canadian $, except for shares outstanding) | 1H 2021 | Full Year 2020 | Full Year 2019 | Full Year 2018 |

| Revenue | $0 | $0 | $0 | $0 |

| Operating Income | ($5,893) | ($2,261) | ($1,367) | ($427) |

| Operating Cash Flow | ($5,494) | ($1,448) | ($876) | ($245) |

| Cash – Period End | $4,929 | $6,603 | $2,787 | $926 |

| Debt – Period End | $8 | $433 | $0 | $0 |

| Shares Outstanding (Millions) | 199.3 | 178.4 | 143.8 | 118.3 |

Many uranium mining stocks, including enCore and Azarga, have spurted higher over the last month on rising spot uranium prices. Uranium investors may want to consider trimming some of their holdings, as the movement higher in the price of the commodity may not translate into incremental revenues for some time.

enCore Energy Corp. last traded at $1.79 on the TSX Venture Exchange. Azarga Uranium Corp. last traded at $0.62 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.