Spot uranium prices have declined about 25% over the last three month to around US$48 per pound. The price of uranium mining stocks like Energy Fuels Inc. (NYSE: UUUU) and Uranium Energy Corp. (NYSE: UEC) have followed roughly similar patterns.

Surprisingly, investors have treated uranium like a speculative stock instead of a commodity over this period despite what appear to be favorable long-term fundamentals for the chemical element. Nuclear power looks to be gaining favor in a number of countries as a way to replace Russian energy sources.

In addition, various industry sources (including Ocean Wall, an alternative energy advisory service) suggest that utilities are beginning to purchase uranium under long-term contracts, a practice that has not been seen in the industry for many years. Such anecdotes seem to confirm Energy Fuel’s mid-April statement that it noted “a marked uptick in interest from nuclear utilities seeking long-term uranium supply.” As a result, Energy Fuels “is now actively engaged in pursuing selective long-term uranium sales contracts.” In general, the degree to which the nuclear industry has become uncontracted has reached unprecedented — and really unsafe — levels.

A May 27 policy announcement by Japan’s Prime Minister Fumio Kishida represents an additional constructive data point for the industry. He told his country’s parliament that Japan will take “concrete steps” to restart the nuclear plants which suspended operations after the March 2011 Fukushima nuclear plant disaster. Since that disaster was caused by a massive earthquake and tsunami, Japan has become much more dependent on (now extremely high-priced) imported oil and liquefied natural gas (LNG).

Until 2011, Japan generated 30% of its electricity from nuclear reactors. In light of the nuclear closures, the country now imports about 90% of its energy requirements.

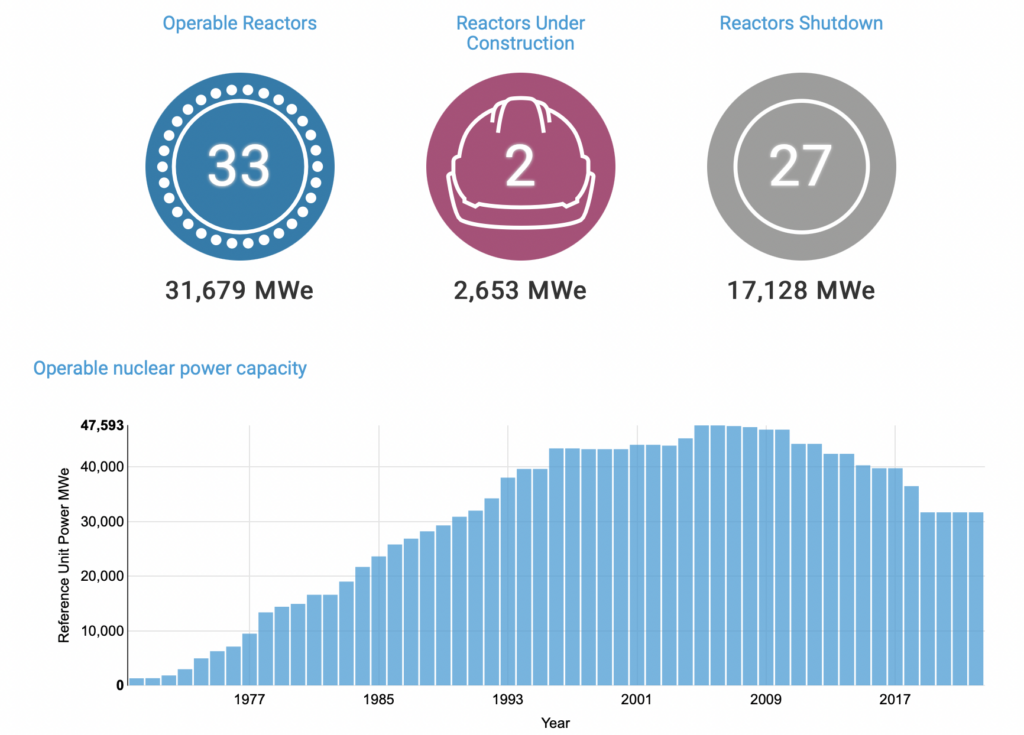

According to the World Nuclear Association, two nuclear facilities are under construction in Japan and 27 reactors are mothballed. Under the Prime Minister’s plan, nearly 20 gigawatts (GW) of new nuclear capacity — representing significant incremental uranium demand — could eventually come on line.

Separately, Great Britain expects its nuclear generating capacity to reach 24 GW by 2050, enough to cover 25% of its demand. This plan similarly aims to reduce the UK’s dependence on oil and gas. Currently, 15 nuclear reactors are operating in the UK which supply 20% of the its electricity needs.

Based on all this, the decline in uranium prices over the last few months may be overdone. A potential catalyst for an upward move: any release of details of robustly priced, new long-term supply contracts between a nuclear utility and a uranium supplier.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.