Numerco reports that the spot price for uranium has breached $60 territory early Thursday — the highest since 2011 and Reddit’s armchair traders are likely cracking their knuckles.

Spot #uranium 5900/6000 USc/Lb #U3O8 (Delivery at ALL , Chg +713c, +11.98%) ALL = CVD 0c/Lb, ALL = CMX 0c/Lb See https://t.co/oK6SEbp4ad

— numerco (@numerco) March 10, 2022

It can be recalled that retail interest for uranium went up last year with the Uranium Squeeze, where spot prices soared when Canadian-listed Sprott Physical Uranium Trust (TSE: U.UN) started snapping up hoards of physical uranium. Our very own SmallCapSteve did a deep dive on the topic.

After the squeeze, uranium stayed pretty much in the $40s causing interest to dwindle or at least plateau. But as Russia’s invasion of Ukraine continues to impact prices of commodities across the globe — and with Elon Musk calling for increased use of nuclear power — it looks like spot prices will just continue to go up.

Hopefully, it is now extremely obvious that Europe should restart dormant nuclear power stations and increase power output of existing ones.

— Elon Musk (@elonmusk) March 6, 2022

This is *critical* to national and international security.

As Steve talks about in the video, uranium is the key ingredient needed to produce nuclear power. Bloomberg reports that Russia produces about 35% of the world’s enriched uranium, and supplies 20% of the US nuclear power industry.

As of this writing, the White House has yet to announce a decision on whether they will be imposing sanctions on Rosatom Corp., Russia’s state-owned atomic energy company and a major supplier of fuel and technology to power plants around the world. They are currently doing consultations with the nuclear power industry on the impact of imposing sanctions.

The uncertainty has provided plenty of room for stocks to jump up: Cameco Corporation was up 5.5% in Toronto, Energy Fuels Inc by 4.6%, Denison Mines Corp. by 4.4%, Global Uranium X ETF by 3.7% to a session high. Meanwhile in the US, The NorthShore Global Uranium Mining EFT shares were up by as much as 6%, and Uranium Energy Corporation by 0.7%.

More and more countries are also showing interest in reviving plans for nuclear energy. Most recently, South Korea’s freshly elected president, Moon Jae-in, announced that they will be resuming paused construction on two reactors and extending the effective lives of several others.

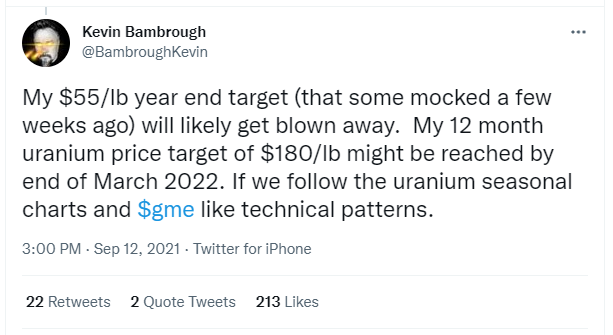

Remember @BambroughKevin, the Twitter user who called that spot prices could close at $180 per pound by March 2022?

He could still be right, and he has tracked well with several uranium price calls. And if you’re curious, here’s what he had to say following the new record high.

#uranium should be at $150/lb today in my mind. Selling for any less is ridiculous. Consider every factor that drove it to $140/lb back in 2007. Every single data point is markedly better to justify a higher price now than 2007.

— Kevin Bambrough (@BambroughKevin) March 9, 2022

At the moment, it seems all indications are telling us we have yet to see spot prices peak.

say what from UraniumSqueeze

Information for this briefing was found via Numerco, Twitter, Reddit, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.