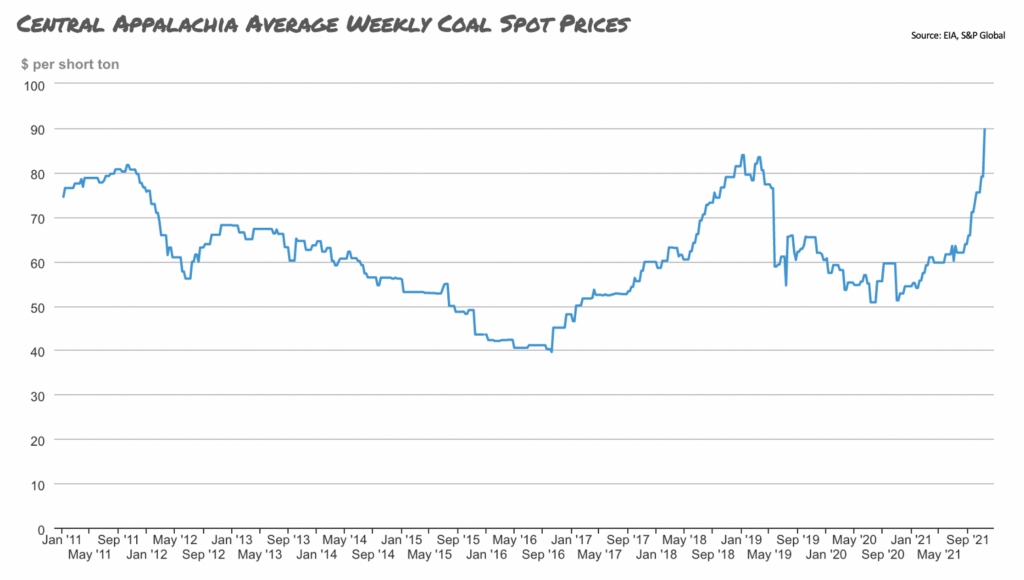

The price of coal hit the highest in more than a decade, further adding to out-of-control inflationary pressures that are turning out to be anything but transitory.

According to data published by S&P Global Market Intelligence, Central Appalachia coal prices soared to $89.75 per short ton last Friday, marking the highest price since 2009 as a sharp increase in exports prompted higher prices for the commodity. The sudden jump in coal prices comes as a deepening global energy crisis escalates the demand for dirtier, alternative fossil fuels for electricity production.

The surge in coal prices— which comes just as natural gas also becomes substantially costlier— will translate to even higher energy bills for Americans come winter. As cited by Bloomberg, a number of energy companies, including Duke Energy Corp and Xcel Energy Inc., have warned that utility bills will increase by at least $10 per month during the already-approaching cold season.

The expected jump in energy prices further adds on to mounting price pressures, as food, housing, and vehicle costs send inflation soaring by the sharpest pace since the early 1990s. The ongoing economic recovery from the Covid-19 pandemic has also helped drive up the demand for electricity, creating sudden supply shortages of fuels. US miners have been struggling to boost coal production as of late, but warn that demand will remain high throughout 2022.

“The reason spot prices are so high in the U.S. is because there’s no supply, no availability,” explained Bloomberg Intelligence mining analyst Andrew Cosgrove. He forecasts that coal prices will likely recede from the current highs over the next several months, but will not return to levels witnessed at the beginning of 2021 anytime soon. That being said, Cosgrove anticipates that utilities will sign long-term energy contracts that will be approximately 30% higher compared to the past several years.

Information for this briefing was found via Bloomberg and S&P Global. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.