The kids are not alright. The cost of living has become so high, that more and more of them are turning to crowdfunding sites like GoFundMe to help finance their education.

Investment research firm Hedgeye on Wednesday posted about how the cost of public college tuition has gone up 1,759% in the last five decades while the salary of the average American has only increased by 596%.

Many on Wall Street would have you believe the "U.S. Consumer is hanging in there" and "in fine shape."

— Hedgeye (@Hedgeye) March 1, 2023

That's horse crap. Let's dispose of that nonsense right now.

1/https://t.co/HlJ7RBXZt7

For private colleges, meanwhile, the College Board’s Trends in College Pricing and Student Aid report found that the average published price for tuition, fees, room and board for a four-year program for the 2022-2023 school year is $53,340, up from $51,690 just the year before, and about 4.5 times higher compared to 1992-93.

GoFundMe, which has a platform that specifically caters to helping higher education students raise funds for educational expenses, found that students’ tuition money fundraising is up 50% from last year while college and trade school fundraising is up 30%.

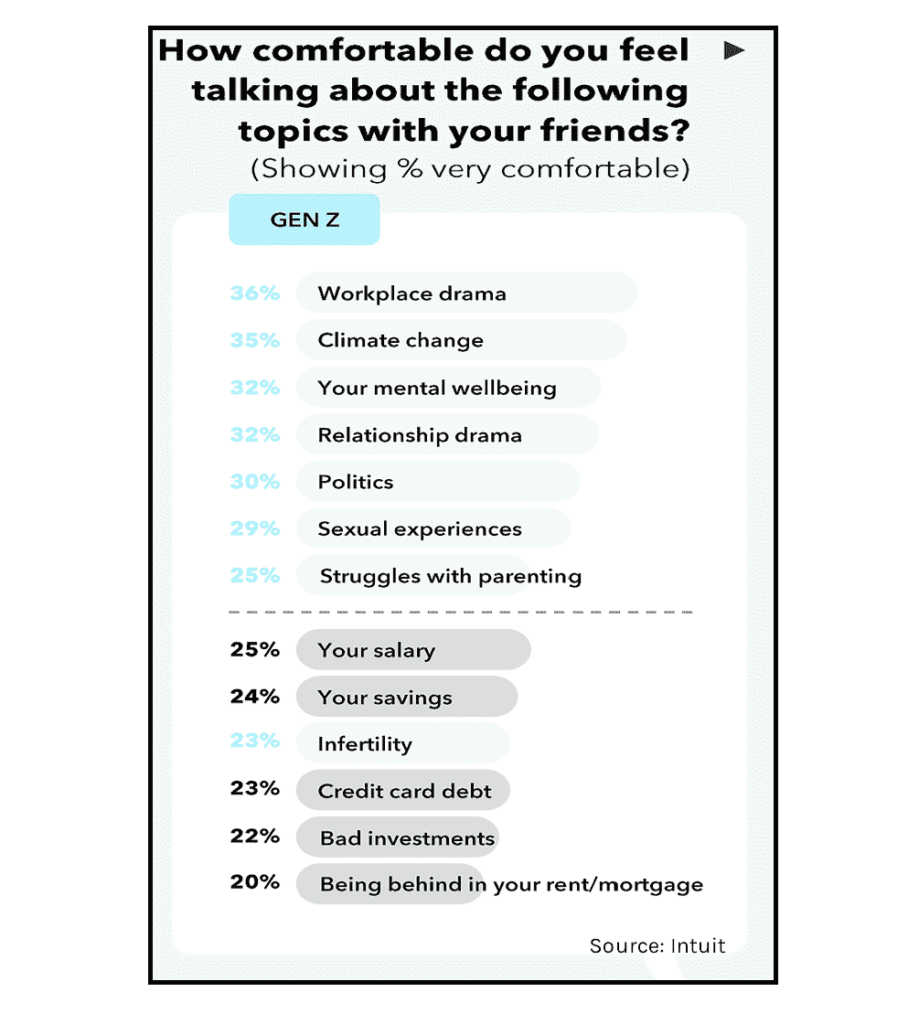

It’s also not just tuition fees. Hedgeye points out that young adults are struggling to talk about finances with their peers — more than mental health, politics, and parenting struggles.

And that young people are having to do this:

Finally paid off my vodka cran from last month. God is good 🙌 pic.twitter.com/ruoINj97bs

— Ian (@ianfluencer) February 27, 2023

And this:

i take your vodka and i raise you chicken pic.twitter.com/LL0na64ooA

— calentine’s day 💌🌹🍫 (@caliiinoel) February 28, 2023

This week, the case over the constitutionality of President Joe Biden’s student loan cancellation plan is being heard at the US Supreme Court. The plan could wipe $10,000 off each student loan debt, and while this would provide a lifeline for the about 40 million Americans it will help, it’s not the solution to the unaffordability of higher education.

Robert Kelchen, a higher education professor at the University of Tennessee, Knoxville, told MarketWatch that reducing the financial burden would need one or both of two major changes.

“You either have to give students more money to go to college, or you have to try to make providing an education less expensive, so spend less money per student on education,” he said. “It’s the same issue we run into with healthcare. The cost of providing it has gone up, and people don’t want to pay it. It’s expensive.”

Information for this briefing was found via Hedgeye, MarketWatch, College Board, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.