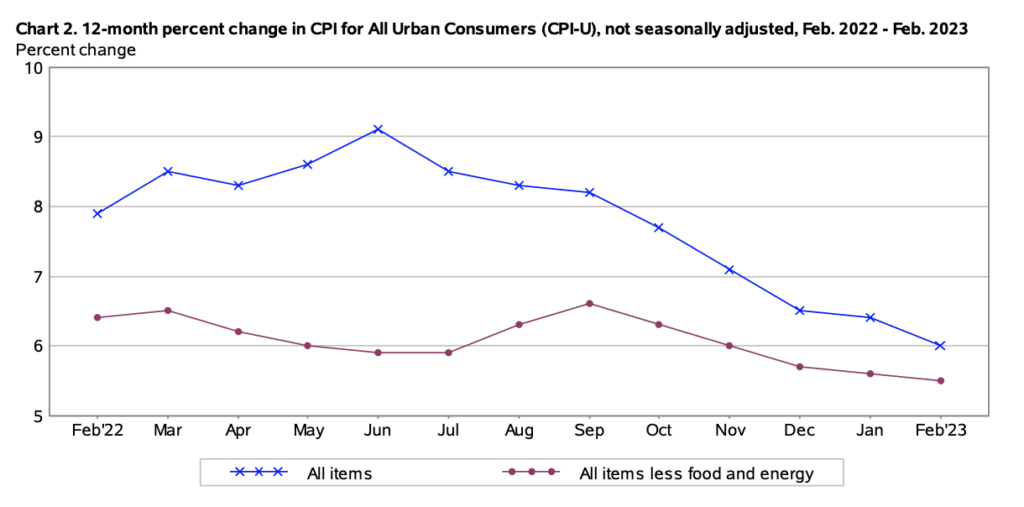

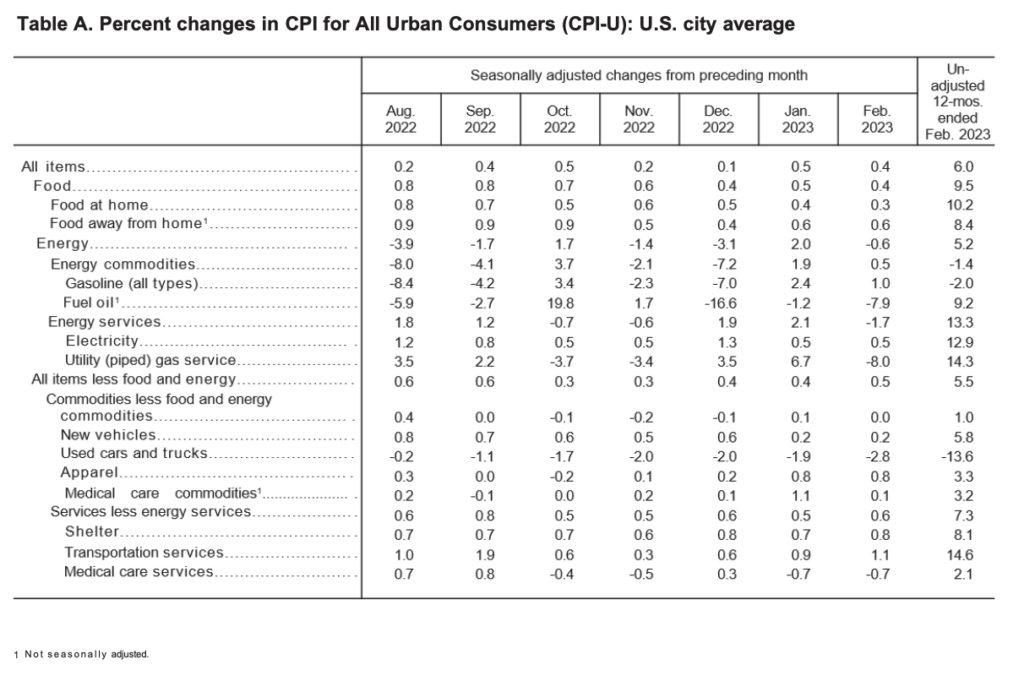

After rising 6.4% year-over-year in January, US consumer prices continued their descent last month, increasing 0.4% to an annualized 6%— in line with forecasts. Core CPI, which does not account for food and energy, was up 5.5% over the past 12 months, slightly below January’s 5.6% and also in line with expectations.

Despite the ongoing gradual decline in headline consumer prices though, shelter and food inflation continue to skyrocket, as the former rose another 0.8% to 8.1% year-over-year, with the increase accounting for over 70% of last month’s overall CPI gain. Food prices also aren’t showing signs of easing anytime soon, as the index rose 0.4%, with five of the six major categories noting increases.

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.