US consumer sentiment fell to the lowest in over a decade in February, as Americans’ views on their personal finances continue to deteriorate amid historically high inflation levels.

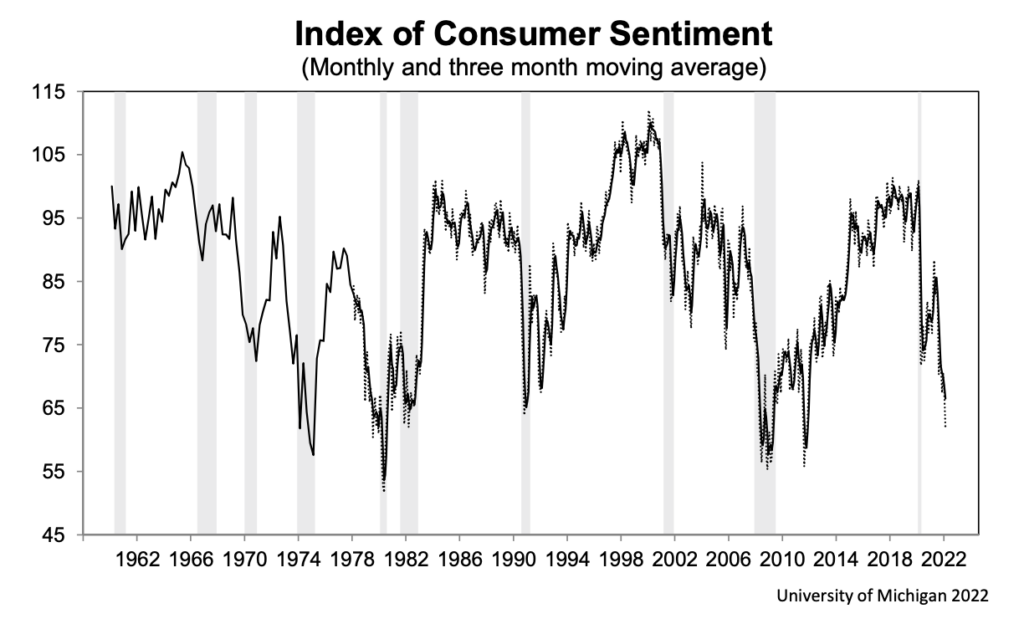

The latest consumer sentiment index from the University of Michigan fell from 67.2 to 61.7 in early February, substantially below an estimate of 67 from economists polled by Bloomberg, and the lowest since October 2011. The measure of current conditions was down to 68.5, while the gauge of future expectations slumped to 57.4— both decade-lows.

The survey’s respondents forecast that the inflation rate will sit at 5% over the next 12 months, up from January’s reading of 4.9%. The latest CPI print for January showed that consumer prices rose 7.5%— the sharpest increase since 1982, as Americans were forced to pay substantially more for food, shelter, and energy. As such, the survey found that 26% of consumers foresee a deterioration in their financial situation— the largest proportion of respondents for the gauge since 1980, as rapidly increasing price pressures erode at household incomes.

The University of Michigan’s report also showed that about two-thirds of respondents anticipate to run into financial hardships over the next five years, marking the poorest long-term outlook in the past ten years.

Information for this briefing was found via the University of Michigan. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.