The US housing construction industry has remained immune to the ups and downs of the coronavirus pandemic since restrictions were lifted back in May. In fact, the change in seasons has had no impact on the surging demand amongst buyers, and as a result homebuilder sentiment has been the strongest on record.

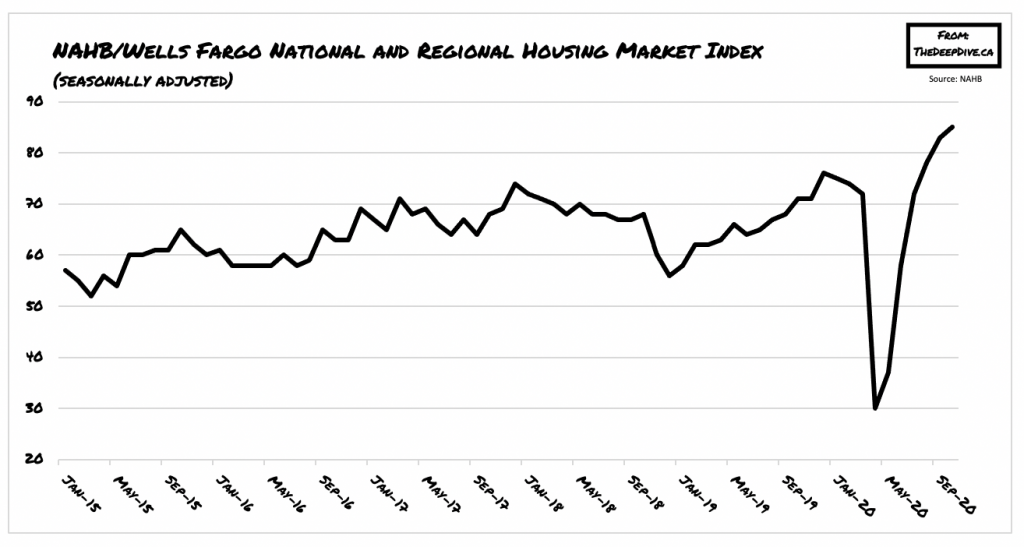

According to the NAHB/Wells Fargo Housing Market Index, builder sentiment has hit yet another record high for the second consecutive month. The index rose to 85 in October, after reaching a staggering 83 in September. Anything greater than 50 is considered positive, but the previous two months were the first times the index has ever reached above 80. In comparison, in September and October 2019 the index was only at 68 and 71, respectively.

In the meantime, the index’s other components also reached record-high readings, with current sales conditions increasing by 2 points to 90, and sales expectations for the next six months rising by 3 points to 88. Buyer traffic remained unchanged at 74 in October, but still remains significantly high given current economic conditions. According to NAHB Chairman Chuck Fowke, historically-low mortgage rates have been attracting a lot of new homebuyers to the market, and thus reinforcing strong demand.

As an increasing number of Americans have been reverting to working from home for the foreseeable future, the concept of a ‘home’ has had a renewed meaning amid the pandemic. The covid era has highlighted the need for more personal space for conducting activities such as work, exercise, school, and family time. However, the increased demand for housing has put a recent strain on supply.

Homebuilders across the country had either reduced or completely stopped production during the onset of the pandemic back in March and April. Then once they resumed work, they were completely caught off guard by the sudden surge in demand for housing. What was remaining of finished lots were quickly swiped up back May, and now competition has ramped up for the extremely short supply. Builders across the US are struggling to increase production, but the rise in building permits and housing starts are still significantly behind market demand.

Moreover, construction times have been under a recent strain lately, given the shortage of lots as well as labour. Moreover, the price of lumber and other key materials has also gone up, adding further strain. Nonetheless, buyer interest remains historically high, especially in the suburbs and rural areas. NAHB chief economist Robert Dietz notes that new single-family home sales have been surpassing housing starts by a significant margin, and in order to decrease the gap, either an increase in construction volume or a decline in available inventory will need to ensue.

Information for this briefing was found via the NAHB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.